Image Source: ABB https://new.abb.com/provider-information

Role of FACTS devices in the grid stability is becoming critical as the generation mix is tipping away from conventional power generation sources. Even though strict grid codes are enforced by the Transmission System Operators (TSOs) to make sure an ample reactive power support from distributed renewable energy sources, the need for dynamically controllable reactive power devices i.e. FACTS such as Static Var Compensators (SVCs) and Static Synchronous Compensators (STATCOMs) is still extremely vital for network stability.

Classification of FACTS Devices:

FACTS devices can be classified into 3 categories based on the type of connection with the grid:

Shunt Compensation: This includes the most common reactive compensation devices Static Var Compensators (SVCs) and Static Synchronous Compensators (STATCOMs)

Series Compensation: Thyristor Controlled Series Capacitor (TCSC) and the Static Synchronous Series Compensator (SSSC) are series compensation devices.

Combined compensation: Thyristor Controlled Phase Shifting Transformer (TCPST), the Interline Power Flow Controller (IPFC), the Dynamic Flow Controller (DFC) and the Unified Power Flow Controller (UPFC) are included in this category of FACTS devices.

Power electronics switching components act as the heart of FACTS devices, so they can be categorized based on the type of switching element i.e. thyristor based and voltage source converter-based technologies. The figure below depicts the FACTS devices categorized with respect to the grid connection and type of power electronics used in the system.

Figure 1. Classification of FACTS devices.

SVCs and STATCOM have the most well-established market based due to the decades of experience gained by OEMs. SVCs and STATCOMs are mainly installed at key load centers, critical substations and large industrial/traction loads to perform following crucial functions:

• Dynamic voltage stabilization

• Power system damping

• Load balancing

• Steady-state voltage support.

Other reactive compensation devices such as TCSC are also paving their way into the market. However, the focus market for TCSC has been the Asian countries such as China and India where sub-networks within a country have been interconnected through high voltage AC links and inter-network power oscillations need to be reduced.

Market Analysis:

The following market analysis is extracted from PTR’s new research initiative into global FACTS market. All the data points and market trends are related to the FACTS (SVC and STATCOMs installed at transmission network only) market in Europe.

Supplier Share in Europe:

The market is dominated by tier one players with years of experience in providing solutions for the grid. Over the last 10 years, ABB retained the highest share of SVCs and STATCOMs installations, on a count basis. Siemens and GE (including Alstom Grid) have almost equal number of projects installed from 2007-2017. Market shares, from the lens of total reactive power (MVAr) installed, are depicted in figure 2.

Figure 2. FACTS (SVCs and STATCOMs) market share based on project count in Europe (2007-2017)

Figure 3 FACTS (SVCs and STATCOMs) market share based on total MVAr capacity in Europe (2007-2017)

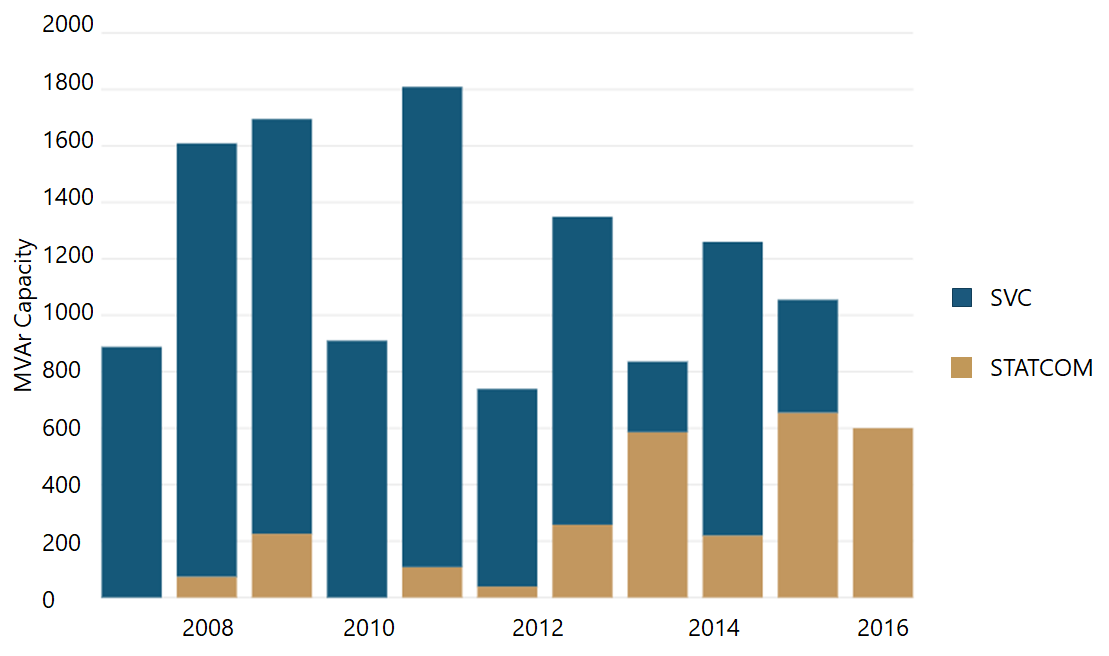

The SVC, a first-generation FACTS device, has proven its capability of maintaining voltage profile through reactive power compensation. On the other hand, the STATCOM, a voltage source converter (VSC) based device have been slowly penetrating the market with the advancements in controllable switching elements like GTOs and IGBTs. This trend can be observed in the market snapshot from last 10 years in Europe where STATCOMs have been increasingly installed by TSOS in the last 5-6 years.

Figure 4. SVC and STATCOM annual capacity additions by year in Europe (2007-2017)

The biggest STATCOM markets from 2007-2017 were the UK and Germany and PTR expects a similar trend to continue over the next 3-4 years. For SVCs and STATCOMs combined, the strongest growth originated from UK, France, Germany and Norway. The presence of new market entrants, RXPE for example, has had a causal effect on STATCOM prices. Additionally, usage of STATCOMs in distribution grids is expected to grow with reactive compensation devices such as the D-STATCOM.

Future Trends:

PTR anticipates steady growth in the FACTS market, mainly driven by addition of renewable energy sources in the networks. Market growth is expected in the UK (especially Ireland), Germany and Norway. Eastern Europe has the lowest concentration of upcoming FACTS projects as most of the reactive compensation is planned through shunt reactors and capacitor banks.