- The distribution transformer market for the Middle East and Africa (MEA) region is the smallest compared to other regions. Three countries, including KSA, Egypt, and South Africa, cover more than 40% of the market.

- The demand drivers for the distribution transformer market are growth in renewable energy generation, potential infrastructure development projects, and aged existing infrastructure in the MEA region.

- Some key trends in the distribution transformer market include the Egypt grid revamp, KSA trade incentives and barriers, and potential grid investments in Nigeria.

The global shift toward sustainable energy is driving a surge in demand for distribution transformers. As countries have committed to net-zero goals, the need for grid upgrades and integrating renewable sources into the grid is accelerating. Moreover, investments in smart grids, adaptable transformers, and electrification in the transportation sector are expected to increase significantly, fostering growth in the global distribution transformer market.

Market Overview of the MEA Region

When compared to other regions, the Middle East and Africa (MEA) region contributes the least amount to the global distribution transformer market. Within MEA, more than 40% of the market is accounted for by three countries: South Africa, Egypt, and the KSA. According to PTR, the total revenue of the global distribution transformer market in 2023 was USD 4.1 billion. , the revenue of the distribution transformer market is expected to rise at a CAGR of 3% from 2023 to 2030. Majority of the demand for the distribution transformer comes from electric utilities, followed by industry and generation. As far as the voltage range is concerned, all voltage ranges have a considerable market share in the MEA region. However, 12-17.5kV voltage range distribution transformers hold the highest share.

Oil-type transformers dominate within the MEA region. Oil-type transformers are preferred due to their robustness and resilience in harsh conditions such as outdoor substations and heavy industrial environments. They are relatively cheaper than dry-type transformers. In indoor installations and sensitive environments like commercial buildings and hospitals, dry-type transformers are favored as they offer safety with no flammable oil.

Demand Drivers

The demand drivers for the distribution transformer market are growth in renewable energy generation, potential infrastructure development projects, and aged existing infrastructure in the MEA region.

Growth in renewable energy

The Middle East plans to bolster its renewable energy generation by deploying solar and wind farms across the region. The infographic shows that multiple countries have set renewable energy targets for 2030.

Figure 1: Renewable Energy Targets Set by Middle Eastern Countries.

Source: PTR Inc.

Infrastructure Development Projects

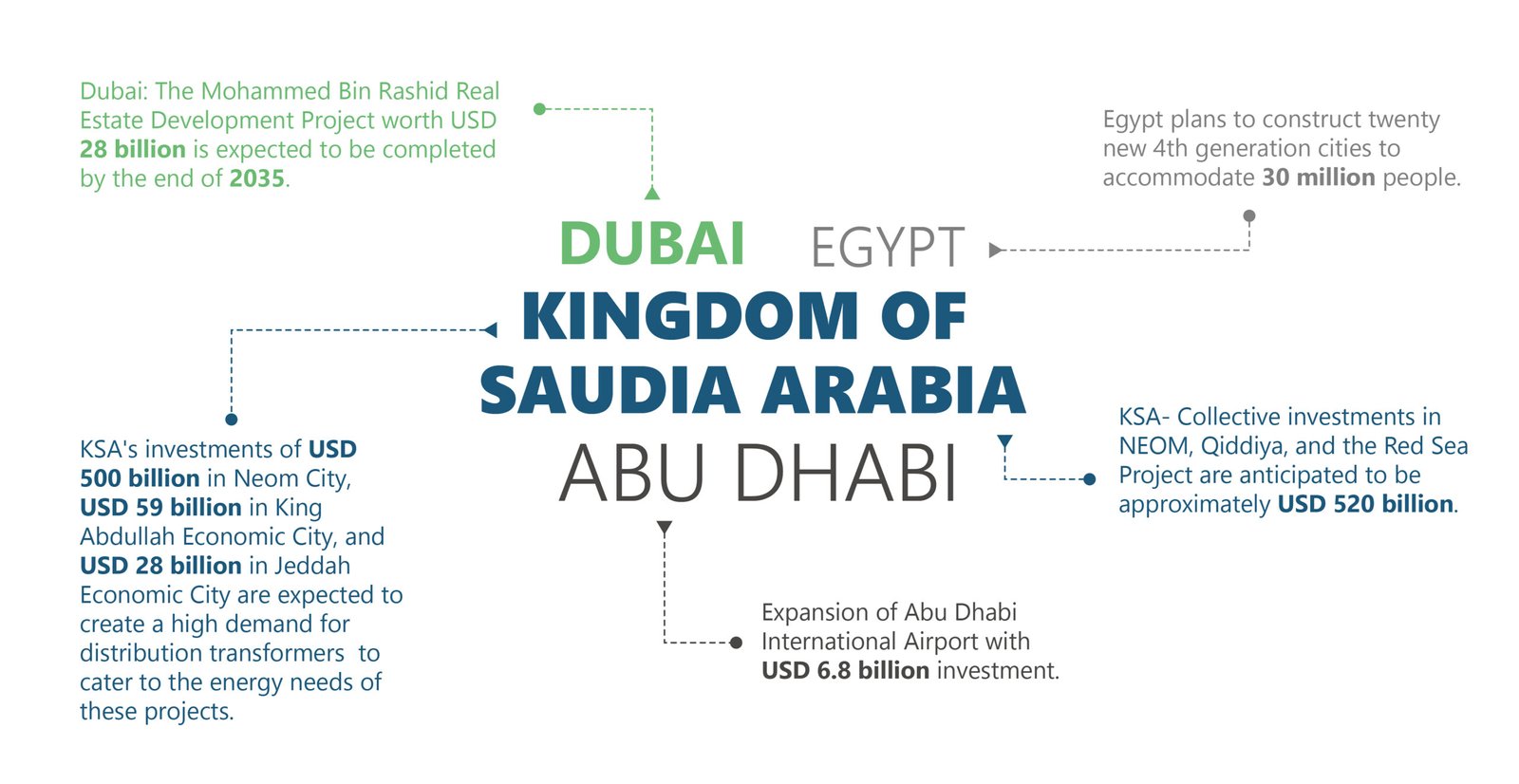

The Gulf Cooperation Council (GCC) countries are investing in power and infrastructure projects to reduce their reliance on oil resources and diversify their economic mix, providing these states a competitive edge in the global economy. Thus, it is driving the demand for distribution transformers upwards. The infographic highlights major power and infrastructure projects in process in the GCC countries.

Figure 2: Upcoming Power and Infrastructure Projects in the GCC Countries.

Source: PTR Inc.

Aged existing infrastructure

In the MEA region, most infrastructure faces the challenge of aging equipment, making it necessary to establish new systems. In Africa, replacements are required to update and modernize the obsolete electricity infrastructure. Updating existing infrastructure drives the demand for distribution transformers, ensuring sustainable and efficient energy distribution.

Key Trends in the Distribution Transformer Market

Hitachi is leading the distribution transformer market for oil and dry-type transformers in the MEA region. In KSA, Alfanar is leading the dry-type transformers market, while Saudi Transformers Company Limited (STC) is leading the market for oil-type transformers. Some key trends in the distribution transformer market include the Egypt grid revamp, KSA trade incentives and barriers, and potential grid investments in Nigeria.

Egypt grid revamp

Egypt plans to invest USD 30 billion into its electricity grid by 2030, with 66% allocated for power generation. The investment will enable deployment of 126,000 megawatts of renewable energy capacities, resulting in a 43% share of renewables in the overall energy contribution by 2030. To shift to clean energy, the government of Egypt also aims to revamp the grid.

In 2020, the costs for transformers from international manufacturers rose as the value-added tax (VAT) was increased from 5% to 15%. Adding on, import duty on transformers rose by 15%, contributing to the increasing cost of distribution transformers. KSA’s business environment presents significant challenges for international players looking to enter the market. The country promotes local manufacturing and initiatives such as Saudization, IKTVA, BENA, and Vision 2030 that create barriers to entry and competition. KSA has set a target to increase local production in the energy sector to 75% by 2030. The country aims to become a self-sufficient economy with minimum reliance on foreign suppliers, enabling it to become an economic player in the global market.

Initially, the GCC tariff agreement had no import duty on goods until July 2021. However, some amendments were introduced, such as excluding goods made in free zones and utilizing Israel’s input. Later, KSA banned goods from the GCC tariff agreement made by companies with a workforce of less than 25% of local people and industrial products with less than 40% of the added value after their transformation process. It leads to expensive distribution transformers and, hence, higher project CAPEX.

Grid investments in Nigeria

Nigeria’s power infrastructure is relatively less developed, with significant hurdles in coverage and limited transmission capacity. It offers opportunities for investment in new transformers to expand the grid and improve the power supply. Moreover, the Nigerian government has set a target of achieving 100% electricity access by 2030, which will require significant investments in power infrastructure, including distribution transformers.

Way Forward

The MEA’s distribution transformer sector stands at the crossroads of opportunity and challenges fueled by regional demand drivers and global sustainability goals. The emphasis on localization, renewable energy, and expansive infrastructure projects presents a promising landscape for market players. However, the impact of trade barriers, tax adjustments, and the dominance of local manufacturers require adaptability from market participants.

Key players such as Hitachi, Alfanar, and STC highlight the importance of strategic partnerships and local market understanding. PTR believes that as the MEA region navigates its energy transition, the distribution transformer market will evolve in response to regulatory changes, economic developments, and technological advancements.

Distribution Transformers Service Overview

The research presented in this article is from PTR's Distribution Transformer service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Distribution Transformer Market Research

Recent Insights

US Power Transformer Market Snapshot

US Power Transformer Market SnapshotMarket OverviewUSA to expand transmission systems by 60% by 2030 and may need to triple those systems by...

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

Europe Distribution Transformer Market: Navigating Changing Energy Dynamics

Europe's transition to clean energy is driving growth in the distribution transformer market. The growth is fueled by integrating renewable energy...