- Major economies in the Middle East (Saudi Arabia and the UAE) are divesting from the O&G sector and making big investments in diversifying the economy.

- Huge investments for the development of infrastructure in the region are planned, which, in turn, will be driving the demand in the Middle East’s MV switchgear market.

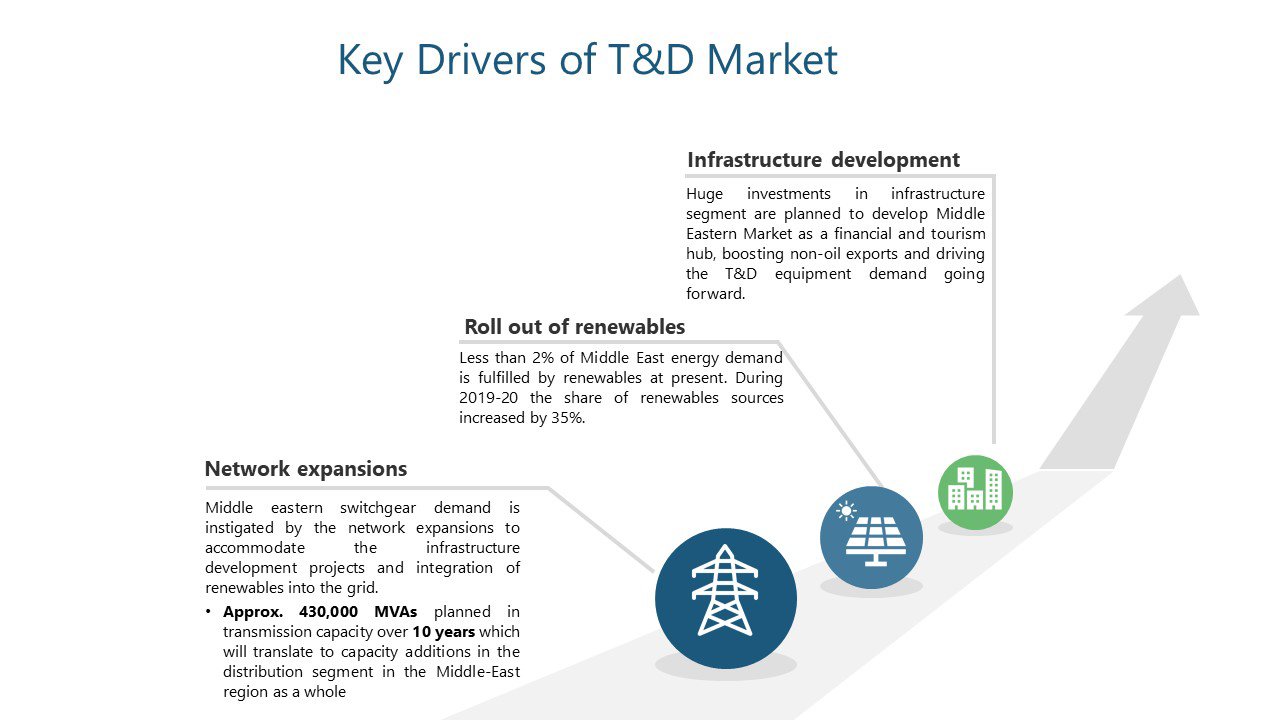

- Middle eastern switchgear demand is instigated by the network expansions to accommodate the infrastructure development projects and integration of renewables into the grid.

Major economies in the Middle East (Saudi Arabia and the UAE) are divesting from the O&G sector and making huge investments in diversifying the economy amidst pushing for industrialization in the region. This has resulted in the roll out of renewables and infrastructure development plans, followed by network expansions which, in turn, are expected to drive the demand for MV switchgear in the region.

Currently, the Middle East market accounts for around 10% of the global MV switchgear market in terms of revenue. The MV switchgear demand in the region is expected to grow with a CAGR of 5% from 2021-2026.

Key Demand Drivers in the Region

Historically, the Middle East, as a region, has largely relied on fossil fuels to meet its energy requirements; however, owing to recent climate concerns and international commitments, the region is shifting towards renewables. A transition has been initiated in the energy mix of the region and the share of renewables in the generation capacity is gradually increasing during 2019-2020, the share of renewable capacity increased by 35%. Currently, less than 2% of the energy demand in the Middle East is met by renewables.

As far as the renewable energy goals of the countries in the Middle East are concerned, the UAE is leading the region and aims to increase the contribution of clean energy in the energy mix from 25% to 50%, with Saudi Arabia plans to increase the renewable generation capacity to 9.5 GW by 2023. Qatar is planning to increase its solar generation capacity to 2-4 GW by 2030 and reduce greenhouse gas emissions by 25% by 2030, while Kuwait has set a goal to generate 15% of electricity from renewables by 2030. Oman plans to fulfill 10% of the electricity needs of the country from clean energy sources by 2025 and Bahrain plans to increase renewable contribution to 10% of the energy mix by 2035.

It is expected that, if the region meets planned renewable energy targets, it will be able to reduce carbon emissions from the power sector by 22% in 2030. It is significant to note that in the first half of 2021, no contracts were awarded for oil-powered and gas-powered power plants in the Middle East and North African region, while contracts for renewable energy projects worth USD 2.8 Billion were awarded.

Figure 1: Renewable targets of countries in the Middle East.

Source: Power Technology Research

Figure 2: Key drivers of the MV switchgear demand in the Middle East.

Source: Power Technology Research

Infrastructure Developments

Network Expansions

Middle eastern switchgear demand is instigated by the network expansions to accommodate the infrastructure development projects and integration of renewables into the grid. Approximately 430,000 MVAs planned in transmission capacity over 10 years will translate to capacity additions in the distribution segment of the region. To cater to the changing grid dynamics, it is estimated that Saudi Arabia will increase its HV transmission substations capacity by 214,000 MVAs by 2030. This will result in the construction of almost 560 transmission substations with a total of ~1,500 new power transformers by the Saudi Electric Company. Egypt increased the transmission capacity by 17.7%, by adding an additional 16,893 MVAs into the transmission network during the fiscal year 2020-2021.In Qatar, Kahramaa’s network is undergoing expansion to offset the increase in load. During 2020, a total of 856 new distribution stations began operations. Currently, to fulfil the growing demand Dubai Electric and Water Authority (DEWA) has invested USD 2.31 Billion in the expansion of its electrical network. Similarly, Abu Dhabi ‘s TransCo plans to add 4680 MVA by 2026.

Looking Ahead

Power Technology Research believes that the diversification of the economy, momentum in adopting renewable energy sources, and infrastructure development projects to promote tourism and industrialization are driving the demand for MV switchgear in the region. It is expected that the share of the Middle East in the global MV switchgear market will increase from around 10% to 12% to meet growing demand. The increase in demand will provide new opportunities to local as well as international suppliers of switchgear in the region.

Medium Voltage Switchgear Service Overview

The research presented in this article is from PTR's Medium Voltage Switchgear service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Medium Voltage Switchgear Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

Charting the Course: China and India Lead APAC’s MV Switchgear Market

The infographic offers a comprehensive overview of the medium voltage (MV) switchgear markets in China and India, encompassing switchgear ranging...

Transitioning to SF6-Free Switchgear: A Timely Shift for the Middle East Market

The infographic advocates for the Middle East (ME) to transition to SF6-free gas-insulated switchgear (GIS). The Middle East region is expected to...