• To avoid transmission system congestion, the Department of Energy (DOE) has taken initiatives such as launching the Grid Deployment Office and Building a Better Grid Initiative, and, most recently, unveiling the Coordinated Interagency Transmission Authorizations and Permits (CITAP) Program.

• These initiatives provide funding and grants to drive the expansion of transmission networks as well as decrease the interconnection queue of upcoming projects.

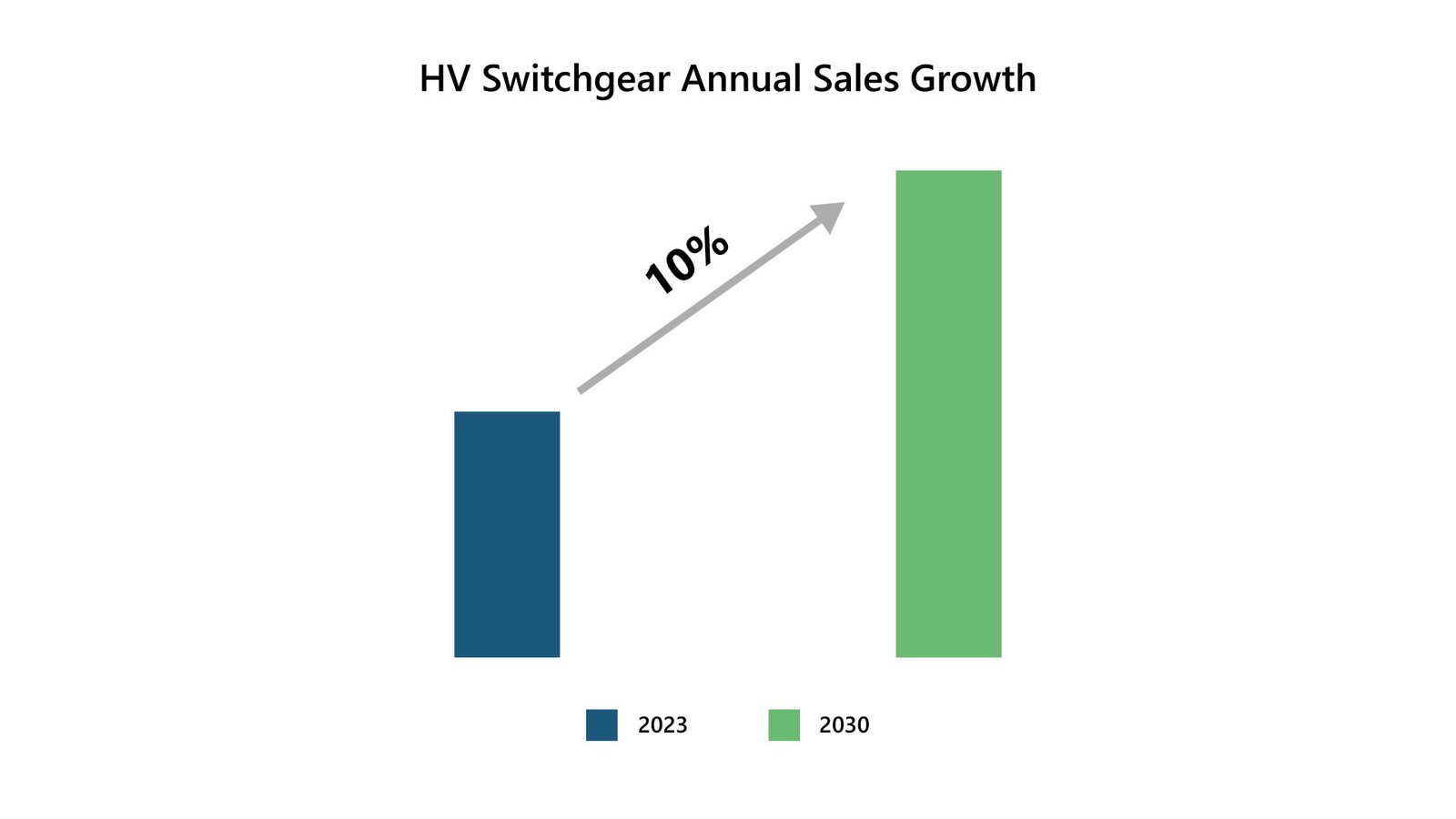

• As a result of expanding transmission systems, the HV (HV >42kV) switchgear market in the country is forecasted to increase with a CAGR of 10% from 2023 to 2030.

PTR estimates a 1.5% annual growth in electricity demand in the US from 2023 to 2030, with a significant push coming from increasing transport electrification. With a conscious effort to increase the share of renewables in the energy mix, PTR forecasts that an additional 370GW of utility-scale solar PV and wind power plants will be online by the decade’s end. However, due to limitations in the current transmission system capacity, these projects may experience wait times of several years in the “interconnection queue.” Ultimately, this situation raises the cost of electricity for consumers, and if projects are withdrawn, it may impede the national efforts toward energy transition.

Recognizing the transmission system congestion as a key barrier to growth, the Department of Energy (DOE) has taken initiatives such as creating the Grid Deployment Office and launching the Building a Better Grid Initiative, and, most recently, introducing the Coordinated Interagency Transmission Authorizations and Permits (CITAP) Program. As a result, PTR estimates that the HV switchgear market in the US will be driven by a CAGR of 10% between 2023 and 2030.

Interconnection Queue

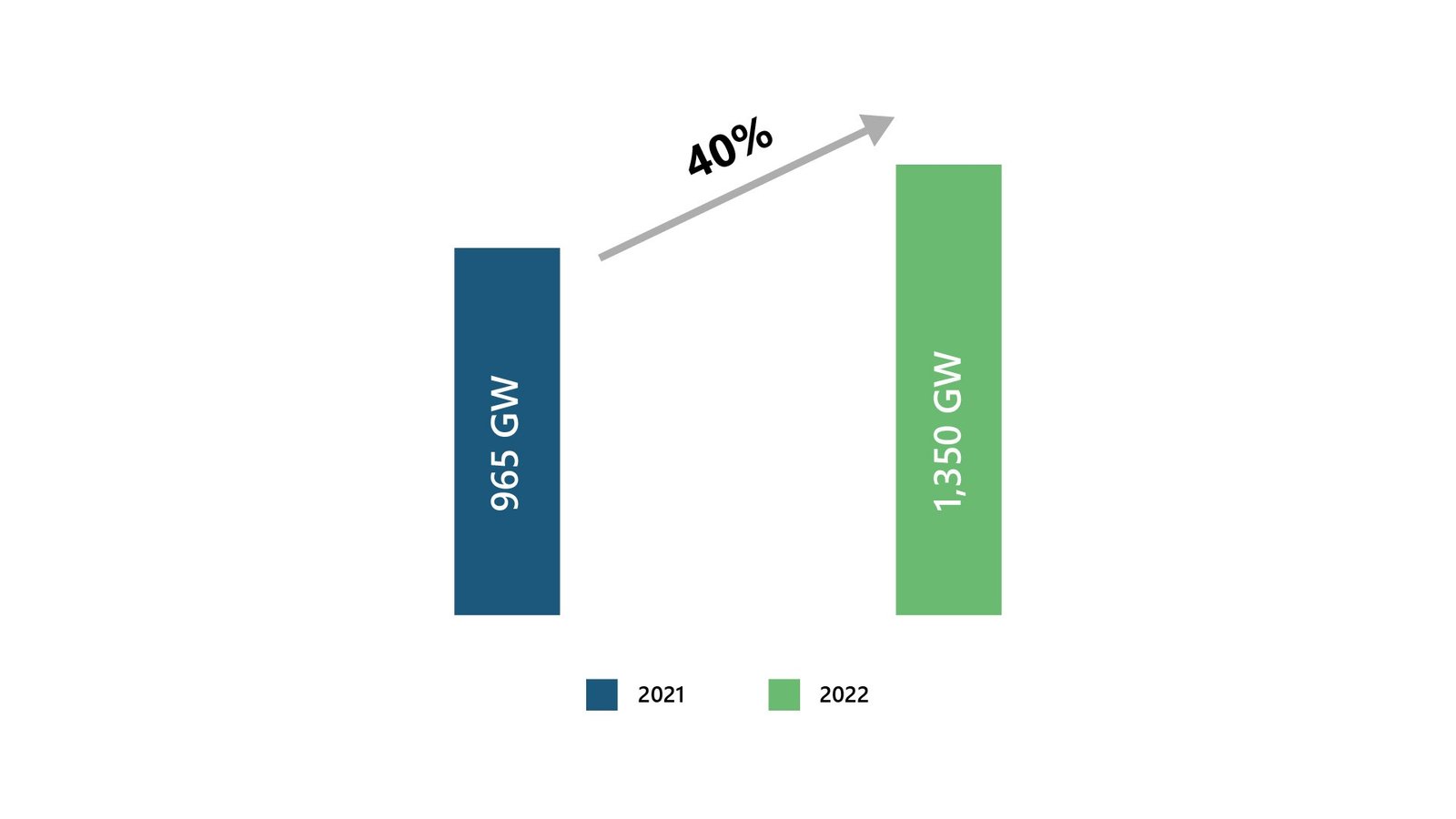

Interconnection is the process of connecting new electricity generators to the electric grid. The interconnection queue comprises power generation and transmission projects that are seeking connection to the electrical grid. The ballooning interconnection queue is a concern in the US, especially for renewable energy developers. According to the latest reports, it encompasses approximately 1,400 GW of projects (See Figure 1), primarily comprised of solar and wind installations, awaiting approval to connect to the grid. Unless the grid expansion is accelerated, the wait times for these projects will exceed five years, and the increase in cost will ultimately be passed on to consumers.

Figure 1: Year on Year Interconnection Queue Jump in 2022.

Source: Department of Energy of the US

Transmission System Expansion Drivers

To avoid interconnection queues, initiatives such as the Grid Deployment Office, Building a Better Grid Initiative, and CITAP Program are expected to increase the transmission expansion rate by supplying funding and decreasing bureaucratic wait times.

Grid Deployment Office/ Building a Better Grid Initiative

The Infrastructure Investment Jobs Act (IIJA), Bipartisan Infrastructure Law (BIL), and the Inflation Reduction Act (IRA) provide funding, tax credits, or incentives (loan guarantees or loan write-offs) worth more than USD 20 billion that are applicable across various sectors. These legislative initiatives aim to stimulate economic growth and address key challenges in the United States.

Fundings, grants, incentives (loans, tax credits, etc.) under the IIJA/BIL

The Federal Transmission Facilitation Program (TFP) will provide USD 2.5 billion to overcome the financial hurdles in developing large-scale new transmission lines, upgrading existing transmission, and connection of microgrids in the US territories.

Moreover, an amount of USD 13 billion is earmarked for The Grid Resilience and Innovation Partnerships (GRIP) Program and Grid Resilience Formula Grants. These programs promote innovation in grid resilience and strengthen the grid infrastructure through collaborative partnerships and research and development.

Inflation Reduction Act (IRA)

The Inflation Reduction Act allocates over USD 12 billion to support rural and tribal communities in accessing cleaner energy sources, enhancing energy system reliability, and reducing electricity costs.

Additionally, USD 9.7 billion is designated for the US Department of Agriculture (USDA) electric infrastructure loan and loan guarantee program, providing benefits to rural electric cooperatives. These funds incentivize cooperatives to reduce greenhouse gas emissions through energy efficiency improvements and the adoption of clean energy technologies.

Another USD 1 billion is assigned for electric infrastructure loans promoting renewable energy in rural America. This will fund the development of renewable electricity facilities, system upgrades, and demand-side management initiatives in rural areas.

Sections 50151, 50152, and 50153 of the IRA direct USD 3 billion towards investments in the US transmission system, removing obstacles to expanding new high-capacity transmission lines.

Title 17 extends USD 40 billion in loan authority through the Loan Programs Office (LPO) for innovative transmission expansion projects and emerging technologies, including HV Direct Current (HVDC) systems. Under the IRA, the DOE receives USD 5 billion in credit subsidies, supporting up to USD 250 billion in loans for energy infrastructure reinvestment, benefiting projects such as transmission line upgrades and underground electricity infrastructure modernization. These funding projects will enable the expansion of transmission systems.

CITAP Program

In a bid to accelerate the environmental review and permitting procedures for onshore electric transmission facilities, the DOE has introduced the CITAP Program. This initiative aims to streamline the bureaucratic process by setting strict deadlines for federal authorizations and permits for electric transmission within a two-year timeframe. Simultaneously, the program intends to ensure comprehensive engagement with tribal groups, local communities, and other stakeholders.

The CITAP Program has emerged in response to the protracted duration of the current transmission project approval process, which IEA estimates can span between 7 to 10 years – with construction further requiring up to 3 years before commissioning. A significant reason for the long bureaucratic wait time is because of the consultation between countless stakeholders as part of the approval process. These include affected utilities, their respective regulators, and the landowners who will host a line to agree on where the line will go and how to pay for it, according to their own respective rules.

HV Switchgear Market

As a result of expanding transmission systems, the sales of HV (HV >42kV) switchgear equipment in the country is forecasted to increase with a CAGR of 10% (Figure 2) from 2023 to 2030. SF6-free gas-insulated switchgear will be preferred due to their lower global warming potential (GWP), compact size, and ability to withstand harsh climate conditions. North America is the third largest market for HV switchgear, amounting to 17% of annual market revenue.

Figure 2: Expected Unit Sales CAGR of HV Switchgear from 2023 to 2030.

Source: PTR Inc.

Way Forward

As the US intensifies its efforts to expand transmission infrastructure and accommodate the surging demand for renewable energy projects, the demand for HV switchgear is set to experience a significant upswing. The projected 10% Compound Annual Growth Rate (CAGR) in the HV switchgear market from 2023 to 2030, driven by the expansion of transmission systems, creates a compelling market opportunity. Manufacturers can capitalize on this growth by strategically aligning their product development and innovation efforts with the evolving needs of the transmission sector.

Moreover, with the emphasis on sustainable practices and the preference for SF6-free insulation gas, manufacturers who prioritize eco-friendly solutions will likely gain a competitive edge. By staying attuned to the policy landscape, engaging in collaborative projects, and embracing technological advancements, HV switchgear manufacturers can position themselves as key contributors to America’s energy evolution while securing their foothold in a flourishing market.

High Voltage Switchgear Service Overview

The research presented in this article is from PTR's High Voltage Switchgear service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

High Voltage Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

Charting the Course: China and India Lead APAC’s MV Switchgear Market

The infographic offers a comprehensive overview of the medium voltage (MV) switchgear markets in China and India, encompassing switchgear ranging...

Transitioning to SF6-Free Switchgear: A Timely Shift for the Middle East Market

The infographic advocates for the Middle East (ME) to transition to SF6-free gas-insulated switchgear (GIS). The Middle East region is expected to...