Introduction

China is deepening energy cooperation, boosting power infrastructure development under its ‘One Belt One Road’ (OBOR) initiative with partner countries to sustain its economic growth. Accumulative population of countries involved in the OBOR is about 4.4 billion accounting for about 63% of global population with a total economic output of 21 trillion USD.

China’s power infrastructure and massive grid system is the corner stone of China’s ‘One belt one road’ initiative which needs to be dissected for better understanding of policy makers, investors and analysts worldwide.

Power Generation, Transmission and Distribution Infrastructure

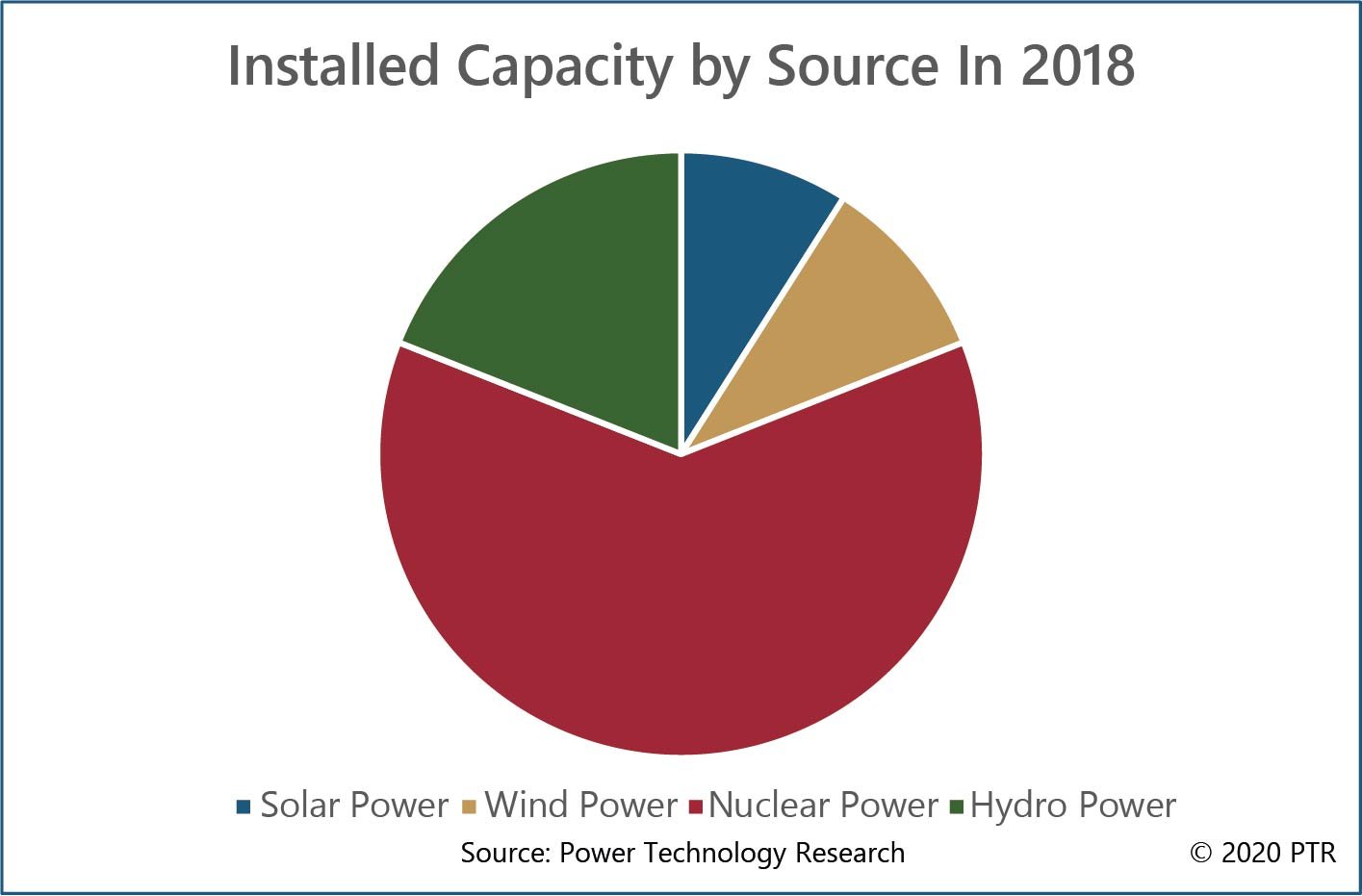

To begin with we first need to know exactly how big is China’s Power Infrastructure. To answer that we will discuss the capacity of China’s power infrastructure first. China has an installed capacity of GW and overall generation in the year 2018 was 6994 TWh. As far as the installed capacity by source is concerned: Solar power capacity is 9.2%, Wind power capacity is 9.7 %, Nuclear power capacity is 60.2 %, Hydro power capacity is 18.6 %. Installed capacity is shown in the figure 1 below.

Figure 1: Installed capacity by source in 2018

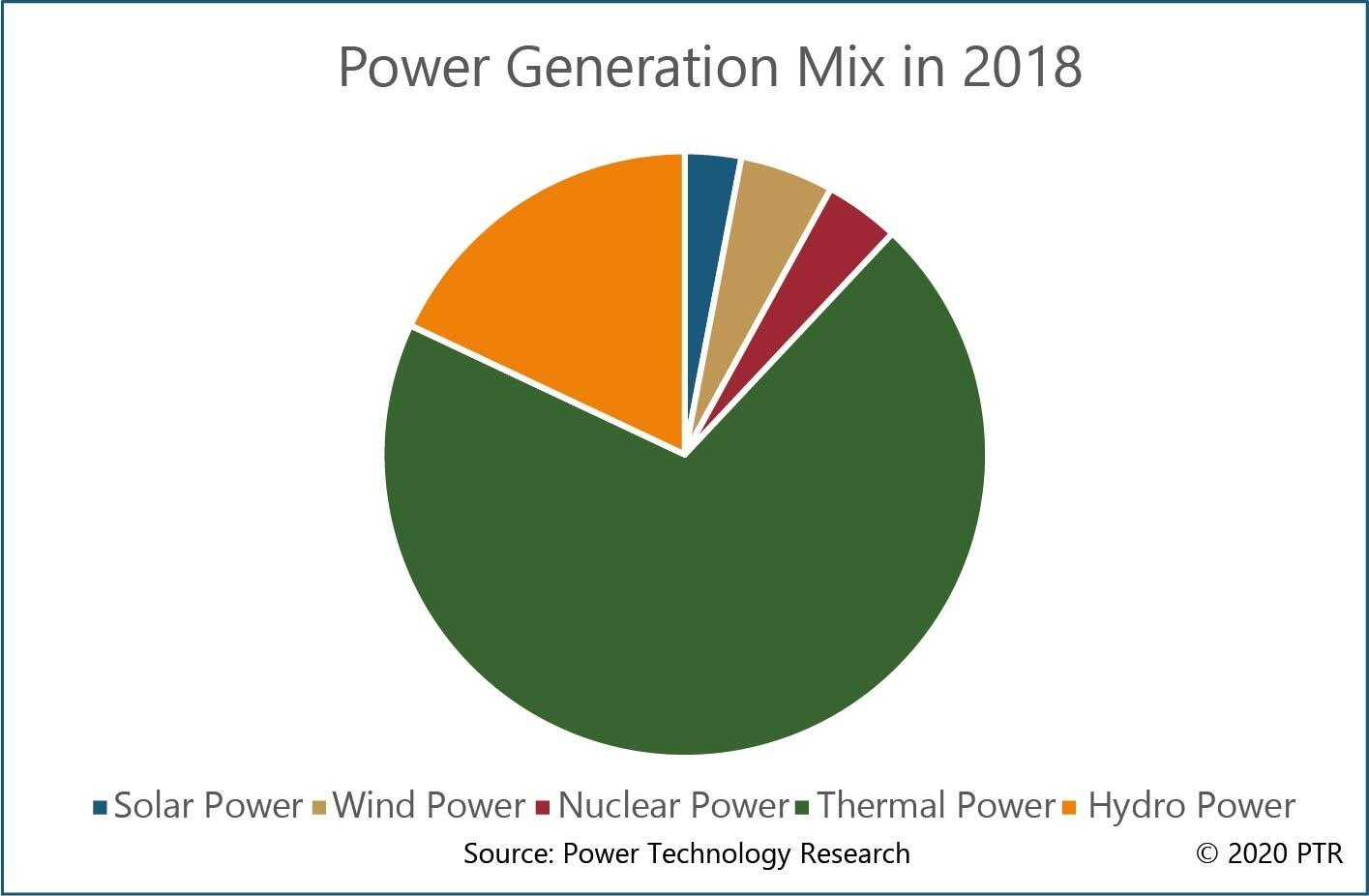

When it comes to China’s power generation mix (in 2018) : Solar power contributed 2.5%, Wind power contributed 5.2 %, Nuclear power contributed 4.2 %, Thermal power contributed 70.4 %, Hydro power 17.6 %.Generation mix is shown in the figure below as well.

Figure2: China’s power generation mix in 2018

Now coming to China’s grid capacity which has a transmission and distribution side. Voltage levels in China’s transmission system are: 110 KV,220 KV, 330 KV, 500 KV, 750 KV, 1000 KV. It has more than 1.8 million kilometers of transmission lines installed and 40,000+ transmission substations installed all over the country.

As far as the distribution side, where voltage levels are 220 V for single phase and 400 V for three phase connection, China has a total of 3564448 kilometers of distribution lines and 151854+ distribution substations installed all over the country.

Reforms in Power Sector

Reforms of 1980s

Reforms in China’s power sector started in 1980s when the country was facing acute power shortages which were directly impeding its economic growth. Under these reforms the country’s power sector, which was wholly state controlled, was opened up for private sector and a ‘fair dispatch policy’ was introduced in a bid to provide level playing field to private investors. ‘Fair dispatch policy’ provided equal operating hours to power plants of the same class.

Reforms of 2002

The second round of reforms came in 2002 which led to the separation of the generation and the transmission side of the power sector which is at times referred to as ‘unbundling’. Under these reforms 5 five generation companies and 2 state grid companies dealing with transmission and distribution of electricity were formed.

The five generation companies formed are: China Huaneng Group; China Datang Corporation; China Guodian Corporation; China Huadian Corporation; and China Power Investment Corporation. The two state grid companies are the State Grid Corporation of China and the China Southern Grid Corporation.

These generation companies have subsidiaries which are independent and are categorized as Independent Power Producers (IPPs) in China.

The five generation companies are referred to as big five in the market. Other than big five there are few generation companies referred to as ‘small nobles’ because of their performance which are controlled directly from Beijing.

Provincial power generation companies which are in Chinese context referred to as IPPs include for instance: Shenergy, Wenneng and Yueidian. Private investors in provincial subsidiaries can only be minority shareholders where foreign investment in China can be done through these main legal entities: Chinese foreign equity joint ventures, Chinese foreign contractual joint ventures.

Regulatory framework of China’s power sector

The National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) are the regulators working under the State Council of China. They are responsible for issuing and implementing industrial plans, policies, pricing and energy sector regulation.

Along with the two regulating bodies several ministries working directly under the State Council are also involved in the policy making but they get restructured frequently. For instance, after the 19th National Congress of Communist Party, ministries involved in making power sector policy were again restructured, but the eight departments within NDRC and NEA dealing with the reforms remained unchanged.

the NEA works under National Energy Commission which in turn reports to State Council where National Development and Reform Commission comes directly under the State Council of China.

The departments within are: Department of economic system reform, department of pricing, economic system adjustment department, basic industry department.

The economic system reform department has the leading role in the power sector reforms within the NDRC. The pricing department deals with the regulation of power prices, establishing benchmark prices of coal power, feed in tariffs of renewables, interregional and interprovincial transmission and distribution tariffs. The economic system adjustment department deals focuses on demand side management and reform related with administrative generation planning and the basic industry department deals with the integration of power industry plan with the macroeconomic development plan of China.

Similarly, NEA also has departments concerned with the power sector reforms, namely: Electricity department, renewable energy department, market regulation department, energy system reform department.

The electricity department deals with the fossil fuel power generation and grid planning. EV charging facilities and grid reforms. The renewable energy department deals with the development and integration of renewable energy, where as, the energy system reform department and market regulation department deals with institutional aspects of reform and regulation of power sector.

State Grid Corporation of China

As mentioned previously, State Grid Corporation of China (SGCC) was formed on December 29,2002 as result of second round of power sector reforms along with China Southern Grid Corporation (CSC).

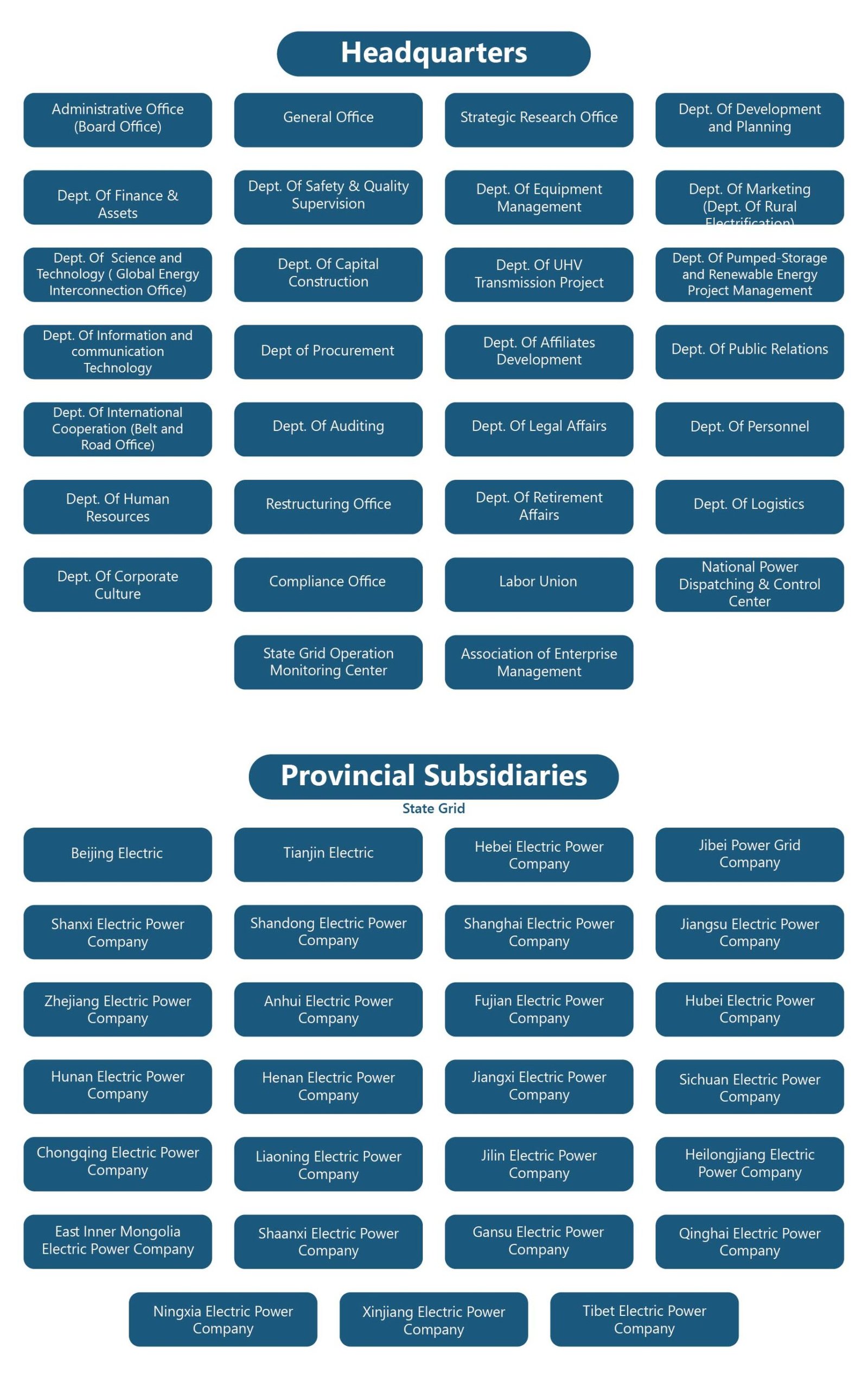

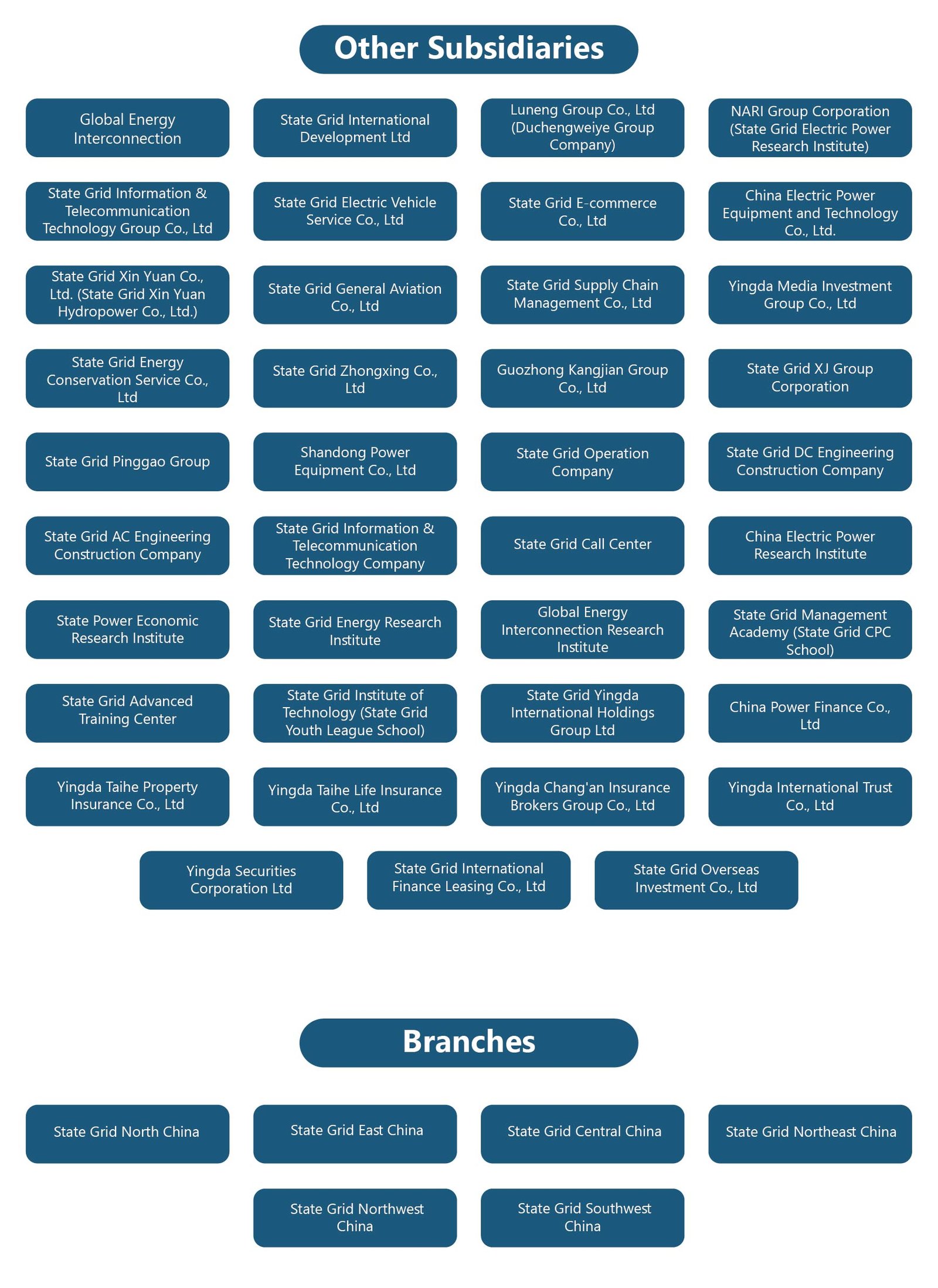

SGCC is a wholly state-owned enterprise with 30 departments,6 branches, 27 provincial subsidiaries and 39 other subsidiaries.

SGCC provides power to over 1.1 Billion people in 26 provinces, autonomous regions and municipalities covering 88 % land area of China. It has total assets of 3.93 trillion RMB and made annual profits of 78 billion RMB in 2018.

SGCC has made investments of 7.8 billion RMB in 2018 in research and where this investment was at 5.787 billion RMB which shows a steady increase over the years.

Out of 40,000+ transmission substations installed in the power grid of China, SGCC has installed a major share of it. According to their annual report of 2018, it has 17912 substations of 110 KV, 428 substations of 220 KV, 188 substations of 330 KV, 55 substations of 500 KV, 45 substations of +/- 750 KV, 25 substations of 1000 KV.

As far as SGCC’s installed transformer capacity at different voltage levels, they have 1401.89 GW capacity for 110 KV,1512 GW capacity for 220 KV, 114.37 GW capacity for 330 KV, 1050.67 GW capacity for 500 KV, 156.8 GW capacity for 750 KV, 147 GW capacity for 1000 KV.

Overseas Investments of SGCC

As per SGCC official report of 2018 shows overseas assets of 65.5 billion and the corporation invested 21 billion USD. It owns an operates assets in seven countries and regions.

SGCC has been involved in the power transmission business with the National Grid Corporation of Philippines since 2009 and worked with REN, in Portugal in the power transmission ,gas transmission and power distribution business since 2002. In Australia, they work in the power transmission business with ElectraNet since 2012, and the in power transmission, gas distribution and gas transmission business with SGSPAA (Jemena) since 2014.

Since 2014, it is also involved in power transmission, gas distribution and transmission business with AusNet services in Australia,in power/gas transmission distribution in Italy,in power generation, transmission/distribution and sales with HK electric investments In Hong Kong.

In addition, since 2017, it is involved in the power transmission business in Greece with ADMIE and in the power transmission and renewable energy power generation with CPFL in Brazil since 2017.

China South Grid Corporation

China Southern Power Grid is a wholly owned state enterprise which was formed as a result of unbundling of power sector in 2002. It has 21 departments, 8 wholly owned subsidiaries, 5 holding subsidiaries and 4 branch companies.

Both China South Grid Corporation and State Grid Corporation of China have synchronous grids hence are connected with a Back to Back HVDC connection.

Conclusion

China’s generation and transmission capacity has shown unprecedented growth over the last four decades following the first round of reforms carried out in 1980s where Power sector was opened up for private investment. These reforms were followed by the reforms in 2002 and 2015 which dealt with unbundling and pricing mechanism respectively.

Private investment, un-bundling of generation and transmission side of power sector and pricing mechanism reforms define China’s contemporary power sector. An overview of its massive grid structure which has been provided in this article sheds light on valuable insights necessary for investors, policy makers and analysts alike.

More about our Grid Market Services

Contact:

Hassan Zaheer – Sales Lead

hassan.zaheer@ptr.inc

+49-89-12250950