• An electrified commercial vehicle fleet is an important step towards a sustainable future.

• There has been an increase at a less than expected rate in the demand for electric commercial off-highway vehicles in the US, unlike China and Germany.

• Supply chain disruptions, raw material shortages, and expectations of a global economic recession have collectively hindered the widespread adoption of electric commercial vehicles.

An electrified commercial vehicle fleet is an important step towards a sustainable future as these vehicles do not emit harmful emissions like traditional internal combustion engine vehicles, mitigating the global carbon footprint. Beyond their environmentally friendly attributes, electric commercial vehicles are viable economically as well in the long term, with significant reductions in operational costs when compared to their fossil-fuel counterparts.

With a positive contribution to the environment, one expects a rise in the adoption of EVs across different segments and regions. However, there has been an increase at a less than expected rate in the demand for electric commercial off-highway vehicles in the US. This is caused by supply chain challenges, shortages of raw materials, and expected global economic recession. This article explores the current market dynamics of commercial vehicles in the US and highlights multiple factors that determine the demand landscape of electric commercial vehicles

Current Market Dynamics of the Commercial Vehicles in the US

The electrification trend within the global commercial vehicle market has gained significant momentum, although there are certain facts to consider. The electric commercial vehicles in the US including buses, light commercial vehicles (LCVs), and trucks accounted for 6.5%, 0.184%, and 0.5% of the total vehicle sales in 2022. Meanwhile, in China, the electric commercial vehicles including buses, LCVs, and trucks accounted for 28%, 14%, and 6% of the total vehicle sale, respectively. Also, Germany is moving towards electrification at a faster rate, with a share of 21%, 8%, and 1% for buses, LCVs, and trucks of the total vehicle sale, respectively. Comparing the sales share of ECVs of the three countries with the total vehicle sale, the US is lagging behind in adopting electric vehicles as smoothly as China and Germany.

Figure 1: Sales of ECVs in the US, China and Germany Expressed in Percentage to Total Number of Vehicles Sold.

Source: PTR Inc.

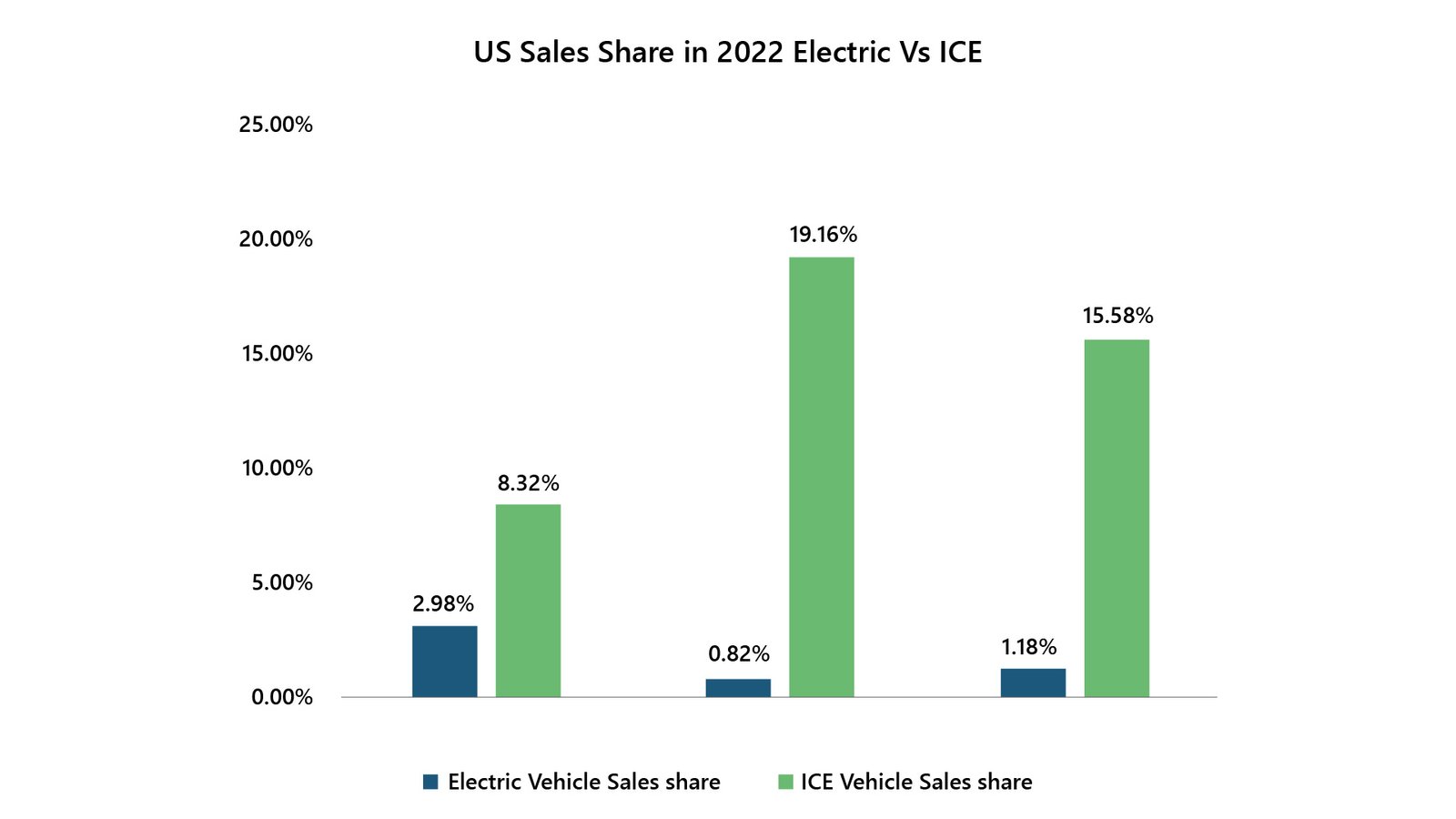

Despite allocating high subsidies for EV adoption and focusing on moving towards net zero carbon emissions, the internal combustion engine (ICE) vehicles hold more market share than the EV market in the US. The sales share for the US ICE vehicles accounted for 8.32%, 15.58%, and 19.16% for buses, LCVs, and trucks, respectively, while the sales share of Electric Commercial Vehicles accounted for just 2.98%, 1.18%, and 0.82% for e-buses, e-LCVs, and e-trucks in 2022. Comparing both the numbers of buses, LCVs and trucks, it is evident that ICE vehicles have a higher demand than Electric Vehicles despite the generous subsidies under the Inflation Reduction Act.

Figure 2: Sales Share of ICE Vehicles vs. EVs in the US in Proportion to Global Sales Share in 2022.

Source: PTR Inc.

Reasons for Increase in Demand at a Less Than Expected Rate

There are a few reasons for the growth in demand for electric vehicles at a rate that is lower than expected. These are supply chain challenges, shortage of raw materials, and expected global economic recession.

Supply chain challenges including raw material shortages

Different manufacturing companies in the US are facing supply chain disruptions. Protera, a California-based electric bus manufacturer, recently filed for bankruptcy due to supply chain issues and inflation, despite support through the Inflation Reduction Act. Additionally, Novo Bus has decided to cease production in the US market by closing its Plattsburgh manufacturing and delivery facility by 2025, which threatens market stability.

Moreover, Rivian reported a USD 1.7 billion quarterly loss due to supply chain issues. Although Rivian plans to produce 25,000 vehicles by the end of the year, it is still facing difficulties in obtaining the necessary components to ramp up production. Raw material shortages are further complicating matters. Despite Tesla’s prominence, it relies on international suppliers for key components in the manufacturing process. The delay in receiving raw materials from other countries contributes to periods of supply scarcity, affecting market dynamics.

The Buy America Act, which is a part of the Inflation Reduction Act, also poses challenges by exacerbating the raw material supply shortage. North America currently accounts for less than 2% of the supply of lithium batteries. With most lithium mining occurring outside of North America, importing batteries increases costs for the US-based manufacturers.

Global economic recession

With the economic recession expected to hit the World, the demand for electric vehicles can be impacted. The New York Federation Recession Indicators predicted a 68.2% chance of recession hitting the US in the coming future, which will lead to higher prices and lesser demand. The demand for EVs will increase more slowly than expected, according to the estimates of PTR.

Way Ahead

In conclusion, the increase in demand at a less than expected rate for electric commercial vehicles in the US can be attributed to a combination of factors. Supply chain disruptions, raw material shortages, and expected global economic recession have collectively hindered the widespread adoption of electric commercial vehicles. These challenges emphasize the need for strategic planning, investment in localized supply chains, and collaborative efforts to drive sustainable electrification within the commercial vehicles market. Despite the current setbacks, the market is anticipated to rebound in the future, with significant growth potential as industry addresses these hurdles and paves the way for a more electrified and sustainable future.

Commercial & Off-Highway Vehicle Service Overview

The research presented in this article is from PTR's Commercial and Off-Highway Vehicle service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Commercial & Off-Highway Vehicles Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

COP through the Ages

This infographic takes a cursory glance at the most significant achievements of the Conference of Parties through the years and offers a chance for...