• Since 1991, when lithium-ion batteries were first commercially introduced, the price has dropped 97%.

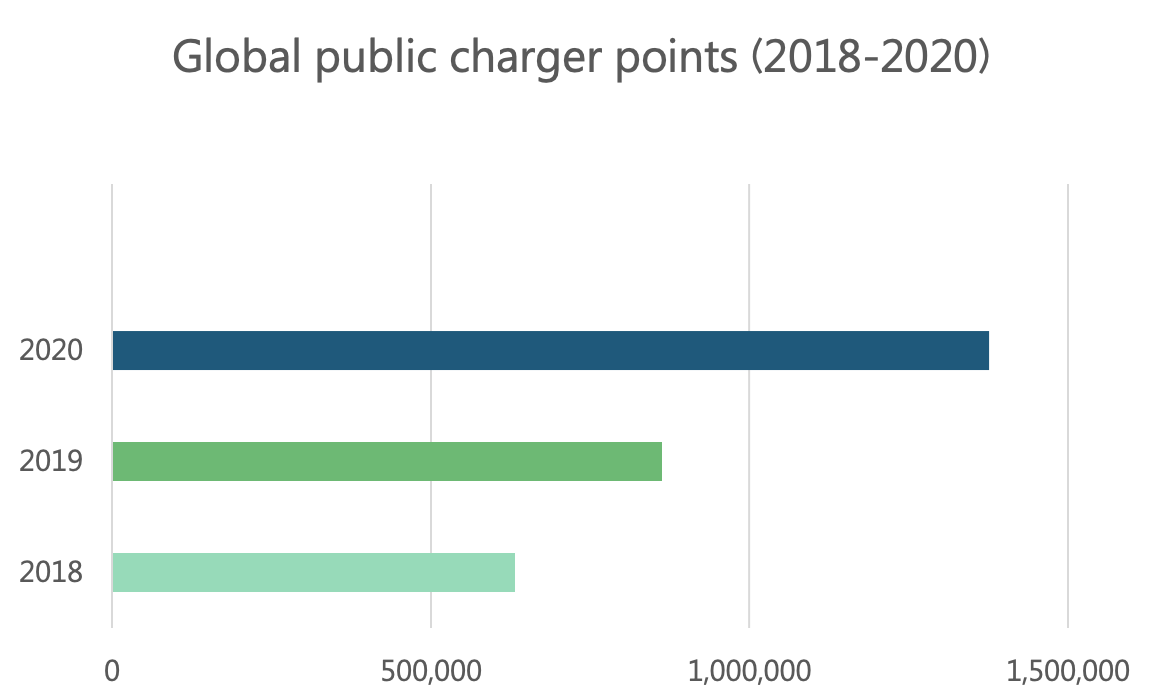

• Globally, the installed base of global public charger points showed a tremendous growth; 118% from 2018-2020.

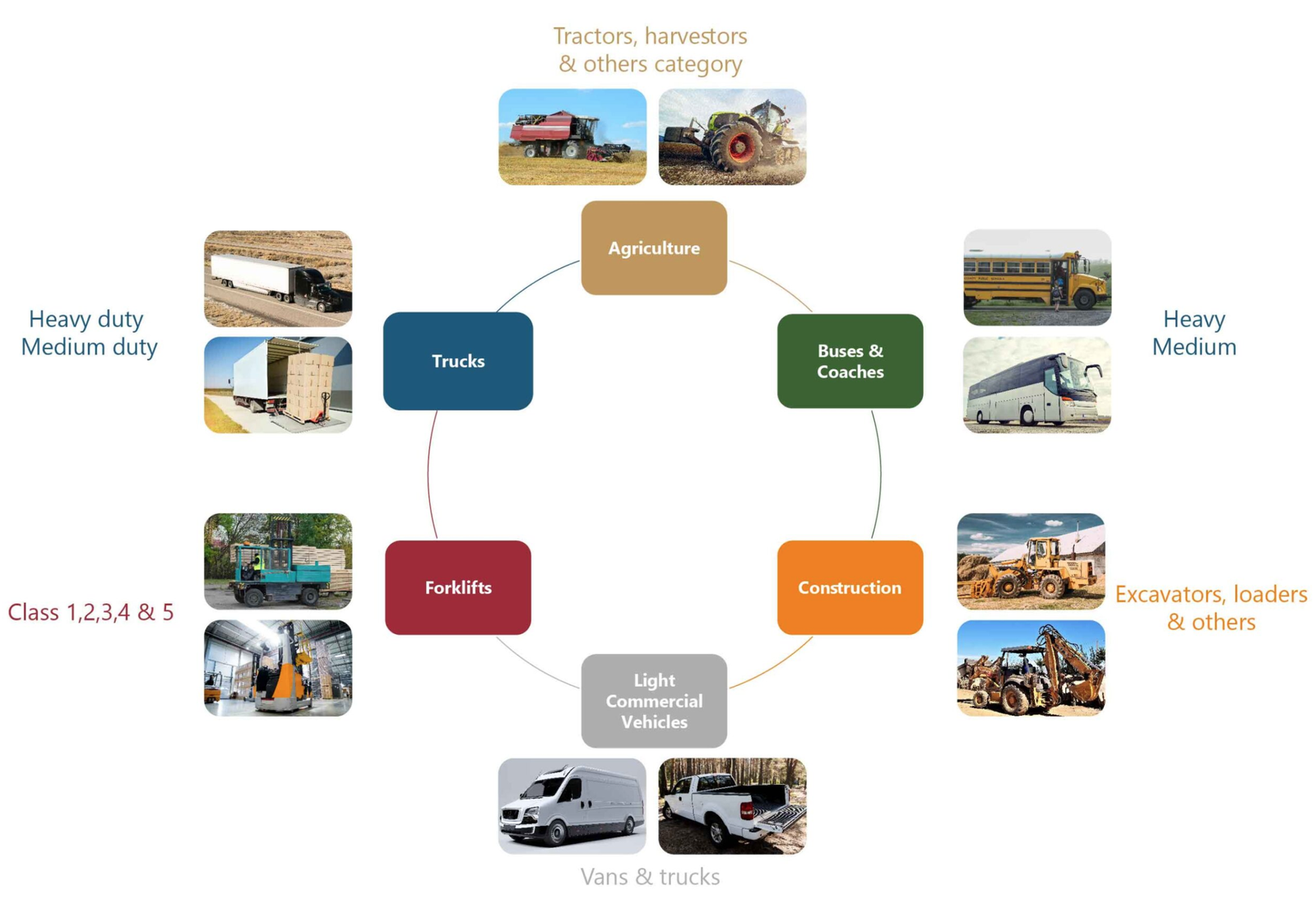

Electric vehicles are rapidly penetrating the passenger vehicle market, but the growth is being observed in the commercial and off highway vehicle segment as well. Although, the incentives and motivation for electrification of Commercial and Off-Highway Vehicles (COHV) is different than that of the passenger vehicle segment. The COHV segment can include Construction Vehicles, Agricultural Vehicles and Forklifts, Trucks, Buses and Lightweight Commercial Vehicles (LCVs). This article will focus on the commercial type vehicles, their electrification and the challenges faced by the industry at today. As can be seen in the figure below, the trucks and buses are further divided into categories of medium and heavy buses. LCVs include vans and pickups with a gross weight of no more than 3.5 metric tons.

Overview and analysis of COHV electrification

The need for electrification in the commercial vehicle segment

The e-commerce industry has grown tremendously, 15% year on year in the past ten years. Covid-19 helped accelerate consumer buying patterns to online. Even when we return to a new normal, online shopping will remain a large part of commerce.

Following the rise in the e-commerce industry there was a surge in the demand for the light commercial vehicles. The increase in demand for LCVs was followed by a rise in fossil fuel consumption and a rise in emissions, especially in the densely populated urban centers of the world, in turn underscoring the case for the electrification of LCVs.

Transit buses are also ideal for the electrification, when compared to other segments of COHVs, as they have established routes, travel within a smaller geographical region and are greater in size so they can house large battery packs.

Technological advancements facilitating electrification

Recent technological advancements are facilitating the electrification of transportation sector as a whole and the COHV segment specifically.

• One of the major drivers, for the growth in the sector was the drop in the cost and size of the lithium-ion batteries. Since, 1991, when the lithium-ion batteries were first commercially introduced, costs have dropped by 97% and the size has reduced more than one-third.

• Furthermore, governments worldwide are making policies and investing in public charging infrastructure.

• The grid will need to be upgraded to accommodate this demand. Expansion plans are concerned globally transition from Distribution Network Operator (DNO) to Distribution System Operator(DSO) model is underway, smart technology is being incorporated, business models of utilities are being adjusted among other measures that are being taken to enable the growth of EVs in the COHV segment and otherwise.

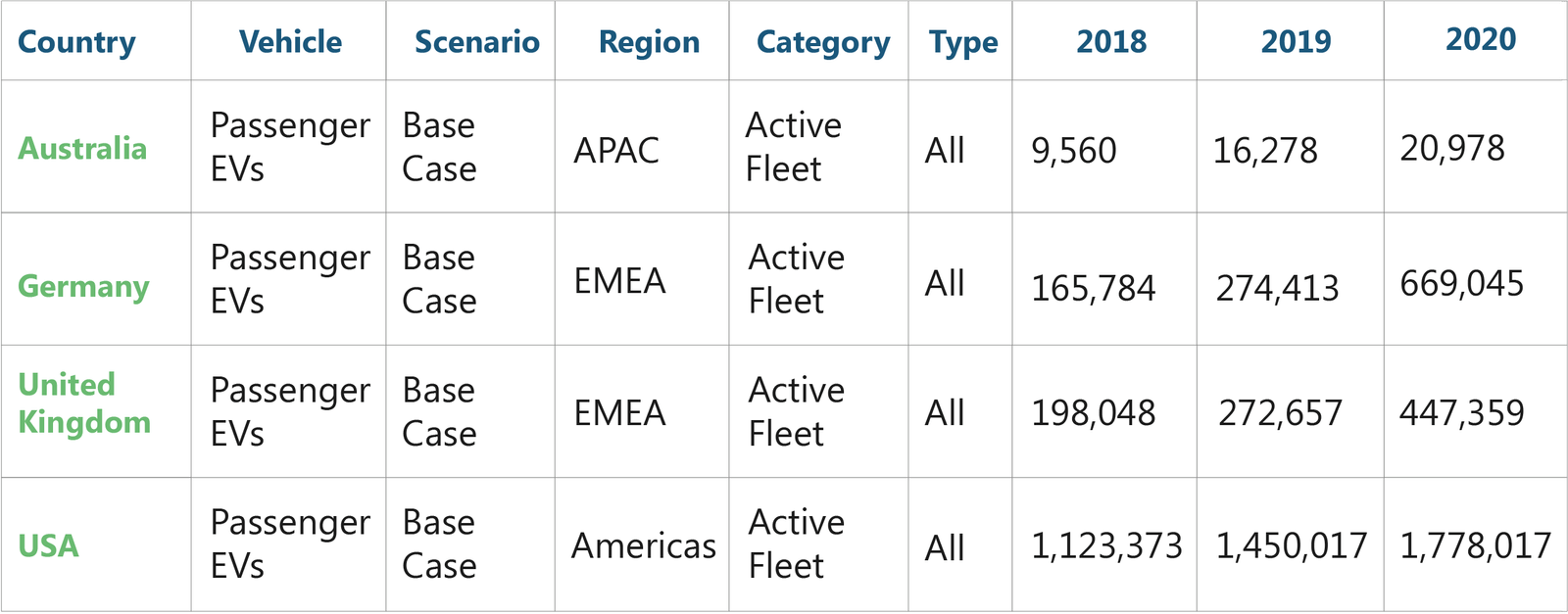

These advancements have resulted in the tremendous growth we are observing in the adoption of EVs. The installed base of global public charger points increased from 632,089 to 1,376,075 from 2018-2020 depicting a growth of 118% (see Figure 1). Consequently, in the passenger EV segment from 2018-2020 , Germany showed a growth of 303% , Australia showed a growth of 119%, UK grew 125% followed by a US which showed a growth of 58% in the same period.

LCVs require high power charging stations, so they cannot use the same charging infrastructure as passenger EVs. As most LCVs have short routes and with better capacity batteries, they will not need to charge enroute and most will charge overnight at the company hub.

Major industry players for COHV segment

Some industry players have recently introduced COHV models:

• Volvo In June, Volvo showcased the VNR electric series trucks. The class 8 truck has a range of 150 miles, and a 264-kWh battery which can be charged to 80% in 70 minutes. Also, Volvo plans to launch the Volvo 7900 electric bus which will be equipped with batteries to providing additional range and supporting flexible charging. The new electric truck will be built in Volvo’s factory in Virginia, USA.

• BYD offers electric transit buses, electric motor coaches and double decker buses as well as several class 6 and class 8 trucks and a terminal tractor. BYD is a Chinese company with manufacturing in the U.S. and in Brazil. With over 40,000 electric buses in over 50 countries, BYD has been in the electric vehicle business for many years. The latest electric bus can seat up to 84 passengers and has of range of 155 miles on one charge.

• Lion Electric is a Canadian manufacturer of all-electric class 6 and 8 trucks and buses, especially. full-size electric school buses. The LionC electric school bus with a range of 155 miles on a single charge, can carry up to 77 passengers and can produce a 1,800 ft-lb torque from the 210 kWh battery capacity.

• Rivian, with a manufacturing center in Illinois, USA, received a contract from Amazon for 100,000 electric delivery vans. In 2021 the vans are currently being tested in 16 cities and should number 10,000 by end of 2022.

The U.S. may become a world leader in electric vehicles as part of President Biden’s strategy to combat climate change. The infrastructure bill was modified in June but still includes some items as expanding and supporting a nationwide network charging stations and electrifying buses. In addition, the administration has called for scaling up battery innovations, including low/no cobalt chemistries and boosting the U.S. recycling of batteries.

President Biden signed an executive order to make the federal fleet, composing mostly of postal trucks, passenger vans and heavy-duty trucks, all-electric. American based companies will benefit from this as the vehicles must be made from at least 50% American-made materials and with union workers.

Conclusion

Although electric delivery vans are seeing their numbers grow greatly, Power Technology Research believes electric buses and trucks are still a long way from being commonplace. Most orders for electric trucks and buses are small and seem to be used on a validation basis. The number of high-powered charging stations will also have to ramp up significantly in order to meet the demand of these vehicles. However, electrification of COHVs is just one component of global climate strategy to achieve net neutrality by 2050..

More about our Commercial & Off-Highway Vehicles Market Analysis

Related Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential gathering left a profound impact, and I am delighted to share a comprehensive analysis of my experiences. The Greentech...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home Energy Rebate Program in the USA and the revised Energy Performance of Buildings Directive (EPBD) in the EU offer roadmaps...

COP through the Ages

This infographic takes a cursory glance at the most significant achievements of the Conference of Parties through the years and offers a chance for introspection on whether these pacts and declarations added any value in the bigger pictureContact Sales: sales@ptr.inc...

Eyes on the Automobile Sector: Companies with Net-Zero Goals

In the wake of burgeoning climate threats, it is becoming ever-important to keep a track of how companies are making progress. Using data from Science Based Targets, this infographic displays the world's automobile companies that have a declared a net-zero target, and...

Contact Sales:

Hassan Zaheer – Exec. Director Client Relations & Advisory

+49-89-12250950