• In 2021, the cumulative renewable installed capacity for India, excluding large hydro projects, surpassed the milestone of 100 GW.

• India announced an enhanced target of installing 450 GW of renewables by 2030.

• India would require a CAGR of around 18% to achieve 2030 renewable target.

In pursuit of climate goals India is rapidly moving towards deployment of renewable generation across the country which in turn owing to intermittent nature of the renewables will create need for energy storage in the country. In this article we will be discussing the generation mix followed by renewable generation trends in the country and explain what it means for the emerging energy storage market of India.

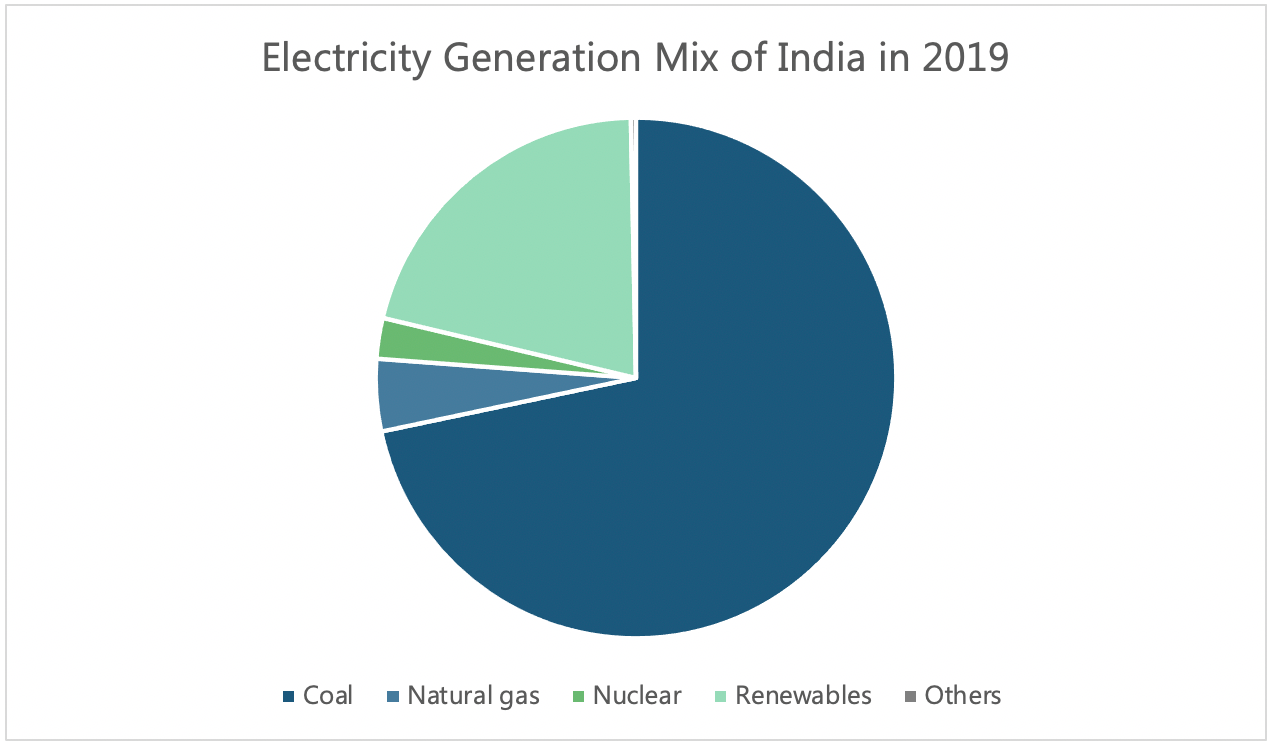

According to the International Energy Agency (IEA), India is the world’s third largest consumer of energy, and it meets most of the electricity demand through coal fired generation. Coal accounts for almost 71% of the generation mix followed by 20% renewables (including large hydro) while natural gas and nuclear constitute 4.4% and 2.5% of the generation mix respectively. If we exclude large hydro, renewables only account for around 10%, with solar and wind accounting for 3% and 4% of the overall generation mix (as per IEA 2019 figures).

Renewable Generation Trends and Energy Storage

In August 2021, the cumulative renewable installed capacity of India surpassed the milestone of 100 GW, excluding large hydro projects. If we include hydropower projects the renewable installed capacity is at 146 GW.

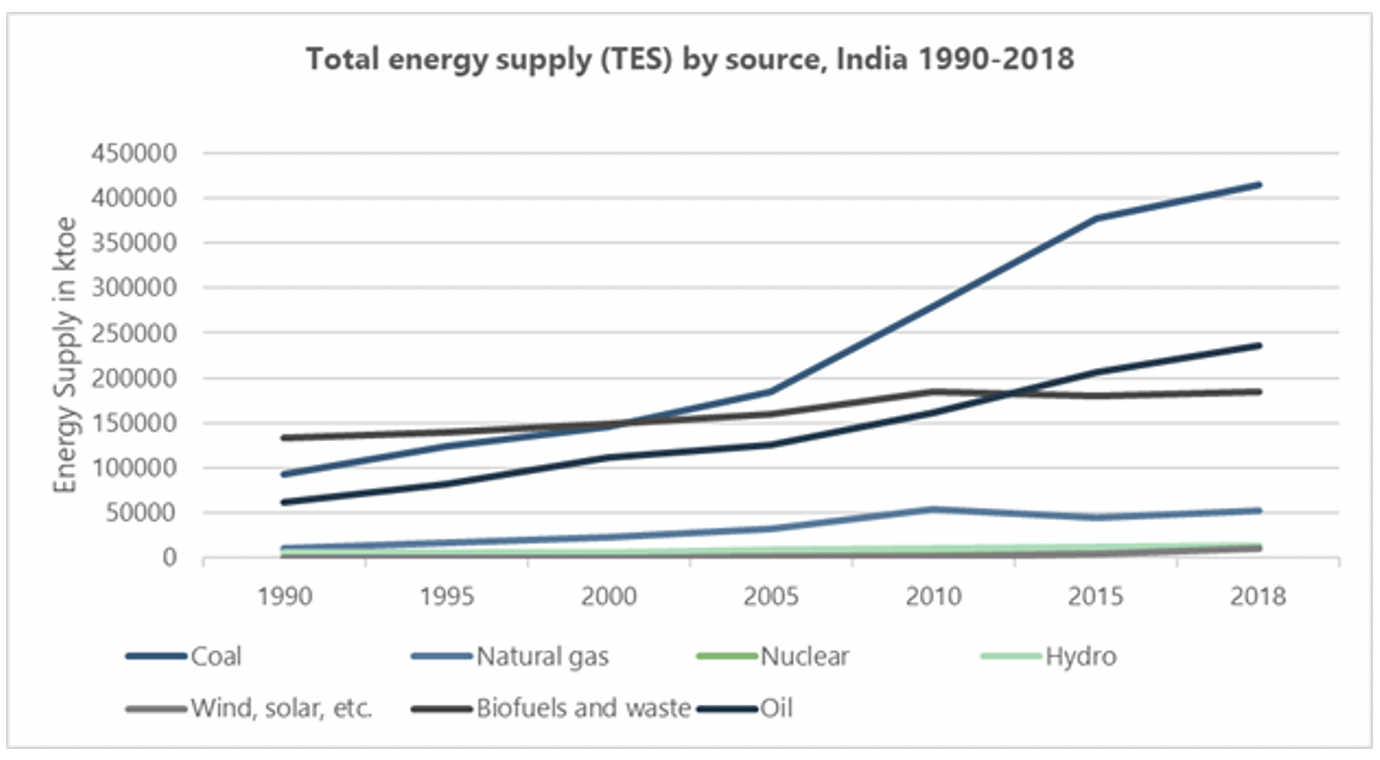

Source: IEA

Source: IEA

Renewable energy, especially solar PV and wind generation are intermittent sources of energy, and are expected to grow further in India, creating a need for utility scale Long Duration Energy Storage (LDES) solutions. Battery storage will not only enhance the cost competitiveness of solar PV but provides much needed flexibility to the grid. In place of energy storage to manage the intermittency of renewables in the grid, natural gas fired generation plants are also an option, but they are only expensive in the long run but don’t fit well with country’s commitments to reduce carbon emissions.

Policies and Incentives

Under the Paris Agreement, each country sets their own Nationally Determined Contribution (NDC) and tries to meet its own goals. India has set 3 targets:

• Lowering emissions intensity of its GDP by 33-35% compared to 2005 levels, by 2030.

• Target of 175 GW of renewable capacity by 2030.

• Create an additional carbon sink of 2.5-3 billion tons through additional tree coverings.

Recently, Prime Minister Modi announced that India is progressing to meet its climate goals, but the country does not have energy storage specific initiatives and policy frameworks available. India also has one of the largest coal capacities in the world and government subsidies for coal are still higher than subsidies for renewables. There is about 33GW of coal-fired power capacity currently under construction and the Central Electricity Authority projects India will reach 267 GW by 2030.

But, in the last 12 months, the Central Energy Authority has not announced any new thermal generation in the country indicating that the growing energy requirements will be met by renewables. In addition, in some states, like Gujarat and Chhattisgarh, thermal generation assets are underutilized leaving the state-owned Distribution Companies (DISCOMs) to pay capacity charges, hence, those states have announced that they don’t plan to install more coal plants in the coming future.

The country’s goal on renewables will foster growth in the energy storage market. In August 2021, India announced a target of installing 450 GW of renewables by 2030. Keeping in mind the present renewable installed capacity of 100 GW, India would require a CAGR of around 18% to achieve 2030 renewable target.

The Indian government is also set to announce tenders for 4000 MWh of energy storage including 1000 MWh tenders for each of four Regional Load Dispatch Centers (RLDCs). This is seen as a good omen for the energy storage market of India, but the current lack of policy guidelines and supporting programs to direct the scope and scale of energy storage deployment present barrier for private investments.

Supply Chain readiness for ESS

India, like many other countries, was reliant on China for sourcing of batteries and other energy storage components. However, like the rest of the world, Covid-19 and the associated lockdowns disrupted supply chains in India pushing the country to focus on in-house manufacturing and diversification of their supply chains. For similar reasons, the country has started a self-reliant India plan which is expected to include the local manufacturing of batteries as well.

Partly, as a consequence of in-house manufacturing scheme, giga factory manufacturing battery was announced whereas another giga factory is under consideration.

As far as market players are concerned, Greeko Energies, Tata Power, Lanco etc are leading energy storage developers whereas ABB and Fluence are major integrators active in India. But with India’s increasing focus on in house manufacturing with an aim to reduce supply chain reliance on foreign countries for solar modules and batteries, PTR expects many emerging players to surface as well.

Looking Ahead

In the next decade, PTR expects India to become a leading energy storage player in APAC after China. While the government still needs to have a proper framework to support energy storage, the country is actively adding renewables to the generation mix with the aim of 450GW by 2030.

The newly introduced auctions and production-linked incentives are an encouraging sign. Several battery manufacturing Giga factories are planned in the coming years including a cumulative 50 GW of advanced chemistry cell batteries and a 1 GWh lithium-ion battery plant set to be operating in mid-2022.

As prices for renewables and batteries go down, the adoption of energy storage, particularly stand-alone storage in India would become more prevalent.

Service Overview

More about our Energy Storage Market Research

Recent Insights

US Elections: Consequences of a Second Trump Presidency for Energy Sector

The US is making strides to move away from fossil fuels and eventually decarbonize the energy sector. The White House aims to achieve 80% renewable energy generation by 2030 and 100% carbon-free electricity by 2035. On the other hand, for electric vehicles, it has set...

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential gathering left a profound impact, and I am delighted to share a comprehensive analysis of my experiences. The Greentech...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home Energy Rebate Program in the USA and the revised Energy Performance of Buildings Directive (EPBD) in the EU offer roadmaps...

COP through the Ages

This infographic takes a cursory glance at the most significant achievements of the Conference of Parties through the years and offers a chance for introspection on whether these pacts and declarations added any value in the bigger pictureContact Sales: sales@ptr.inc...