- According to Power Technology Research, the annual market share of Germany’s EVSE market is USD 219 million and is expected to grow with a CAGR of 21% from 2020-2026.

- Transportation constitutes 24% of the total emissions in Europe, the electrification of which will clearly provide much needed respite to the environment.

- Germany is set to provide USD 6.5 billion in funds for a national EV charging infrastructure. The funding will be available till 2024.

According to Power Technology Research, the annual market share of Germany’s EVSE market is USD 219 million and is expected to grow with a CAGR of 21% from 2020-2026. There are a total of 295,612 private and public charging points in the country. In the public charging segment (as reported to the Federal Network Agency) 40,257 are normal charging points and 6,840 are fast charging points.

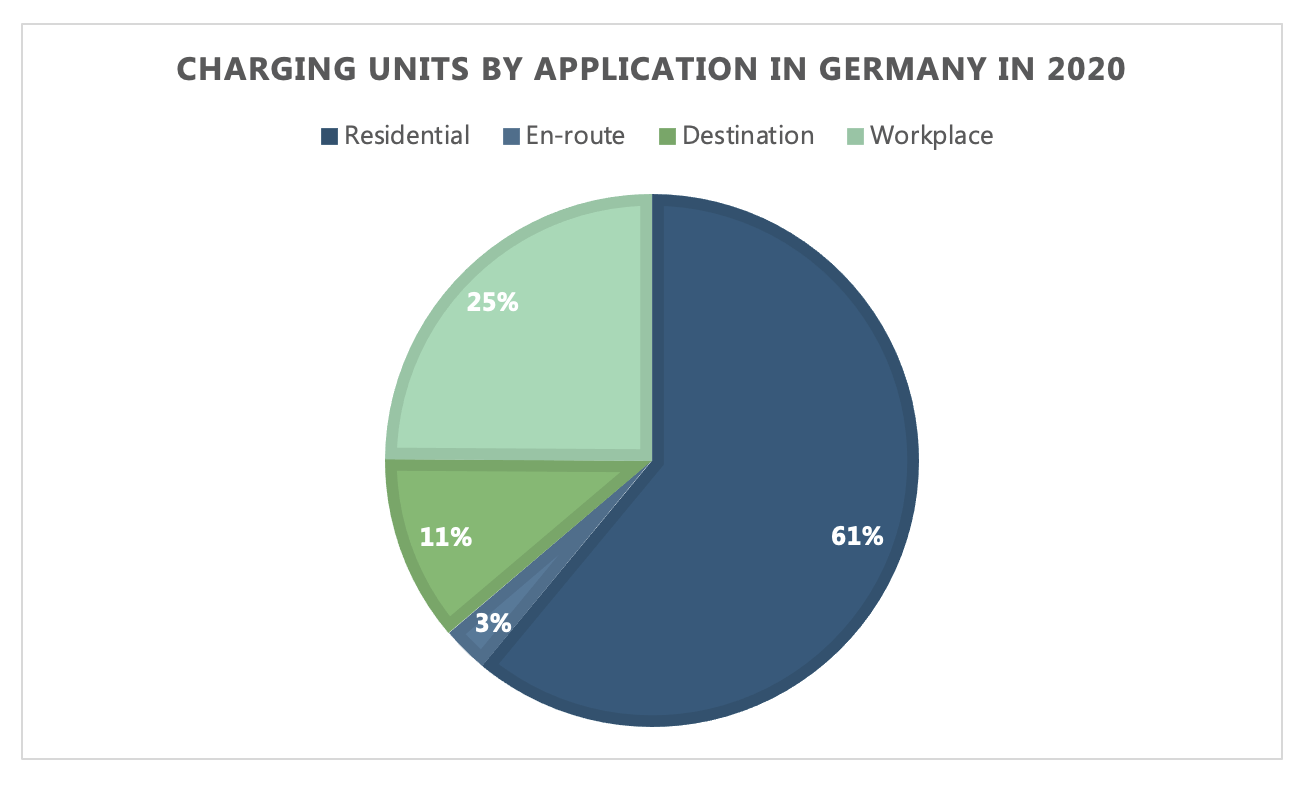

Application wise division of the charging points is such that 61% of the total chargers are residential chargers, 2.8% are enroute chargers, 11.3% are destination chargers, and 24.9% are workplace chargers (see figure 1).

Figure 1: Charging units by application in Germany in 2020.

Source: Power Technology Research.

Figure 1: Charging units by application in Germany in 2020.

Source: Power Technology Research.

Residential chargers include off street (non-shared) charging, chargers installed on private premises, and charging in parking areas of residential complexes. Workplace chargers include ones installed in offices and commercial buildings, depots for fleet vehicles, and e-bus/e-truck depots. Destination chargers include chargers installed in shopping areas, hotels, resorts, cinemas, universities, and hospitals. En-route chargers include ones installed on highways or at gas stations and other transitory non-rest stop areas.

New incentives and grants

Transportation constitutes 24% of the total emissions in Europe, the electrification of which will clearly provide much needed respite to the environment and help meet Germany its climate goals. Germany is coming up with several incentives and grants to support the uptake of EVs in the country.

The country is providing additional support of EUR 100 million to subsidize private charging stations for EVs installed in residential buildings. EUR 400 million was already invested to support the installation and purchase of wall boxes. As of July 2021, an average of 2500 applications for private charging points in residential areas have been filed for the country’s EUR 900 support grant every day.

Germany is set to provide USD 6.5 billion in funds to support the EV charging infrastructure in the country. This funding will be available up until 2024. In order to have 1 million charging stations by 2030, Germany under post-Covid stimulus package of EUR 130 billion, allocated EUR 2.5 billion for battery cell production and the expansion of the charging infrastructure.

The German government came up with a EUR 300 million incentive program for SMEs (small and medium sized enterprises in the retail, hotel and catering industry). The subsidy provides support to a maximum of 80% of the total cost of purchase and installation while requiring the use of renewable energy to power charging stations. Under the SME incentive program, there is a subsidy of up to EUR 4,000 per AC/DC charger ranging from 3.7 to 22 KW, a subsidy of up to EUR 16000 for DC fast chargers ranging from 22 to 55 KW, a subsidy of up to EUR 10,000 for low voltage chargers, and one up to EUR 100,000 for MV grid connections.

Further, EUR 1.2 billion will be provided to private and municipal operators to switch to alternative drive systems as an incentive for electrification of the transport sector. Under the WELMO program which has been recently extended, the state government of Berlin supports the procurement and lease of commercially used EVs as well as the development of a charging infrastructure in commercial areas. From July 1, 2021, taxi companies in Berlin can also benefit from the funding.

The funding covers a maximum of 50% of the cost for acquisition or lease of AC and DC charging stations in public and non-public areas. This is a maximum of EUR 2500 for AC, EUR 30,000 for DC charging points, EUR 5500 for connection to the low voltage network, and a maximum of EUR 55000 for connection to the MV network. Additionally, it provides up to EUR 15000 for the purchase of a battery EV or fuel cell vehicle that is to be used as a taxi.

Looking Ahead

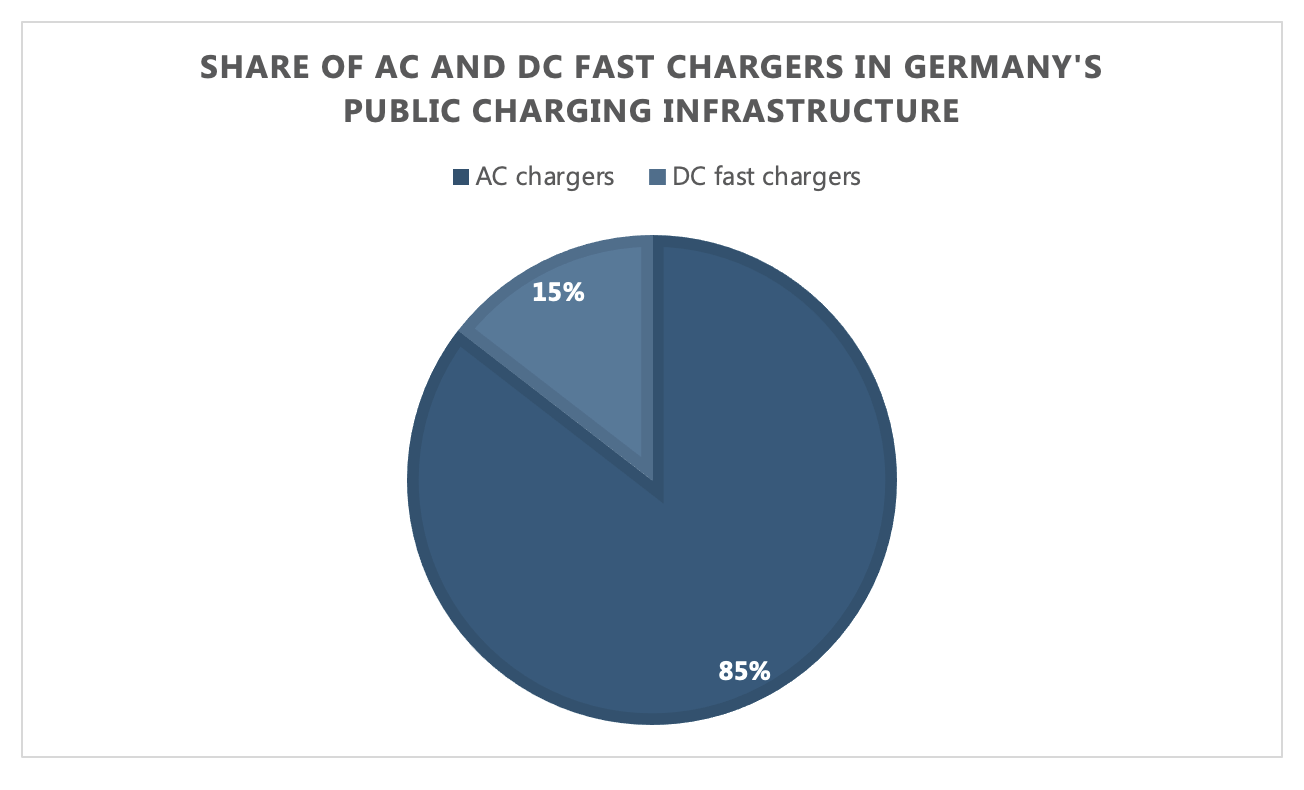

According to Power technology Research, Germany is not expected to achieve the target of 1 million charging points by 2030 regardless of the growth and funding available in this sector. Significant to note is the fact that most growth in the EVSE sector will be observed in the DC chargers segment which will grow with a CAGR of 46%, suggesting a shift from AC to DC fast charging in the coming years.

EV Charging Infrastructure Service Overview

The research presented in this article is from PTR's EV Charging Infrastructure market research. For information about this service please submit a request shown below.

Contact Sales:

More about our:

EV Charging Infrastructure Market Research

Recent Insights

European Electric Vehicle Charging Infrastructure (EVCI) Services Market Landscape

This infographic gives an overview of the electric vehicle charging infrastructure (EVCI) services market in the European region. It highlights the...

Exploring the European EVCI Services Market Key Players and Emerging Trends

There has been a significant surge in the development of EVCI due to the widespread adoption of EVs in Europe. By 2030, it is expected that Europe...

Global EV Market: Analysis of EV Sales Slowdown in 2023

• EV sales were impacted adversely in 2023 on account of various factors, including price disparity, consumer perception and supply chain...