Electric Vehicles (EVs) are on a path to provide a clean, sustainable economically viable alternative to vehicles with internal combustion engines (ICEs). Every day, new targets are being set by governments and car OEMs on the increased adoption of EVs. Globally, the total number of EVs on ground is expected to grow to 50 Million vehicles by 2025 (IEA-2020), if we only consider stated policies. Recent announcement by EU predicts 30 Million EVs on the road by 2030. All these electric vehicles require corresponding charging infrastructure to cater to charging requirements, leading to huge investments in EV charging infrastructure around the world. The global installed base of EV Chargers is expected to increase many folds and reach 2.5 million publicly available charging outlets by 2025. However, from a power grid perspective, this represents an increased load. How would this interaction between EVs and Grid evolve, is a key question for many utilities around the world today. The effects would vary from utility to utility depending on the current state of grid infrastructure. Nevertheless, it is very important to understand and take measures for possible mitigation of these effects.

Overview of Charger families today

There are generally three types of charging mechanisms for Electric Vehicle (EV) charging: AC Charging, Low Power DC Charging and High-Power DC Charging. AC Charging is the slowest form of charging which ranges from 0-22 kW. It is further divided into two subcategories: Level 1 and Level 2. Level 1 chargers employ a 110 V output and a Level 1 chord. Power output for this sort of charging ranges from 12-16 A. Where Level-2 Chargers employ outlets with voltages over 200 V and have higher power output level ranging from 16-40 A.

AC charging is the cheapest charging method and is most suited to be installed at parking spots where a car will be parked for 20 minutes or more. Generally, costs (production, installation and operation) and charging tariffs increase with the increasing power of charge point. In other words, fast chargers cost more than slow charges.

It is important to note that this does not consider the charging capacity of your electric vehicle. If your car cannot be charged at high capacity, it does not matter if you are connected to a fast-charging station or not. If you do so, you may be paying a lot more for the small amount of energy that you have extracted.

Then we have DC Charging, which is used for fast charging of electric vehicles and is referred to as Level-3. Level-3 charging is further divided into two subcategories: Low Power DC Charging ranging from 0-50 kW and High-Power DC Charging which is higher than 50 kW.

DC Charging came into being to cater the needs of customers who need charge right away and are willing to pay little more than usual for instance when on a road trip or when you are low on battery and running late for some work.

DC charger has inverter inside it which makes it larger in size and converts the AC supply to DC, bypassing the on-board inverter of the EV and directly transmitting to the ‘battery management system’ of the battery as per instructions of vehicle’s charging control system. As far as DC charger installation is concerned, it requires a lot of power from the grid (around 100 A). This renders DC charging expensive (production, installation and operation), resulting in high tariffs for charging. Charging speed is dependent on the output power of charging point along with the capability of the converter to convert to DC.

Market growth of different types of EV charger families

According to Power Technology Research, EV market is one of the fastest growing markets and its installed base is expected to increase with the compound annual growth rate of approximately 18.4 percent during the period 2020-2025. New additions will constitute of both AC and DC chargers, but most new installations will be AC chargers where number of DC Chargers will also increase.

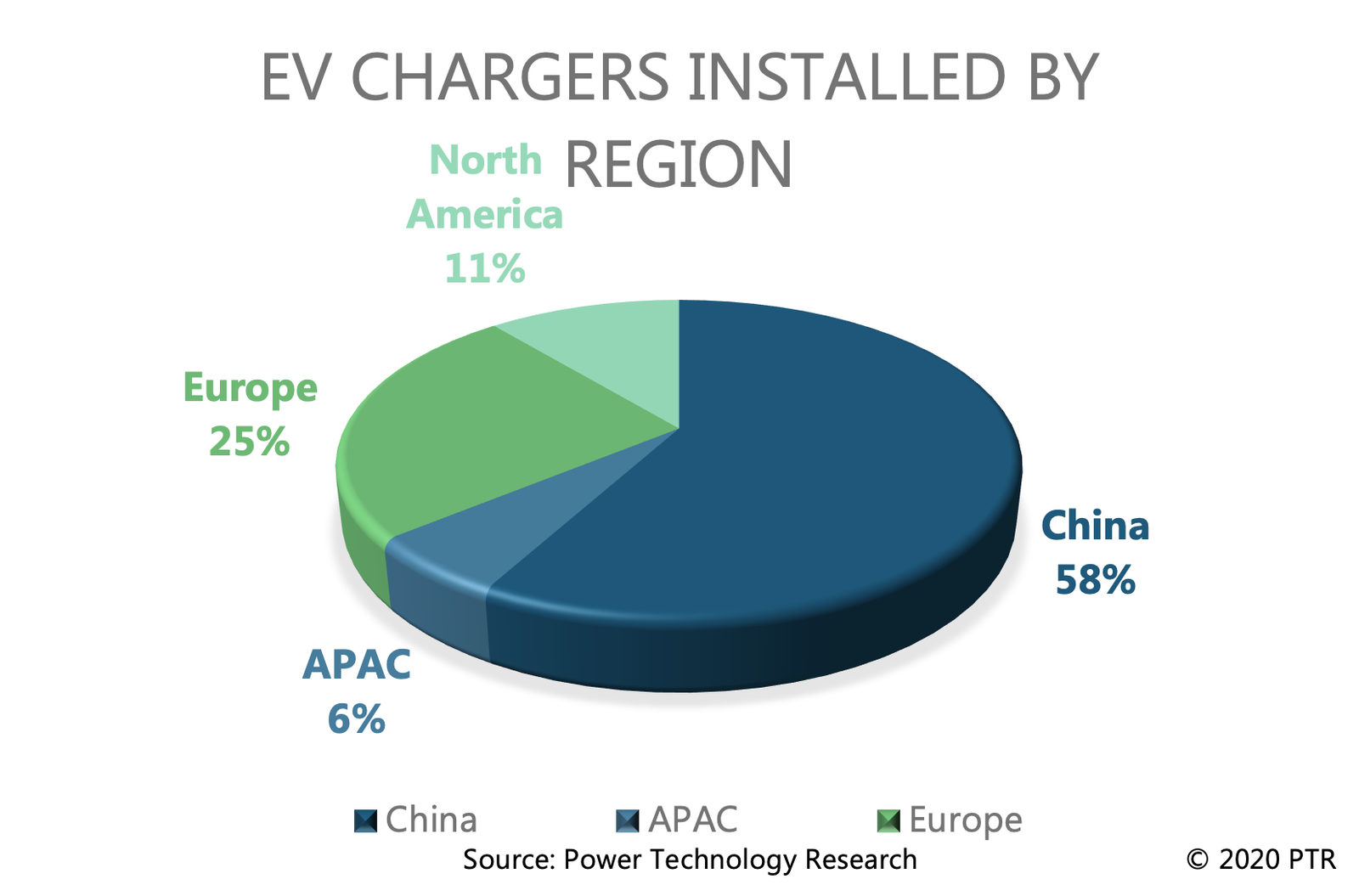

Region wise installed base

As shown in the figure below, China has the greatest number of public chargers installed with a market share of 58%. Around 497,000 publicly available chargers were installed in China by the end of 2019. Second highest is Europe which has 25% of global installed base followed by North America and APAC countries with 11% and 6% respectively.

Figure 1: EV Chargers Installed by Region

Connector wise installed base

CCS, ChaDeMo, GB/T, Tesla SC are the most widely used DC charging connectors in the world as shown in the figure below. GB/T has the largest share in the world accounting for 78% of global installed base. The reason for the high GB/T share is that it is the mandated standard by the Chinese government.

Figure 2: DC Chargers by Connector Type – 2019

Impact of EV chargers on grid

Although the growth of EVs and their associated charging stations have a positive impact on the environment and economic viability of countries, they can have detrimental effects on the power grid. These effects need to be understood before moving to possible remedies or ways to mitigate them. For instance, the high charging loads associated with fast charging stations result in:

- Increased peak demand.

- Reduced reserve margins.

- Voltage instability.

- Reliability problems.

Distribution companies should consider installing fast charging stations on strong buses to prevent potential break downs and reduce the impact on the performance parameters of the grid especially if the number of charging stations are increased. An upgrade of the system is required if you intend to go beyond recommended numbers.

If the fast-charging stations are installed on weak buses the smooth operation of the system can be curtailed, leading to sharp voltage drops and sharply increasing power losses. This can incur a higher amount of economic loss. It is interesting to note that weak buses can handle slow charging stations.

It is necessary that utilities identify the strength of buses and allow installation of chargers accordingly. It has been found that the distribution of fast charging stations between multiple buses is more suited as compared to placing multiple charging stations on a single bus. In one case it was observed that placement of even one fast charging station at a weak bus incurred approximately USD 1.4 million in economic loss.

It is important to note that generation the levels of power transmission are as follows:

Residential or commercial users get power directly from low voltage where this low voltage side is the most vulnerable one. There are fast charging solutions for instance ‘Fastened which installs fast charging stations at the medium voltage side which can bear more load as compared to low voltage side of the grid.

Solutions to Mitigate the Effects on the Grid

Smart charging

Smart charging is another remedy to curtail the impact of EV charging stations on the grid. It enables us to intelligently manage EV charging without overloading or destabilizing the grid.

It works by opening pathways enabling utility companies and charging operators to communicate with each other optimizing the charging process. Smart chargers increase or decrease the power provided to the EV depending on the load on the grid. EVs cannot simply plug in and extract as much energy as they want in smart charging. This technology provides the network operator the ability to adjust the flow of energy into EVs and this in turn benefits the consumers because it enhances the reliability of the grid.

Smart Charging has three main features:

- Power sharing

- Power boost

- Dynamic power sharing

It is a one-way process and is essential for the increased number of EVs in the market and to make an effective transition from ‘Internal Combustion Engine’ powered vehicles to EVs avoiding chaotic disruption.

Vehicle to grid integration

Vehicle to grid integration (V2G) is a technology which enables the transmission of power from the battery of the EV back to the grid. The idea behind V2G is similar to smart charging but allows the grid to control the charging of the EV increasing or decreasing the charge per the grid’s requirement. In addition, it enables the charged power stored in the battery to be withdrawn and transmitted back to the grid to balance fluctuations in energy production and consumption.

V2G enhances the grid’s ability to balance itself which will come in handy with the increase in the amount of solar and wind energy coming on-line. Without V2G, energy will have to be brought back from the reserve power plants situated at long distances which increase the electricity tariffs as initiating reserve plants not only takes time, but the process is costly. Localized balancing of the grid is what V2G provides, potentially increasing stability and reducing losses.

EV Charging Stations (EVSE) with Storage

EVSE with storage is another method to mitigate the effects of EV charging stations on the electricity grid. Although the growth of the EV market is a welcoming change, it will also mean that the power sector will be required to add generation, transmission and distribution capacity to meet the added demand especially during peak hours. This will give a rise to pollution levels coming from these power plants. Peak time is when maximum power draw from grid occurs.

This issue has been under great focus of legislators, policymakers, regulators and utilities on how to deal with the added demand that charging of EVs during peak times will add. There are conventional responses, as discussed previously but there is an alternative response to it as well.

One possible solution requires installing distributed storage at or near EV charging stations. Storage is charged during off peak hours with low-priced off-peak energy and can be served to EV owners during peak hours. This would satisfy customers and provide a smooth demand curve to utilities without having to add additional capacity.

Another benefit would be to assist with distributed storage as EV charging could become part of strategy to integrate distributed PV’s and enhance service reliability in the area.

Microgrid ecosystem

To further enhance the capability of the grid to manage increase in demand during peak hours we look towards the development of a microgrid ecosystem. Schneider Electric defines the microgrid ecosystem as a locally interconnected system within clearly defined electrical boundaries:

- Incorporates loads and decentralized energy resources, including storage.

- Multiple energy sources.

- Can be grid connected or be off grid.

- A single entity with its own independent control in both modes.

- Power can range from several KW to multiple MW with a voltage range up to MV.

Energy management systems are put in place to allow clean energy for instance from solar power to be stored on-site batteries so if EVs can still be charged when electricity tariffs are higher during peak hours. It will be difficult to incorporate such infrastructure in urban areas, so it opens possibilities for Installation of EV charging stations in rather remote areas for instance inter-city roads or in smaller less congested towns where upgrading of the network is not economically viable.

Conclusion:

With the increase in EVs around the world, the potential for revenue also grows inciting wide range of players to tap into that potential and experiment with the overlapping business models. One key player in this regard are the utility companies.

Utility companies globally are exploring ways to provide EV charging to customers because of various opportunities attached with it. Regulated transmission companies, which earn a return on allowed investments, may see EV charging as a way to boost long-term revenue. Power companies with generation infrastructure may see an opportunity in rising demands.

Haphazard installation of EV charging stations, especially fast charging ones, can be destabilizing for the power grid, but with a little planning and modern solutions (i.e. smart charging, V2G)., these effects can be mitigated.

Utility companies are key players in this regard which need to prepare for EV uptake beforehand. The primary focus should be on identification of weak and strong buses in their system followed by potential reconfiguration and business models. Some utilities may see EV charging as a way to improve grid operation and better utilization of grid infrastructure with demand response where other may see branding and image building potential.

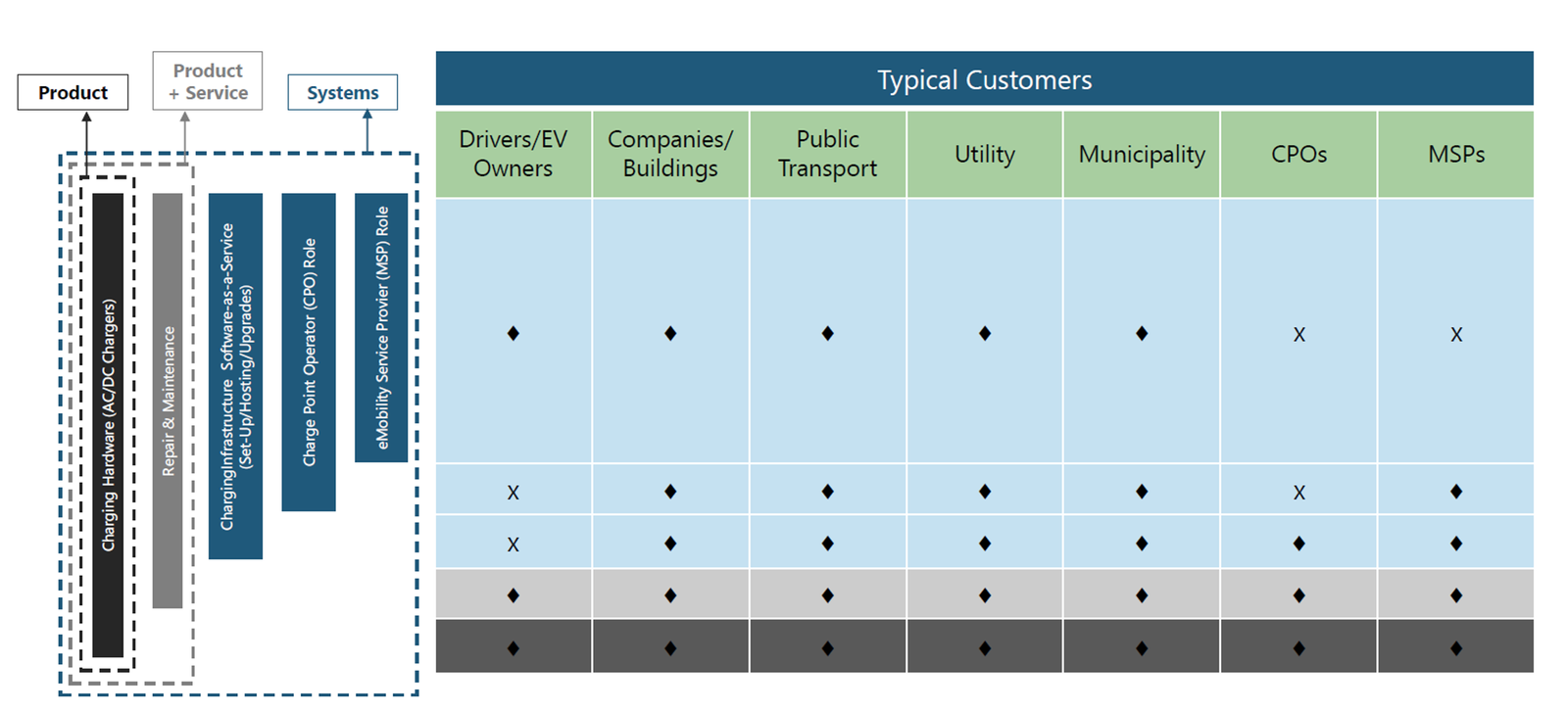

Figure 3: Business models and key players in the EV market.

There are some other constantly evolving business models and market players as well which will have a crucial role to play in the future as shown in the figure below. Some businesses are providing charging hardware (AC & DC Chargers) and repair/ maintenance services separately while some business models provide both the product and service. Other than that, there are some business models which provide charging infrastructure software where some have assumed charge point operator and e-Mobility service provider’s role. The coordination and evolution of these players/business models will decide the future landscape of global EV market.

About The Author

Muhammad Rafey Khan is Product Manager/Analyst at Power Technology Research. His responsibilities include managing a team of analysts to conduct research on Electric Vehicle Supply Equipment (EVSE) and Commercial and Off Highway Vehicle and conduct primary research for products related to electrical grids and generation facilities for countries in Europe, the Middle East, and Africa, America and the rest of world.

Prior to joining Power Technology Research Mr. Khan was a project engineer at Schneider Electric. Mr. Khan received is undergraduate degree from Lahore University of Management Sciences in Lahore, Punjab, Pakistan and his Masters of Business Administration degree from Institute of Business Administration in Karachi, Sindh, Pakistan.

More about our EV Market Research

Nordics EVCI Market Comparison: Quarterly Growth and Market Dynamics – 2024

This infographic examines the ambitious policies and regional targets that are propelling the growth of Electric Vehicle Charging Infrastructure (EVCI) across the Nordic countries, particularly in Norway, Sweden, Denmark, and Finland. As leaders in electric mobility,...

Electrifying Future: Emerging Trends and Strategic Targets in the Middle East

This infographic presents an overview of the burgeoning electric vehicle (EV) market in the Middle East. It highlights the region's ambitious targets and key trends to shift towards sustainable transportation. It explores how the Middle East is steering towards a...

US Elections: Consequences of a Second Trump Presidency for Energy Sector

The US is making strides to move away from fossil fuels and eventually decarbonize the energy sector. The White House aims to achieve 80% renewable energy generation by 2030 and 100% carbon-free electricity by 2035. On the other hand, for electric vehicles, it has set...

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential gathering left a profound impact, and I am delighted to share a comprehensive analysis of my experiences. The Greentech...

Contact Sales:

Hassan Zaheer – Exec. Director Client Relations & Advisory

+49-89-12250950