Introduction

Electric Vehicles (EVs) are on a path to provide a clean, sustainable economically viable alternative to vehicles with internal combustion engines that use non-renewable fuel and are damaging to the environment. With a comprehensive policy guideline and implementation plans in place by the governments across the world to promote EVs and the Electric Vehicle Supply Equipment (EVSE), we can better our chances to achieve our climate goals. In addition, countries, especially in the developing world, will be able to deal with their current deficit problems by reducing their crude oil import bill alongside increasing their energy security.

In 2019, imported global crude oil purchases stood at 1.05 trillion USD. This number has risen almost 25 percent since 2015 when total crude oil imports were 841.6 billion USD. China, India and USA constitute 46 percent of total global crude oil imports. Details of total crude oil imports in 2019 can be seen in the figure 1 below.

Figure 1: Net Crude Oil Imports in 2019.

Consequently, these countries are at the forefront of the EV race in the world. In pursuit of their electrification goals they have rolled out various subsidies, tax incentives, grants and premiums which we will discuss by each country.

China

In China, the central government pursues development of charging networks as a matter of national policy. The policy focuses on targets, funding and setting standards for EVs and the charging infrastructure. In addition, provincial and local governments in China also promote the development of charging networks with financial incentives and include policies such as requiring residential building owners to have EV charging spaces.

The State Council has laid out policies for the promotion of EV charging infrastructure in five government documents. In 2015,

Policies for the promotion of EV charging infrastructure in five government documents in 2015

- The State Council issued the ‘Guidance on Accelerating the Construction of Electric Vehicle Charging Infrastructure.’ The document called for an EV charging infrastructure with enough capacity to cater 5 million EVs by 2020. All upcoming residential construction had to be equipped with EV Charging and at least one public charging station for every 2000 EVs. Guidance also requires public-private partnership to install pubic chargers specifically mentioning shopping malls, grocery stores and major parking areas.

- In October, the National Development and Reform Commission (NDRC) issued the ‘Guidelines for Developing Electric vehicle charging infrastructure (2015-2020)’ calling for at least 120,000 EV charging stations and 4.8 million charging posts by 2020. The guideline divided China into three regions with changing degrees of EV Infrastructure promotion. It also called for establishing a grid of EV Charging enabled highways spanning the populous eastern coastal provinces.

- The National Standards Committee issued standards for Electric vehicle charging interfaces and communication protocols where National Energy Administration summarized new standards through a notice.

- Ministry of Science & Technology, Ministry of Industry & Information Technology, National Development & Reform Commission, and National Energy Administration published 13th Five-year plan for ‘New Energy Vehicle Infrastructure.’ The plan involved 90 million RMB in funding for developing charging infrastructure, specifying minimum number of charging points for charging, called to install chargers at government buildings and procurement of chargers from any charging manufacturer.

In 2016, A notice issued on ‘Accelerating Residential EV Charging Infrastructure Construction’ laid out standards and procedures for residential charging. Notice also designated Jing Jin Ji, Yangtze River Delta and Pearl River Delta regions as a demonstration zone for residential charging infrastructure.

Following the central government, provincial and local governments in China also promote deployment of EV Charging Infrastructure with financial incentives and laying out New Building Construction Policies.

New Building Construction Policies

- The City of Shenzhen offers buyers of EVs subsidies of up-to 20,000 RMB for vehicle insurance and installation of charging equipment. Over 30 other cities offer some form of home or public EV charging incentives.

- In 2014, Guangzhou adopted a policy that new buildings must have 18 percent of parking spots either equipped with EV Charging equipment or enabled for future installation.

- In 2017, Beijing Municipal Government began mandated that all parking spots in new residential developments to have EV Charging Infrastructure where new government or State-owned enterprise buildings were to install at 25 percent of parking spots.

- The central government is considering a shift from incentives on charging installation to reduction in the per kwh EV Charging fee. However, in 2018, the Beijing Municipal Government removed caps on EV Charging tariffs in a bid to make the EV charging business viable. Complaints were filed by charging station owners that EV charging rates are too low for them to make money taking into consideration high land prices and low utilization.

The problem with the spike in the charging fee is that EV drivers are highly price sensitive where EV rental agencies complain that high charging rates keep rental volume low inhibiting rental agencies from making money.

In 2014, the NDRC clarified the EV Charging rates for three classes of customers. Residential charging pays residential rates which are usually the lowest tariffs. Dedicated central EV Charging and battery swap stations pay the large industrial customer rate but are exempt from basic (demand) charge. Where Government offices, public parking lots and other businesses pay the commercial and small/medium industrial (C & I) rate which is usually the highest tariff.

USA

The United State Federal government is a minority player in the development of EV charging infrastructure. State and local governments have a larger role.

The Federal Government’s Incentive Policies are:

Federal Government’s Incentive Policies

- 30 percent tax credit on the cost of installation of charging station up-to a maximum of 1000 USD (Expired).

- Voluntary programs have been put in place to support workplace and municipal EV charging run by US Department of Energy. These programs provide a forum for employers and municipalities to learn from the experience of one another.

- In 2016, the U.S. Department of Transportation designated 48 EV charging corridors along US highways. These charging stations would be installed very 50 miles, along 25000 miles of US highways across 35 states. While corridors mostly provide signage for existing chargers, the federal government authorised 4.5 billion USD in loan guarantees for companies building the charging stations. No such guarantees and loans have been given.

loans.

The states which offer rebates, tax credits, tax exemptions, grants and are as follows:

- ‘Charge Ahead Colorado’ program for instance offers business tax credits up-to 16000 USD for installing EV chargers.

- California offers low interest program for businesses installing EV chargers.

- Local city governments and utilities also offer rebates, grants, city land and right of way for EV Charging. Los Angeles Department of Water and Power offers incentive up-to 4000 USD per charger installed. Idaho power offered an incentive of 2500 USD for stores installing EV Charging for a limited time.

- Other than financial incentives, some states are pursuing enhancement in EV Charging infrastructure through standards, mandates and codes. For instance,

- Oregon requires homeowners’ association to approve applications for new residential charger in 60 days.

- California’s CalGreen Code goes further requiring residential buildings with over 17 units to have a minimum of 3 percent of all parking spaces ready for future installation of EV Chargers. The CalGreen Code also mandates minimum number of required electrified parking spaces for commercial, retail and residential locations. California will phase out the sale of all gasoline-powered vehicles by 2035.

As of Sept. 2020, there were over 100,000 Level 2 and DC fast EV chargers in 32,470 stations across the U.S. This number does not include-residential charging units. Fast chargers add 60-80 miles of range per 20 min. of charging.

Included in the number above are the charging stations of Tesla. Currently having 16,320 stations globally, 44% of those are located in the US, and 15% in China. Each Tesla charging station has an average of 8 chargers.

India

As of 2019, oil imports stand at 103.9 billion USD and the central government of India intends to reduce its oil import bill to 40 billion USD by 2030 though widespread dissemination of EVs in the country. The target number of electric vehicles was lowered in Feb. 2018 to be 30% of all vehicles, but the two-wheelers will be electric by 2026.

Under the Electric Vehicle Policy, Power Ministry intends to cover 4 million plus population cities in the first phase. In second phase it plans to cover all state capitals, union territories, major highways and key cities.

- In a grid of 3 by 3 km, at least one public charging station will be setup in urban areas.

- For highways at least one fast charging station is planned for every 100 km, as per India’s Power Ministry’s policy statement.

In April 2019, Power Ministry announced that charging of electric vehicles is not a licensed activity and will be considered as a service. The delicensing ensures anyone can setup a public charging station in the country although they have adhered to the set international standards of EVSE.

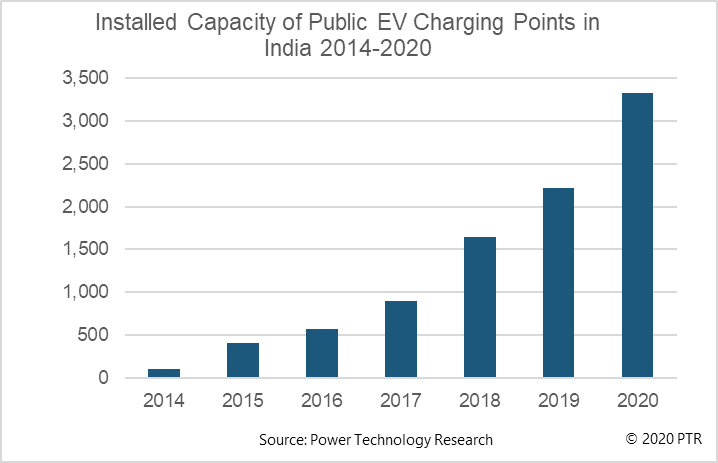

Figure 3: Installed of public EV charging points in India.

Moving Forward

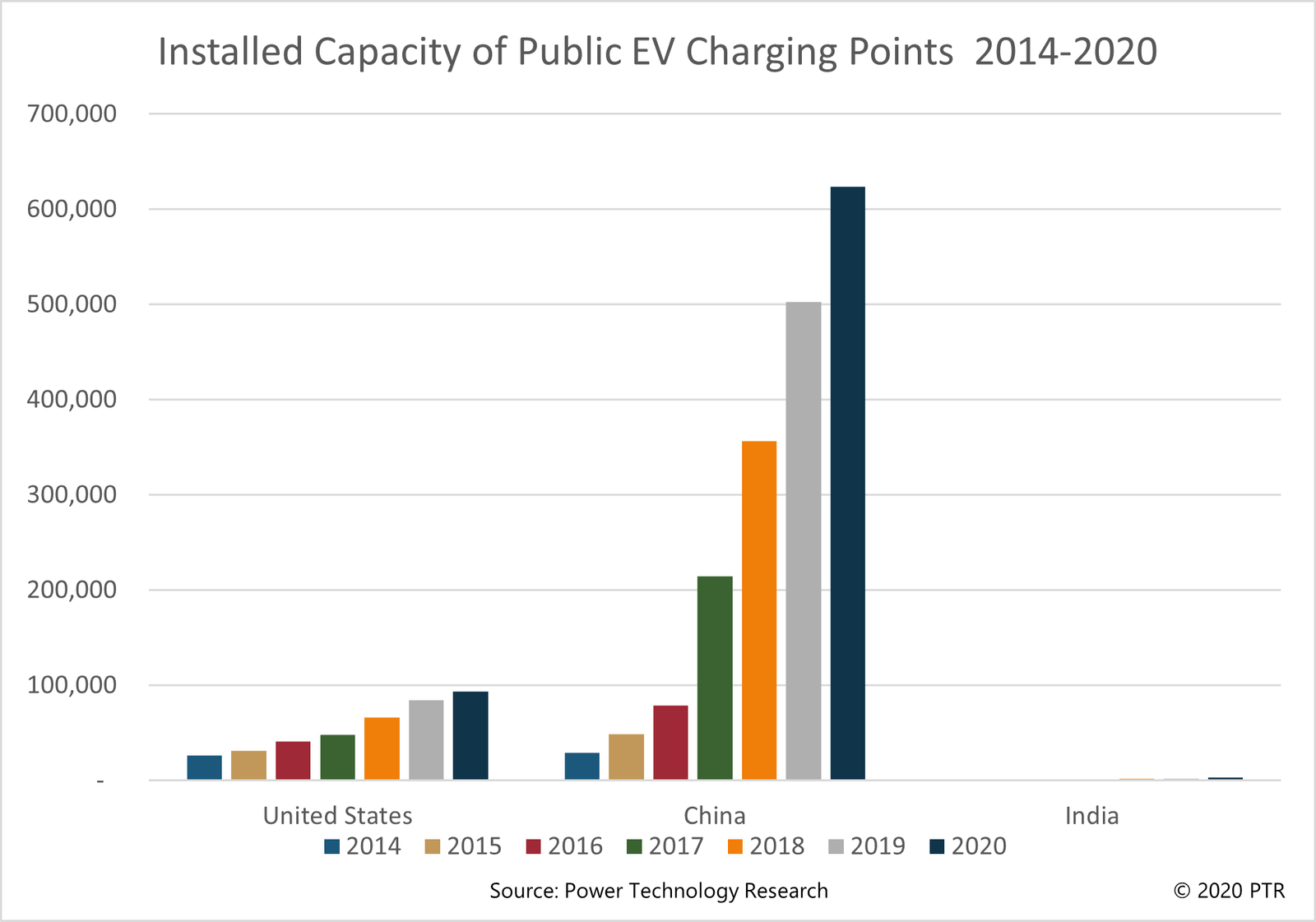

As can be seen in the figure 2 that public charging installed capacity in case of UK, USA and China is seeing a steady growth with a slight slowdown in 2020 because of the pandemic. The pandemic has been a double-edged sword with regards to electrification globally in ways that it has reinforced need for sustainable future but at the same time shrunk the fiscal space needed to pursue such policies.

Figure 2: Installed capacity of Public EV Charging Points 2014-2020.

Where India on the other hand has been very late in the EV race and it is yet to be seen how its EV landscape develops over the years. Though there has been a yearly increase in the public EV charging capacity from 2014 onwards as can been in the figure 3 but it is nowhere in comparison with the installed capacity of USA, UK and China.

Governments in these countries are actively indulging in public private partnerships to enhance the EV Charging Infrastructure. Where other than possibly China, it is expected that countries would expect and let the private sector completely take over in the later market stages.

More about our EV Charging Infrastructure (EVSE) Market Analysis

Related Insights

Exploring the European EVCI Services Market Key Players and Emerging Trends

There has been a significant surge in the development of EVCI due to the widespread adoption of EVs in Europe. By 2030, it is expected that Europe will dominate global EV charger I&C and maintenance market and for a 42% and 50% share of the market in 2030,...

Nordics EVCI Market Comparison: Quarterly Growth and Market Dynamics – 2024

This infographic examines the ambitious policies and regional targets that are propelling the growth of Electric Vehicle Charging Infrastructure (EVCI) across the Nordic countries, particularly in Norway, Sweden, Denmark, and Finland. As leaders in electric mobility,...

Electrifying Future: Emerging Trends and Strategic Targets in the Middle East

This infographic presents an overview of the burgeoning electric vehicle (EV) market in the Middle East. It highlights the region's ambitious targets and key trends to shift towards sustainable transportation. It explores how the Middle East is steering towards a...

US Elections: Consequences of a Second Trump Presidency for Energy Sector

The US is making strides to move away from fossil fuels and eventually decarbonize the energy sector. The White House aims to achieve 80% renewable energy generation by 2030 and 100% carbon-free electricity by 2035. On the other hand, for electric vehicles, it has set...

Contact Sales:

Hassan Zaheer – Sales Lead

hassan.zaheer@ptr.inc

+49-89-12250950