- There is an immense untapped potential in EV market especially in countries within the Association of Southeast Asian Nations (ASEAN), where there has been positive momentum regarding the EV production and its charging infrastructure.

- Malaysia plans to build 25,000 public charging points and 100,000 private charging points by 2030

- Singapore already has 1,800 public charging points available across the country and with a plan of installing 60,000 charging points by 2030.

While the EV adoption rate is significantly high in Europe, North America and China, other regions like Southeast Asia have been lagging in their transition towards e-mobility. However, recently there have been promising signs for the future of the EV market especially in countries within the Association of Southeast Asian Nations (ASEAN); where there has been an increase in charging infrastructure investments, purchase incentives for EVs, and model availability.

Southeast Asian markets are already important automotive manufacturing hubs. Since Indonesia and Thailand manufacture more than 1 million and 2 million vehicles per annum respectively, therefore the transition will be relatively easy. Southeast Asian countries, with less developed automotive manufacturing capabilities, see the transition to vehicle electrification as an opportunity to reduce carbon emissions and allow their economies to achieve greater social inclusivity.

Looming EV Potential in the ASEAN Countries

Currently, six countries in Southeast Asia are emerging in the EV market: Singapore, Thailand, Vietnam, Philippines, Malaysia, and Indonesia.

Singapore is at the forefront of EV charging infrastructure with 1,800 public charging points available across the country and with a plan of installing 60,000 charging points by 2030. The government has also set aside USD 22 million between 2021-2025 for initiatives to promote EV adoption and increase the number of chargers at private properties. In tandem, Singapore has also managed to successfully establish itself as the R&D epicenter for the region’s EV industry, by facilitating investments from multinationals and start-ups to build a strong local EV ecosystem.

Thailand has 1,000 charging stations installed throughout the country and their key initiatives include a plan for 53,000 electric motorcycle taxis by 2022 and 5,000 electric buses by 2025. Recently, the Asian Development Bank and Energy Absolute signed a USD 48 million green loan to finance a countrywide EV charging network in Thailand.

In Vietnam, EV adoption for private vehicles is also steadily increasing: Recently, VinFast, a domestic automaker, released designs for three electric SUV models to add to its model lineup. These models are currently slated for export but have the potential to be distributed within Vietnam and other ASEAN countries.

In Indonesia, EVs are seeing greater adoption by ride-hailing operators such as Grab, which recently announced a partnership with local power company PLN, to develop its fleet charging infrastructure. Public transport operators, such as Transjakarta, also have plans to expand their electric bus fleet to 10,000 units in the next decade.

In Malaysia, the launch of the National Low Carbon Cities 2030 plan, entails the establishment of 200 low carbon zones across the country, which may bring about a greater push for green vehicle options, including EVs. In addition, Malaysia plans to build 25,000 public charging points and 100,000 private charging points by 2030.

In Philippines, there are not many incentives targeted for purchasing EVs or charging infrastructure, however, it has 5% and 4% of global nickel and cobalt reserves respectively and therefore has an immense potential to participate more actively in the EV battery production value chain.

In many Southeast Asian countries, two and three-wheelers such as motorbikes or tricycles are the dominant form of transport. Approximately 80% of households own two-wheelers in Indonesia, Thailand, and Vietnam therefore, electrification of two wheelers emerges as a promising case.

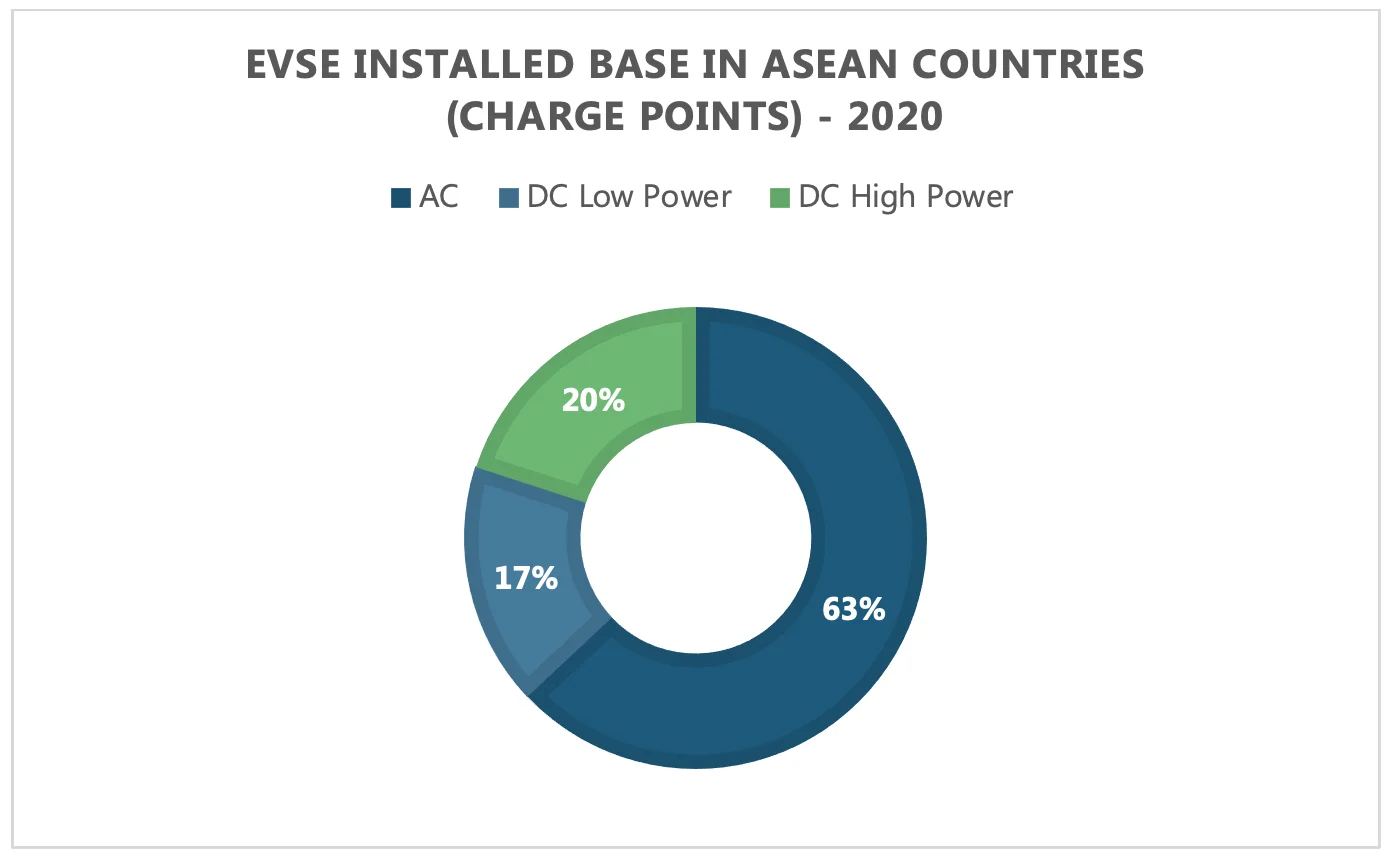

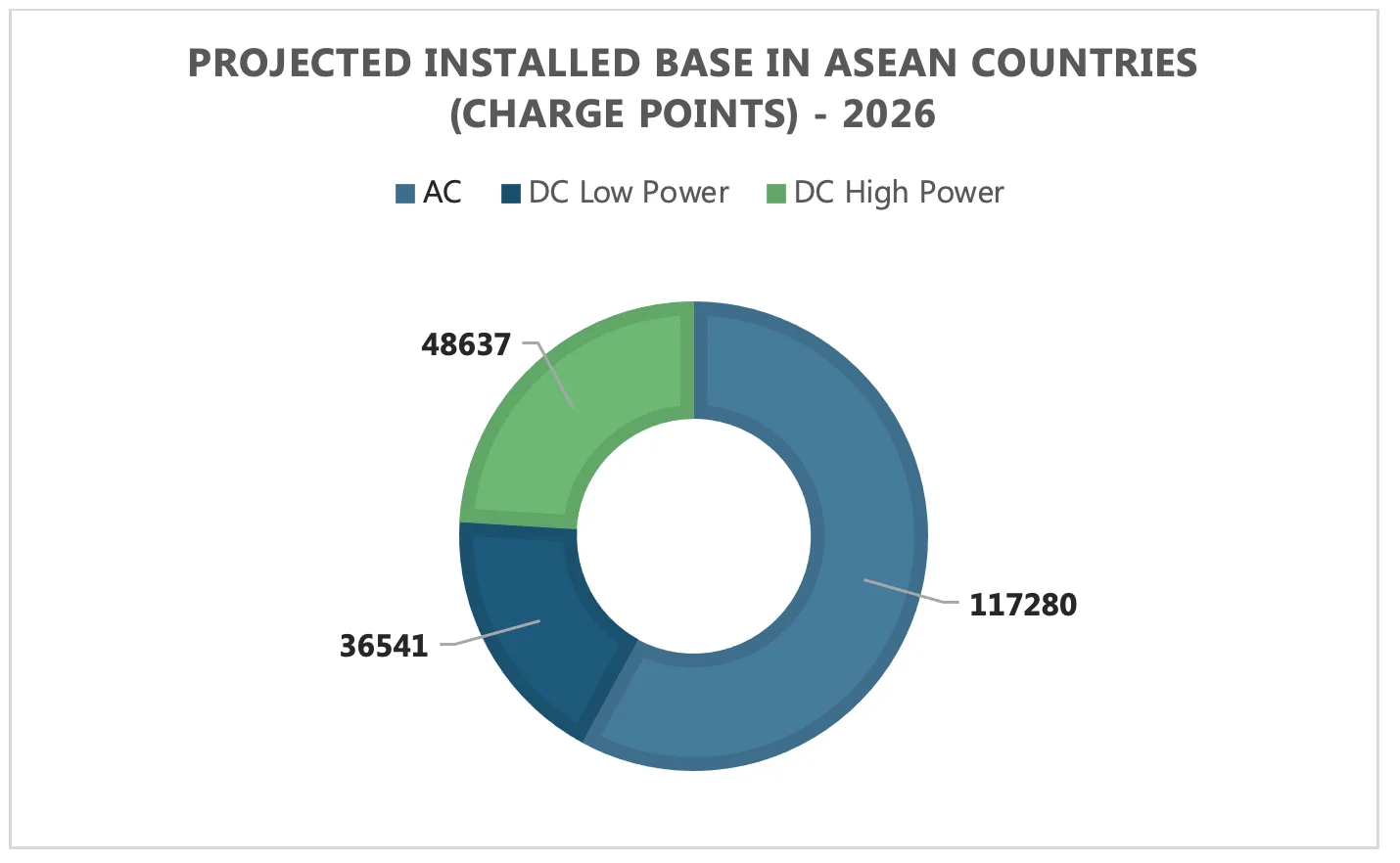

Source: Power Technology Research

Factors Deterring the Growth of EV Charging Penetration in the ASEAN Countries

Governments play a pivotal role in promoting the growth of EV charging infrastructure. Existing Asian Pacific markets that have relatively strong EV adoption rates such as, China, Japan and South Korea, have had supportive EV purchase incentives for years. China has grown to be a leader in the EV market globally through comprehensive EV policies and strategies to promote technological innovation.

In China, the government’s Electric Vehicle Charging Infrastructure Development Guidelines (2015-2020) include requirements relating to public charging outlets per EV to be a minimum of 1:7 in key cities of the eastern coastal provinces by the end of 2020 and for the public charging service radius to be less than 0.9 km in urban core areas. Likewise, in South Korea, the government has set guidelines for subsidy measures, such as subsidy support standards, to stimulate the creation of an electric vehicle charging infrastructure network. In 2020, the Government stated the number of subsidies for the purchase of electric and hydrogen vehicles was 94,000 units, an increase of 57% from 60,000 units in 2019.

While Southeast Asian governments are pushing for increased vehicle electrification, there needs to be usage and purchase incentives that either reduce the total cost of ownership or increase the convenience of using EVs for consumers. These could include access to traffic lanes typically reserved for buses or car-sharing, that will help EV users reduce their travel times, especially during peak hour traffic.

Another deterrence in EV adoption is high import tariffs. The price of an average EV in Indonesia is higher than a conventional ICE vehicle despite the removal of the luxury tax, which was previously pegged at 30% of the purchase price. In the Philippines, fiscal incentives, such as tax cuts can bridge the price parity between EVs and conventional vehicles. Philippines made changes to the automotive tax structure under the Tax Reform for Acceleration and Inclusion Act (TRAIN):

- ICEVs are subject to an excise tax of between 4% and 50% of their initial purchase price.

- EVs, however, will be exempt from this tax. Therefore, it is imperative that the government provides fiscal incentives as well as promote local players in automotive manufacturing.

Not only is it imperative that the government provides fiscal incentives to promote local players in automotive manufacturing but unlike forerunners such as China and Norway, many markets in Southeast Asia currently do not have sufficient charging networks to support consistent EV usage. For EVs to proliferate across ASEAN countries, interoperability and accessibility is the key. Irrespective of the battery’s range, there is a need of accessible charging stations on long haul routes. Public charging network providers in Southeast Asia have been working independently, leading to an inefficient distribution of charging stations. This has resulted in a saturation of EV chargers in commercial areas, and a lack of EV chargers in residential areas where it is more convenient for EV users to use overnight charging.

Governments will need to streamline the processes and allow data-sharing – between charging points and the vehicle; the manufacturer and the vehicle; the charging network providers and charging points; or charging network providers and utilities providers – that could also help to strengthen the overall EV ecosystem.

Looking Forward

There is a diversity of approaches towards electromobility in the ASEAN countries and it stems from the fact that these countries are in different stages of economic and automobile industry development as well as policy orientations. One thing is certain, the market will require substantial OEM investment and government subsidies as well as an influx of local manufacturing automotive players to increase the uptake of EV.

Service Overview

More about our EV Chargers Market Research

Recent Insights

Exploring the European EVCI Services Market Key Players and Emerging Trends

There has been a significant surge in the development of EVCI due to the widespread adoption of EVs in Europe. By 2030, it is expected that Europe will dominate global EV charger I&C and maintenance market and for a 42% and 50% share of the market in 2030,...

Nordics EVCI Market Comparison: Quarterly Growth and Market Dynamics – 2024

This infographic examines the ambitious policies and regional targets that are propelling the growth of Electric Vehicle Charging Infrastructure (EVCI) across the Nordic countries, particularly in Norway, Sweden, Denmark, and Finland. As leaders in electric mobility,...

Electrifying Future: Emerging Trends and Strategic Targets in the Middle East

This infographic presents an overview of the burgeoning electric vehicle (EV) market in the Middle East. It highlights the region's ambitious targets and key trends to shift towards sustainable transportation. It explores how the Middle East is steering towards a...

US Elections: Consequences of a Second Trump Presidency for Energy Sector

The US is making strides to move away from fossil fuels and eventually decarbonize the energy sector. The White House aims to achieve 80% renewable energy generation by 2030 and 100% carbon-free electricity by 2035. On the other hand, for electric vehicles, it has set...