Commercial & Off-Highway Vehicles (ICEs, PHEVs, BEVs) Market Analysis

INTRODUCTION

PTR’s Commercial Off-Highway Vehicles Service takes a look at the following 6 types of vehicles: Agriculture, Buses & Coaches, Construction, Light Commercial Vehicles, Forklifts, and Trucks, further breaking down each type into various sub-types and sub-categories. Electric Vehicles have been penetrating the passenger vehicle market significantly, but what is the story for commercial and off-highway vehicles? Motivations and incentives are different in this sector where latest-and-greatest pales in comparison to ROI. Within PTR’s e-Mobility segment, the Commercial & Off-Highway Vehicles Service has been designed to look deeper into the sales of these vehicles, complimenting the EV Charging Infrastructure (EVSE) Service. Many segments have different drivers and market dynamics as well as a myriad of OEMs providing solutions. Accelerators and Inhibitors in this market include the available EV charging infrastructure, EV policy and plans, and company product portfolios.

Recently, the transition towards zero-emission vehicles has been evident, especially in the electric commercial vehicles segment (Buses, Trucks, LCVs). Several new electric models have been announced in the commercial vehicle segment with higher range and battery sizes. New long-haul models have also been announced by major OEMs indicating an imminent market shift in the United States. Alongside these market changes, major fleet operators have announced their sustainability goals as they start electrifying their fleets. In Europe, the United States, and China, there has been rapid growth in the adoption of e-bus fleets. China, on a global scale, hosts over 90% of all e-buses currently.

There has been a clear shift from PHEVs to BEVs as well, especially in the LCV segment, as only BEVs may be considered zero-emission commercial vehicles, leaving PHEVs out of incentives and subsidies in some countries. That said, the market is still reliant on subsidies. In a 2019 momentum test in China, the market of e-buses slowed down as subsidies were temporarily removed. In addition to this, OEMs still appear reluctant to completely abandon ICEs in the commercial vehicle market segment. But as the adoption of BEVs increases, the market is naturally gravitating towards such vehicles and many OEMs are expanding into the market to avail new growth opportunities to stay relevant in this change.

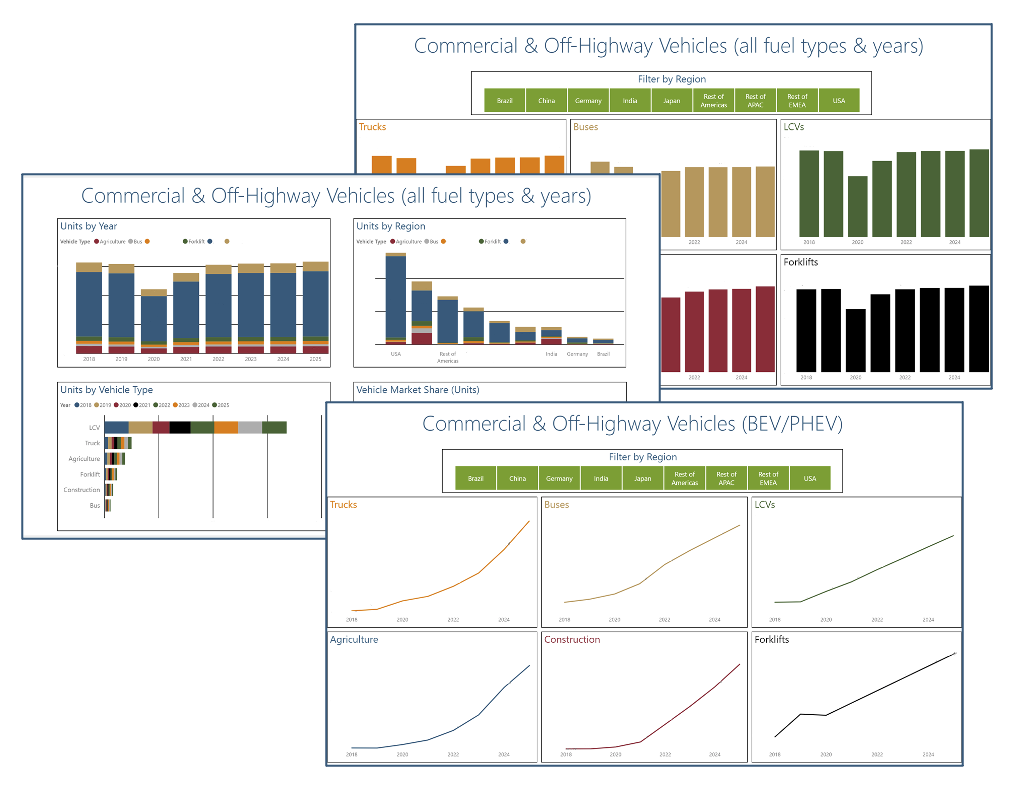

PTR’s Commercial & Off-Highway Vehicles Service takes a look at the following 6 types of vehicles: Agriculture, Buses & Coaches, Construction, Light Commercial Vehicles, Forklifts, and Trucks, further breaking down each type into various sub-types and sub-categories. As a part of this service, PTR delves into the current and projected sales to accurately forecast and predict market happenings based upon qualitative and quantitative shifts observed due to changes in market dynamics. The service includes annual sales volumes, and historical data; Market Shares by vehicle segment; Key Market Trends along with exclusive analyst commentary.

High-level collected data is categorized into sub-categories based upon the aforementioned vehicle types and then triangulated and validated through primary research. Data through secondary research is obtained from automotive OEMs and primary research is conducted through interviews of vehicle manufacturers, fleet-operators and auto-dealers to validate and understand the market trends.

Data is presented as database along with a Power BI Dashboard for interactive and quick analytics on the data; and a Live App for quick access to industry news, important sources, and update logs. With the extensive intel that this service provides, all that remains requiring your attention is the set of informed and data-backed decisions you need to make to ensure company and investment success.

Key Questions Addressed in the Service

- What is the ICE market for these six COHV segments? (Units – Conventional)

- What is the PHEV/BEV market for these six COHV segments? (Units – Electrified)

- Forecast across these 6 COHV segments for both ICE and PHEV/BEV vehicles types?

- Who are the top manufacturers (OEMs) in each segment?

- Where are these vehicles produced?

Scope of Research – Commercial & Off Highway Vehicles

Delivery Format

Report and Analysis in Power BI

We take a lot of pride in what we do for our clients as we aim to surpass ambiguous methodology and uninspired presentation, which has led most market research to remain relegated to ‘me-too’ slides, often remaining a footnote in presentations. With this service, we aim to transform the way you digest the market information. We are using interactive PowerBI platform as the delivery vehicle for this service. The access is granted through login credentials accessible via Computer, Tablet or Phone:

Why Choose Power Technology Research?

Too often is third-party market research disregarded by decision makers due to ambiguous methodology and uninspired presentation. This had led most market research to remain relegated to ‘me-too’ slides, often remaining a footnote in presentations. Our goal is to change that, and bring back pro-active decision making within the global power and e-mobility sectors by providing market research based on a transparent and flexible methodology.

While working with you, we will do everything to ensure that we are strictly following our three pillars of excellence: Transparency (meaning no black-box datasets with our analysts supporting the data provided), Diligence (deep technical knowledge translating into the research for you) and Digestibility (ensure working with you once you have purchased the service, to answer any questions so you can utilize the data as you intended). These claims are backed by our track record of working with some of the largest companies in industry and their testimonials.

“Very professional with consultancy approach. Which means, hearing your client’s needs and understand it while making them feel comfortable. Also very intelligent being able to build such cost model.”

“PTR was able to provide a level of depth to its methodology not replicated by other research companies I have worked with. It was a pleasure to work with PTR in developing our market strategy and a step-up from alternatives available”

“I was impressed by PTR’s level of knowledge and insight on the automation industry. Their work is professional and they are good fun to work with too. I would have no hesitation in recommending them to others”

“Thanks to Power Technology Research for the great support in terms of market modelling and in getting a better understanding of the different applications. All our discussions and meetings were very fruitful and as well useful! Would be great to work with your team together in future for other topics.”

Recent Insights

US Elections: Consequences of a Second Trump Presidency for Energy Sector

The US is making strides to move away from fossil fuels and eventually decarbonize the energy sector. The White House aims to achieve 80% renewable...

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

Recent Insights

US Elections: Consequences of a Second Trump Presidency for Energy Sector

The US is making strides to move away from fossil fuels and eventually decarbonize the energy sector. The White House aims to achieve 80% renewable...

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

European Electric Bus Market

The electric bus market in Europe has seen a significant year-on-year increase of 42% in the first three quarters of 2023. Notably, Solaris, which...