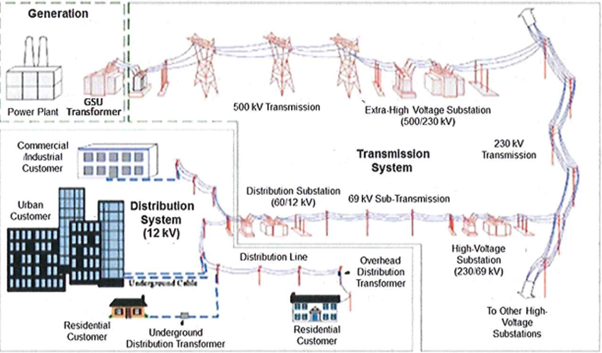

Large Power Transformers (LPT) are of critical value to both the electric power transmission and the distribution grid. (see Fig. 1)

These transformers are unique in their design, tailored to specific customer use, and are uniquely vulnerable to schedule slippage because of long lead times required to manufacture them and replace them. In addition, they are vulnerable to ever evolving threats ranging from physical to cyber-attacks leading to widespread power outage. The timeline, from identifying the need for a LPT to its delivery is shown in Fig. 2.

The LPT vulnerability has caught the attention of the U.S. government and industry players highlighting the need for spare or reserve transformer capacity. This will enhance the robustness of the electric grid and deal with widespread transformer failures.

Figure 1: Electric Power Generation, Transmission and Distribution – source is (U.S. Department of Energy, 2016).

Figure 2: Breakdown of long lead time required in the manufacturing of Large Power Transformers.

Individual Industry Initiative

A number of initiatives aimed at enhancing the resilience of the US power grid, through the stock piling of spare transformers and related equipment is underway. Within a utility, the spare transformer strategy will involve stocking interchangeable spare transformers, ordering extra inventory spare conventional spares or the early retirement of old transformers so they can be utilized as spares once the new transformers are installed.

These measures are meant to address individual unit failures and offer greater flexibility in times of emergencies across territories in a utility’s service area.

Regional Initiatives

The North American electric power market is divided into nine Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs), and two non-RTO groups, that are responsible for the operation, management and for providing power to customers. The Canadian and American power markets are interlinked in various areas.

Regionally, the ISOs and RTO may require member utilities to maintain inventories of spare transformers or direct owners and operators to keep spare equipment on hand for emergency situations.

For instance, PJM’s Regional and Expansion Program mandates owners and operators to procure a designated quantity of spare transformers. The quantity required is based on a risk assessment that calculates the health of existing inventory of transformers and possibility of a capacity emergency.

Industry Collaborations

As early as 2016, several sharing programs were implemented whose purpose was to strengthen the electric sector and restore the nations’ transmission system more quickly through the sharing of transformers and associated equipment in case of major grid disruption. Overview of approaches is as follows:

Survey of Utility Industry

At the request of Department of Energy, Edison Electric Institute, the American Public Power Association and National Rural Electric Cooperative Association (in 2016) carried out a survey of its members to identify ‘spare LPTs’ that could be made available to replace LPTs at crucial substations. The survey identified LPTs of 345 KV or higher as spare transformers at substations and central locations maintained by utilities.

Spare Transformer Equipment Program (STEP)

The Edison Electric Institute (EEI), is an association that represents U.S. investor-owned electric companies. EEI established a program requiring participating utilities to maintain and, if need be, acquire a specific number of spare transformers up to 500 KV which will be available to other member utilities in case of a substation failure.

Under the EEI’s STEP program, members sign a binding contract called ‘Sparing Transformer Sharing Agreement’ which establishes the governance of program and guarantees confidentiality to utilities participating in the program. The sharing is subject to a coordinated act of deliberate, documented terrorism resulting in the destruction or disabling of a transmission substation and declaration of a state of emergency by the President of the United States.

Each utility under contract is mandated to commit a certain MVA capacity of spare transformers of the class in which the utility is member. The capacity committed is based on the size of utility and their self-assessment of their own ability to restore system to minimal (not normal operating conditions) in the event of losing its 5 most critical substations.

Thus the program enables participating utilities the ability to recover from the loss of 5 substations simultaneously. In some cases, participating utilities have committed additional spare transformers which is beyond the requirement of the program.

As of 2016, 56 utilities, serving 98 million residential, industrial and commercial customers, have signed onto STEP constituting 67 percent of US electricity consumers.

To participate each utility has to pay an enrolment fee of 10,000 USD and annual fee of 7,500 USD. FERC and State Commissions have issued orders approving participation and cost recovery.

SpareConnect

SpareConnect is another industry funded program and as in the case of STEP, it is administered by EEI . Both STEP and SpareConnect require utilities to assess their own assets and deploy spares accordingly. This program is much less formal as compared to STEP which builds on existing communication channels between utilities. SpareConnect is designed for emergencies as well as events unrelated to terrorist activity. As of 2016, this program included 126 participants.

Grid Assurance

This company was formed by utility and energy companies to develop a more cost-effective cooperative method to procure additional spare transformer equipment instead of utilities acquiring equipment on their own. Grid assurance maintains a large inventory of transformers and equipment that is kept ready for rapid deployment in case of emergency to subscribers.

The service is similar to STEP but more comprehensive as it provides the associated equipment in addition to transformers. It also covers wide range of emergency situations than just terror attacks. The program is expected to maintain an inventory of at least 100 spare transformers costing 2-10 million dollars each. As of May, 2018, six major utilities with 31 transmission owning affliates signed on.

Wattstock

Wattstock which is an independent private company developed ‘The Transformer Recovery Inventory Program’(TRIP) to enhance coverage of spare of transformers in the US grid. The company claims to offer enhanced transparent pricing and terms with enhanced coverage, service and performance than the rest of private sector programs.

The TRIP program intends to build an inventory of 60-100 modular Wattstock Recovery Flex Transformers (RFT) located at regional distribution centers. Participants like other programs have to pay an enrollment fee followed by annual membership as well as rental fee on use of spare LTPs with an option to purchase the transformer.

A spare LPT can be shipped and installed within 2-3 weeks of an emergency event. The program offers 9 step-up transformer models which Wattstock claims to cover 97 percent of traditional MVAs in market.

Background of Tariffs

In January (11th and 17th),2018, the Department of Commerce released two reports after carrying out investigations under Section 232 of the Trade Expansion Act of 1962 called ‘The steel report’ and ‘The aluminium report’ respectively. The US Department of Commerce found that imports of steel and aluminium pose a national security threat and recommended actions including global tariffs.

Based on these reports, President Trump on March 8,2018 announced a 25 percent tariff on steel imports and 10 percent tariff on aluminum imports which were implemented on 23rd March. On May 4, 2020, after the Presidential Executive Order (discussed in detail below), the Commerce Department self-initiated an inquiry to investigate whether imports of certain electrical transformers or their parts, including laminations and cores made of grain oriented electrical steel posed a threat to National Security.

The existing tariffs under section 232, included the expanded derivative products but didn’t cover Grain-Oriented Electrical Steel (GOES )derivative products. GOES are iron silicon alloys that were developed to provide low core loss and high permeability required for efficient and economical transformers.

The US also alleged that these tariffs were circumvented by some firms by increasing imports from Mexico and Canada. Canada however defended that allegation claiming that the North American market is highly integrated and that Canadian manufacturers source certain amount of GOES from US suppliers. Canada further added that tariffs on Canadian imports may adversely affect the North American shared grid.

Core Coalition, a trade group comprised of U.S. and international companies which are active throughout the transformer industry’s value chain, is also protesting the ban on imports of GOES derivative products. The coalition supports competitive market which depends on access to imports and claims that 85 percent of imported cores and laminations come from closely allied US trading partners hence they feel this doesn’t constitute a security threat.

In addition, laminations and cores are steel products with no room to incorporate software and establish any kind of remote access from adversary countries during times of war or any other kind of confrontation. US Department of Commerce appears to have taken cue from the Whitehouse following May 1 EO. If the ban sustains, the situation may get worse as the United States has just one GOES producer ‘AK Steel’ which will not be able to meet the local demand of transformer manufacturers.

Executive Order of May 1st

On May 1, 2020, the President of United States signed an Executive Order (EO) 13920, ‘ Securing the United States Bulk-Power System’ which permitted US Secretary of Energy Dan Brouillette to work with federal partners and the energy industry to secure America’s Bulk Power System (BPS).

The Executive Order:

Prohibits any acquisition, importation, transfer, or installation of bulk-power system electric equipment which has a nexus with any foreign adversary and poses an undue risk to national security, the economy, or the safety and security of Americans;

Authorizes the Secretary to establish criteria for recognizing particular equipment and vendors as “pre-qualified”;

Calls for identifying any now-prohibited BPS equipment already in use, allowing the government to develop strategies and to work with asset owners to identify, isolate, monitor, and replace this equipment as appropriate; and

Establishes a Task Force on Federal Energy Infrastructure Procurement Policies Related to National Security, which will focus on the coordination of Federal Government procurement of energy infrastructure and the sharing of risk information and risk management practices.

The order provides local manufacturing industry market space but at the same time presents an uphill task to not only meet the demands stemming from yearly growth of LPT Industry but sudden spike in demand owing to blanket ban on import of transformers. Once the prohibited BPS equipment is identified, they are mandated to be isolated, monitored and replaced across the grid which will further add to the demand.

Where the pre-qualification clause in the order places an extra check on the manufacturer and vendor alike.

Market Situation

Over the years, China has emerged as a largest power transformer manufacturer and this has caught attention of the US government. Domestic production has increased, since 2010, but in the last decade, 85 percent of transformers have come from abroad.

Security planning for US power grid is focused on threats to approximately 2000 extra HV transformers (345 KV or above ). The utilities are mandated to identify, monitor and replace these transformers in the national grid which is expected to create additional demand in the long run.

Recently, several companies have increased their presence in the U.S. In December of 2019, Hyosung Heavy Industries entered the US transformer market with an estimated investment of 86.9 million dollars. WEG Transformers USA purchased a 147,000 sq ft Melton and Control factory and expanded its manufacturing facility. Eaton Corporation has also announced expansion of its production facility with an investment of 24 million dollars on a 233,000 sq ft facility. Hitachi ABB Power Grid is also investing 6.2 million dollars to expand operation in Bland, Virginia.

Moving Forward

The US government has abandoned the idea of forming a ‘Strategic Transformer Reserve’ with public funds and is focusing on private industry driven initiatives instead. Strategic transformer reserve posed financial and logistic challenges eventually rendering the plan infeasible .

Incentives to local transformer manufacturers are not given in the form of any subsidy but market space which is a direct consequence of the May 1st Executive Order by POTUS. The ban on the imports of transformers and possible ban/additional tariffs on GOES is not sustainable and itself poses a National Security risk since the US has only one GOES producer (AK Steel). This producer cannot even meet the original demand of local industry let alone the additional demand owing to blanket ban on import of transformers.

We can expect in the coming months that either the White House or the Department of Commerce will revisit its stated policy and at least shed the idea of extending tariffs or banning GOES derivative products.

Lastly, in recent months we have seen investments in the local transformer manufacturing industry but the private sector is still waiting for a clear U.S. policy to be defined.

Recent Insights

Medium Voltage Switchgear Supply and Demand

In the article, the authors, Saqib Saeed, CPO & Abdullah Kamran, Analyst at PTR Inc. elucidates that medium voltage (MV) switchgear, operating between 1 kV and 42 kV, is essential for controlling, protecting, and isolating electrical equipment. Valued at...

Europe’s Distribution Transformer Market: Adapting to the Impact of Energy Transition

The article authored b Eyman Ikhlaq, Analyst at PTR Inc. highlights that the European distribution transformer market is poised for substantial growth, driven by Europe's commitment to decarbonization, the integration of renewable energy sources, and the increasing...

Europe’s Renewable Revolution

Azhar Fayaz, Senior Analyst at PTR, emphasizes in his article that global initiatives like COP 28 have heightened the urgency for decarbonizing energy systems, positioning Europe at the forefront of the renewable energy transition. The continent's ambitious plan aims...

Ensuring Grid Reliability: Integrating Digital HV Switchgear and Artificial Intelligence

The article by Saifa Khalid, Senior Analyst, and Saad Habib, Analyst at PTR Inc., highlights the evolution of the U.S. high-voltage (HV) switchgear market, driven by advancements in smart grid technology, renewable energy deployment, and the increasing adoption of...

Contact Sales:

Hassan Zaheer – Sales Lead

hassan.zaheer@ptr.inc

+49-89-12250950