In the United Kingdom, as in most places, the electricity distribution network was built to have electricity flow one way, from power stations to customers. As the UK moves to net zero emissions there will be an increase in distributed generation and this will require Distribution Network Operators (DNOs) to take on operator functions previously associated with Distribution System Operators (DSOs). New smart technologies will allow these DSOs to have real time visibility into the operation of the network.

The Energy Networks Association (ENA) is an industry body for companies that own and operate the wires and pipes that carry electricity and gas into the community. The ENA provides support in overhauling systems, processes and policies to make it easier to connect low-carbon electricity generators and green gas producers to the grid. There are 14 licensed distribution companies in the UK and these are owned by 6 groups. The members of ENA include the licensed DNOs groups, as well as other energy network companies:

- Licensed Distribution Network Operator Groups

- Electricity North West

- Northern Powergrid

- SP Energy Networks

- Scottish and Southern Electricity

- UK Power Networks

- Western Power Distribution

Active Distribution System vs Passive Distribution System

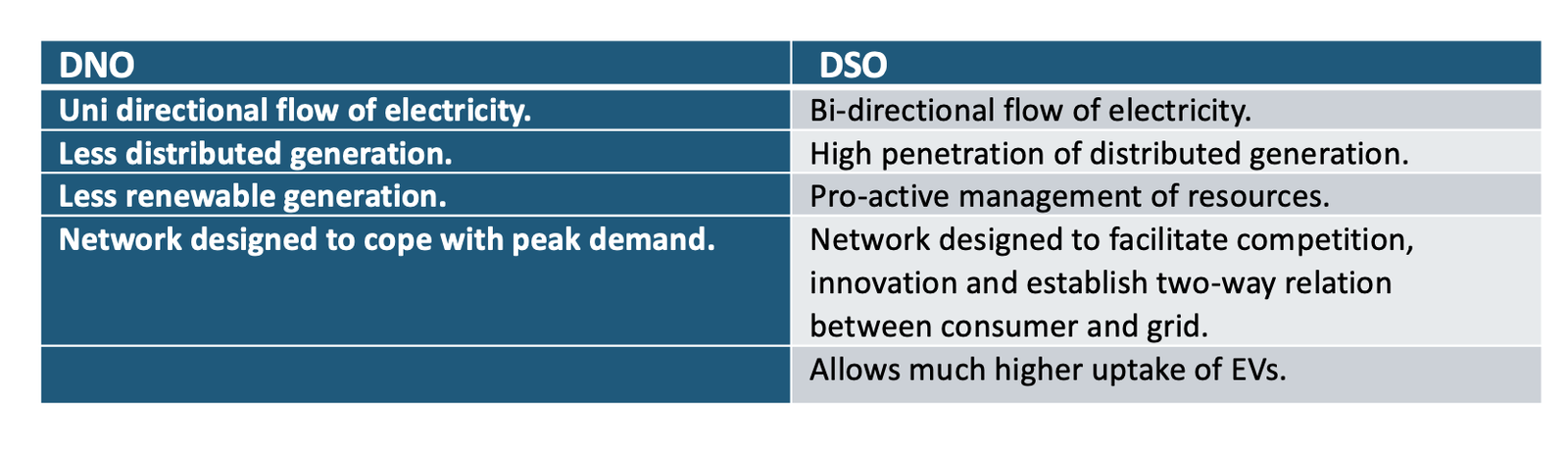

A DNO already performs much of the tasks that a DSO does, but there are differences.

A conventional distribution network is not an active but a reactive or passive network. Passive distribution networks are designed to accept bulk power from transmission system and distribute it, down the network, to consumers. There is no local level management nor control of generation assets or resources, leading to a less efficient and less reliable operation of grid.

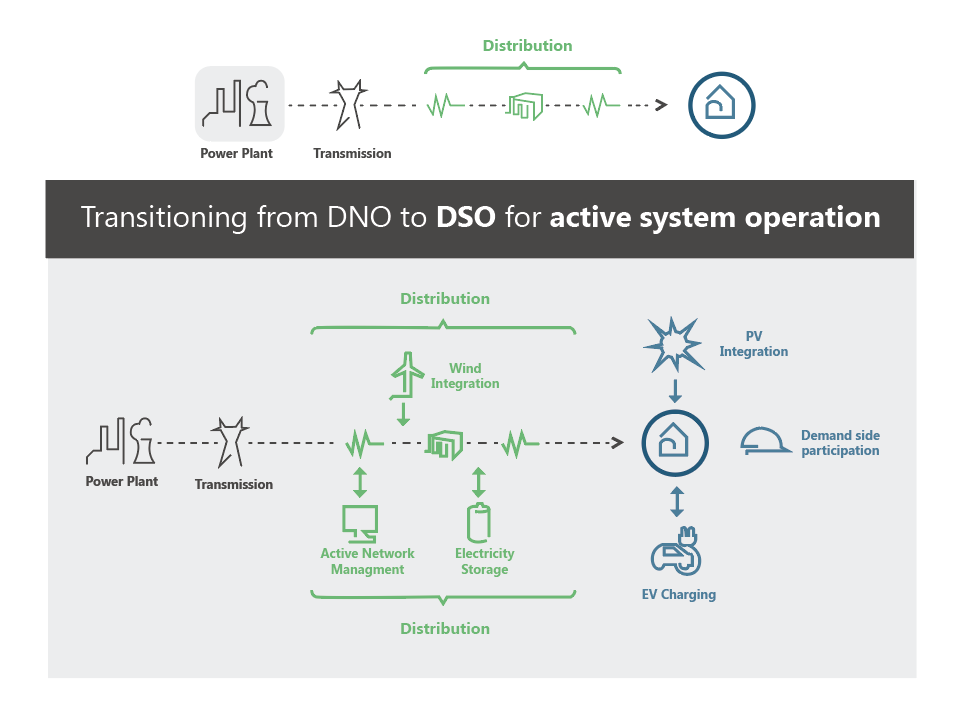

According to ENA, a DSO “securely operates and develops an active distribution system comprising networks, demand, generation and other flexible distributed energy resources”. An active distribution network offers greater flexibility by coordinating the demand and the supply with the UK’s biggest energy suppliers of gas and electricity (known as the Major Power Producers) and other generators (including distributed generators) This type of network allows the controlling of voltage, faults and flows both at macro and local levels. (see Figure 1)

Figure 1: Difference between DNO and DSO.

Now coming to second point on how it is different from smart grid. It is different in ways that along with the incorporation of smart grid technology, ‘distribution network operator’ must alter its business model which is followed by introduction of appropriate and relevant regulatory framework recognizing altered business model, latest technology, and new stakeholders in the system.

The new role of the distribution operator is that of a neutral facilitator permitting visibility to not only major contributors of electricity but to distributed generators as well, all of which is required by the market to function efficiently and to allow trade of energy throughout the network.

It is also worth noting that the process of transition from DNO to DSO is neither an overnight nor a binary process. It requires a long time to transition from thee DNO to the DSO model and the rate of transformation depends on the continent, country, and region. The transformation rate also depends on the government and regulatory bodies overseeing the power sector where with in a region or country certain distribution companies may feel more pressure as compared to others which eventually pushes them to adopt technology at a faster pace.

Evolution of Grid

Electricity grids were least evolved when the state owned the generation assets and the transmission/distribution systems. This arrangement, called bundling, turned power sector into highly inefficient monopolies lacking ability to meet electricity demand and drive economic growth.

This was followed by unbundling of power sector (separation of generation and T&D) and liberalization where the private sector was allowed to invest and install their own generation assets. This involvement of the private sector increased competition and enhanced efficiency, which in turn benefited the consumer. But there have been cases where state owned generation assets were given priority even though at times these assets were old and inefficient compared to their private counterparts.

This led to introduction of ‘fair dispatch’ policy for instance in China. This policy provides private generation assets a level playing field through the provision of equal operating hours if they fall in the same class of power plants. This not only improved service and reduced retail cost of electricity.

Now, along with state and private generation assets, we have ‘distributed generators’ spread across the grid. This requires a much-evolved business model where the fair dispatch policy reaches out to distributed generation to ensure neutral facilitation as well as incorporating battery storage facilities, microgrids and EV vehicles with grid. The provision of level playing field to distributed generators will further enhance competition, drive down energy prices, reduce capacity costs and provide a much needed push towards achieving a net zero carbon future which is sustainable and environment friendly.

The uptake of EVs can have a detrimental impact on the overall performance of grid and reduce service reliability. The current DNO model lacks the capacity to deploy cost effective and efficient remedies to mitigate the impact caused by smart charging and vehicle to grid integration. The DSO model, mitigates the effects of EVs including the otherwise expensive capacity enhancement of all segments of the power sector (generation, transmission and distribution) to accommodate additional load. (see Figure 2)

Figure 2: Transition from DNO to DSO

Status of the Grid in the UK

There are three Transmission Operators in Great Britain permitted to develop and maintain the high voltage system. National Grid Electricity Transmission for the network in England and Wales (NETS), Scottish Power Transmission Limited for southern Scotland (SP Transmission) and Scottish Hydro Electric Transmission for northern Scotland and the Scottish island groups (SHE Transmission). Northern Ireland is part of the single electricity market with the Republic of Ireland.

Currently the 14 licensed DNOs have started to implement plans for their transition to a DSO model. Most have had engagement session with stakeholders in part to inform but also to gather their input in shaping their DSO strategy.

The DNOs are working on their local network plan (known as RIIO-ED2) which will cover the period from 2023 to 2028. The date to submit their draft plans to the Office of Gas and Electricity Markets (Ofgem) is January 7,2021 and the final plans must be submitted by December 1, 2021. The business plan requires each company to provide a DSO strategy that sets out how they will meet the expectations set by Ofgem. As part of the strategy, there is the expectation to digitize and make better use of data, and the business plan should include related data improvements.

A key component to the plan is the allowance set by Ofgem which will enable the companies to invest in the network to meet the Net Zero policy goals. Some companies have expressed uncertainty in meeting those goals and plan to submit the “most likely scenario”.

Moving Forward

To keep pace with rapidly changing landscape of electricity grid, the transition from a DNO to a DSO model is unavoidable but, businesses, communities and individuals will be able to have an active role in how the electricity network is operated and how to manage the electricity network more efficiently. The changes in the energy system will also provide new opportunities including payment for reducing usage at certain times, storing solar energy in batteries to be exported later, and being paid to use surplus energy when there is too much electricity generation.

More about our Power Grid Market Research

Recent Insights

Medium Voltage Switchgear Supply and Demand

In the article, the authors, Saqib Saeed, CPO & Abdullah Kamran, Analyst at PTR Inc. elucidates that medium voltage (MV) switchgear, operating between 1 kV and 42 kV, is essential for controlling, protecting, and isolating electrical equipment. Valued at...

Europe’s Distribution Transformer Market: Adapting to the Impact of Energy Transition

The article authored b Eyman Ikhlaq, Analyst at PTR Inc. highlights that the European distribution transformer market is poised for substantial growth, driven by Europe's commitment to decarbonization, the integration of renewable energy sources, and the increasing...

Europe’s Renewable Revolution

Azhar Fayaz, Senior Analyst at PTR, emphasizes in his article that global initiatives like COP 28 have heightened the urgency for decarbonizing energy systems, positioning Europe at the forefront of the renewable energy transition. The continent's ambitious plan aims...

Ensuring Grid Reliability: Integrating Digital HV Switchgear and Artificial Intelligence

The article by Saifa Khalid, Senior Analyst, and Saad Habib, Analyst at PTR Inc., highlights the evolution of the U.S. high-voltage (HV) switchgear market, driven by advancements in smart grid technology, renewable energy deployment, and the increasing adoption of...