- Despite the reduced demand for electricity, due to Covid-19, the demand for renewables grew .

- Transformer markets in the U.S., China and Europe are expected to reach 2019 levels.

- Driven by various regional and technological factors, such as an increase in electric vehicles, there will be an immense potential for growth for the transformer market.

CWIEME held Transformer Day in a digital forum on June 22, 2021, in collaboration with Power Technology Research, EATON, BLOCK, Cargill, Transformer Technology, Transformers Magazine and VAISALA. CWIEME gave a panel discussion on ‘innovation and challenges in the utility transformers space’ and market research company Power Technology Research, a specialist in power grid and new energy, presented ‘Global Transformer and Component Market’. This is a synopsis of the paper presented.

Power & Distribution Transformer Market

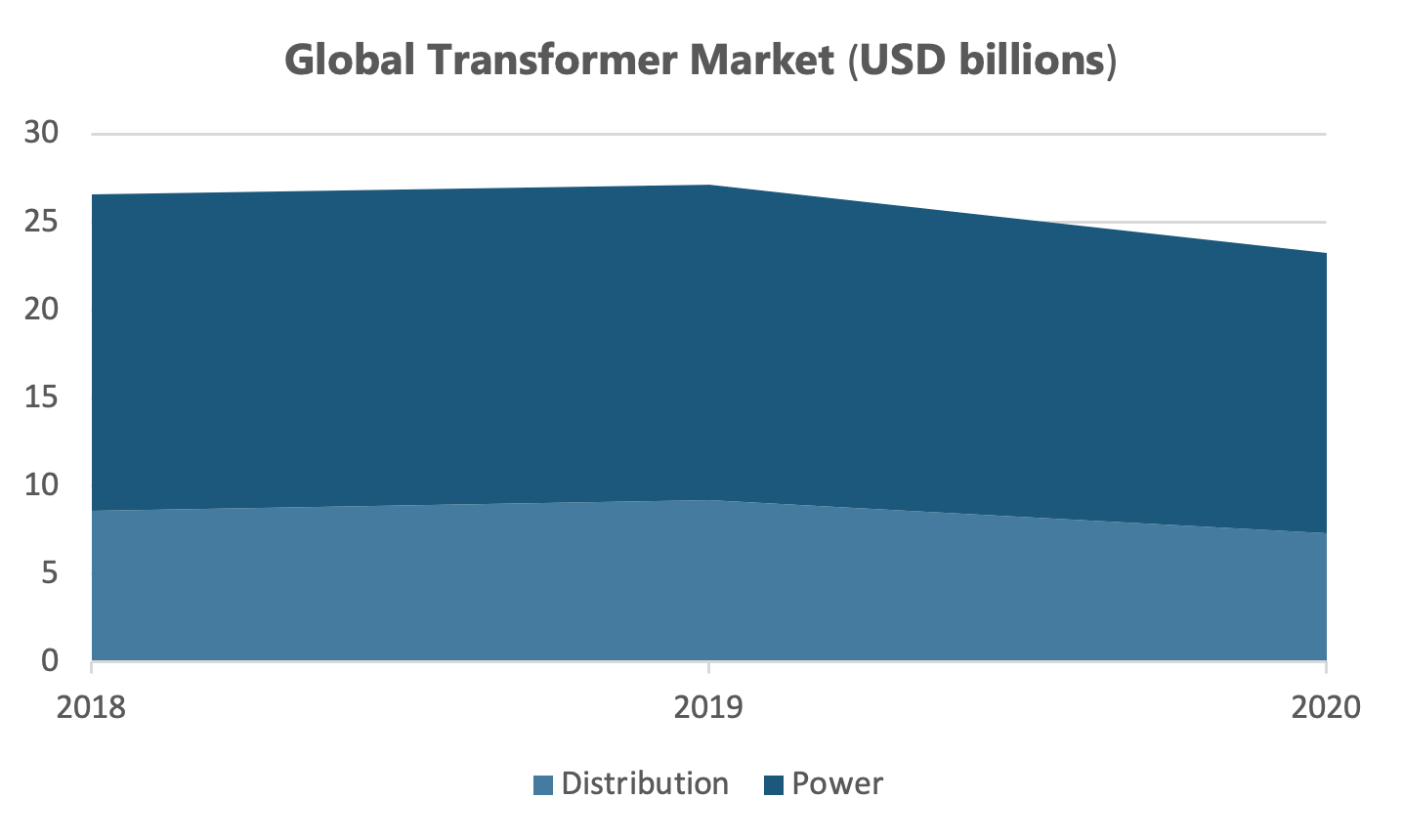

It is important to segment the transformer market into power and distribution transformers as each segment showcases different market behaviors. The global transformer market size was 16 billion USD in 2020. This was a 16% decline compared with 2019 and was partially attributed to Covid-19. The distribution transformer segment, with a 20% decline YoY, was the most affected, while power transformer market declined close to 11% (see Fig. 1)

Market Drivers

The distribution transformer market in 2021, has still not reached 2019 levels, but the power transformer market is almost there. The growth in Electric Vehicles (EVs), the addition of renewables for power generation and the digitalization of transformers are all key market drivers for transformers.

EV Chargers

EVs are one of the fastest growing markets and their installed base is expected to increase with the compound annual growth rate of approximately 18.4 percent during the period 2020-2025. As demand for EVs grows, more EV chargers will be used, create a higher demand for electricity. There will be an immense potential for growth in the global transformer market as electric grids will need to be upgraded.

Renewables

Renewable capacity grew despite the slowdown due to COVID-19. Globally, there was a 21% increase in solar capacity and a 15% increase in wind capacity observed in 2020. Half of the world’s new solar additions were carried out by China and the U.S. Furthermore, with regards to wind capacity, China’s share stood of new additions in 2020.

Renewables are driving more than half of the increase in global electricity supply in 2021 and the share of renewables in electricity generation is projected to reach almost 30%; with solar and wind expected to account for two thirds of the growth.

Regional Market Drivers

In addition to the key market drivers mentioned previously, transformer demand is driven in each region of the world by unique factors:

- China’s extensive rural electrification project came to an end in 2019, causing a slowdown in transformer demand in 2020, but expansion plans in 2021, by major transmission and distribution utilities, will affect the market positively.

- Most of the growth in renewables came from U.S. and China, although a slowdown is expected at the end of 2022.

- Grid expansion plans, for some of the main TSO/DSO, were delayed in Europe due to the pandemic, but now are expected to move forward with updated timelines.

- In the MEA region, transformer demand is driven by infrastructure projects in the Middle East and electrification projects in Africa.

- Saudi Arabia’s demand for transformers is reaching 2019 levels and most of the demand is originating from the renewable energy sector.

COVID-19 and T&D sector

The year 2020 was largely marked by Covid-19 and a stand-still in most economic matters. The effects to the T&D sector were multifaceted.

- Market decline – A steep decline in the global market was observed as the demand of distribution transformer dropped, due to cancelled or delayed new projects and/or grid capacity additions.

- Investment drop– Furthermore, outside of Europe & US, investments dropped radically in the T&D sector for instance in India investments dropped approximately 25% in the sector owing to the pandemic.

- Lead times – A shortage of freight services increased the lead time of power transformer by 12 months approximately.

- Capacity utilization – The manufacturing capacity of transformers was reduced by 15-20% globally.

- Outlook – Owing to investments made in the utility and generation sector, the transformer market in the U.S., China and Europe is expected to reach 2019 levels this year. Furthermore, recovery plans in the western European market are expected to provide an additional push to the transformers market.

Looking Ahead

Moving forward, EV charging and renewables would require digitalization of the grid and transformers specifically. The requirement for digitalization is more on the distribution transformer side than on the power transformers because that is where we already see products that could utilize the digital aspect of the transformers and the grid.

Links to the event recording & Whitepaper:

The recorded digital event can still be viewed at the event website here: https://coilwindingexpo.com/Page/thank-you-for-your-interest. In addition to it, the Market Report: Transformer Market and Component Developments is also available to download now here: https://www.coilwindingexpo.com/Articles/market-report-transformer-market-and-componen.

More about our Power Grid Market Research

Recent Insights

Medium Voltage Switchgear Supply and Demand

In the article, the authors, Saqib Saeed, CPO & Abdullah Kamran, Analyst at PTR Inc. elucidates that medium voltage (MV) switchgear, operating between 1 kV and 42 kV, is essential for controlling, protecting, and isolating electrical equipment. Valued at...

Europe’s Distribution Transformer Market: Adapting to the Impact of Energy Transition

The article authored b Eyman Ikhlaq, Analyst at PTR Inc. highlights that the European distribution transformer market is poised for substantial growth, driven by Europe's commitment to decarbonization, the integration of renewable energy sources, and the increasing...

Europe’s Renewable Revolution

Azhar Fayaz, Senior Analyst at PTR, emphasizes in his article that global initiatives like COP 28 have heightened the urgency for decarbonizing energy systems, positioning Europe at the forefront of the renewable energy transition. The continent's ambitious plan aims...

Ensuring Grid Reliability: Integrating Digital HV Switchgear and Artificial Intelligence

The article by Saifa Khalid, Senior Analyst, and Saad Habib, Analyst at PTR Inc., highlights the evolution of the U.S. high-voltage (HV) switchgear market, driven by advancements in smart grid technology, renewable energy deployment, and the increasing adoption of...