• The global distribution transformer market experienced a dip of approximately 7.6% year on year in terms of revenue in 2020.

• According to Power Technology Research, distribution transformers in excess of 1 million are sold in the U.S. every year.

• The U.S. is the largest market in North America and one of the largest markets at a global level, accounting for around 17% in terms of revenue.

The global distribution transformer market, as per the estimates of Power Technology Research, experienced a dip of approximately 7.6% year on year in terms of revenue in 2020, mainly due to Covid-19. Unlike the global distribution transformer market, however, the North American market did not experience any dip. The North American market instead grew at 2.6% in terms of revenue year on year, largely because of the U.S.

North America’s distribution transformer market follows the global trends in terms of demand generation. The penetration of renewables and electric vehicles is encouraging utilities to expand their network, triggering the demand for distribution transformers. However, the replacement of aging grid infrastructure continues to be the largest demand driver in the region’s distribution transformer market, which is expected to grow with a CAGR of 3.6% in terms of revenue from 2021-2027.

The U.S. boasts the largest distribution transformer market in North America, accounting for 80% in terms of revenue, and is one of the largest distribution transformer markets in the world.

Growth Drivers in the Distribution Transformer Market of the U.S.

The U.S. distribution transformer market is expected to be significantly propelled by replacements of aging grid infrastructure, followed by the ongoing energy transition, and the uptake of electric vehicles in the country.

Replacement driven

According to Power Technology Research, distribution transformers in excess of 1 million are sold in the U.S. every year, but only one-third of these account for capacity additions; the other two-thirds are used to replace decades old transformers in the grid as nearly 70% of the U.S. transformers are older than 25 years. So, despite the penetration of renewables and electric vehicles in the U.S. market, the distribution transformer market of the US will still be a replacement driven market.

Fig 1: Demand segregation in distribution transformer market in US 66% is replacement and 33% is capacity addition.

Source: Power Technology Research

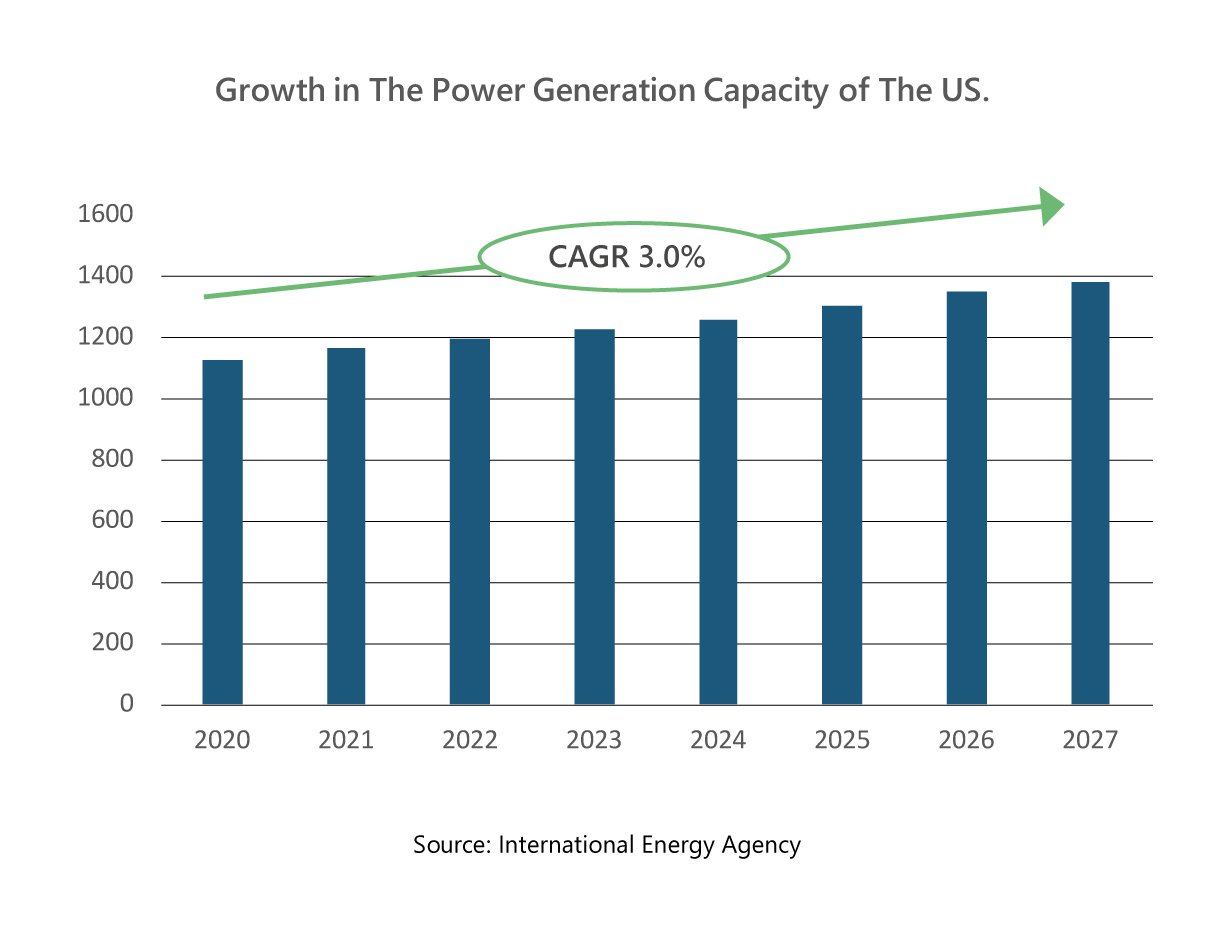

Energy transition

According to the International Energy Agency, the power generation capacity of the U.S. is expected to grow from around 1,126 GW in 2020 to 1,380 GW in 2027. A significant increase in renewable generation is also expected: rising from 16% in 2020 to more than 30% in 2027. Wind power generation capacity in the country is forecasted to increase from 120.6 GW in 2020 to 210.17 GW by 2027. Furthermore, solar energy capacity is expected to increase from 59.9 GW in 2020 to 223 GW in 2027.

Fig 2: Growth in the power generation capacity of the US.

Source: International Energy Agency

At the recent COP26, both the U.S. and China reaffirmed their pledge to limit the global rise in temperatures to 1.5 °C, as originally set out in the Paris Agreement in 2015. This may spur the U.S. to further increase its renewable generation capacity targets. This massive growth in the generation capacity of the country will require a corresponding increase in the transmission and distribution grid, leading to growth in the distribution transformer market of the U.S.

E-mobility

Electrification of the transport sector in the U.S. is also expected to drive the growth in the distribution transformer market of the U.S. Under the Bipartisan Infrastructure Law, USD 7.5 Billion have been allocated for the EV charging infrastructure in the country, leading to the expansion and modernization of the distribution grid. Even though there are currently around 2 million active passenger EVs in the country, the number is expected to cross 26 million vehicles by 2030, as per the estimates of Power Technology Research. Furthermore, there is an increasing trend of electrification in buses and the light duty commercial vehicle segment as well. The U.S. plans to strategically place EV charging infrastructure to provide support to the country’s electrification plans in the transport sector. The installed base for AC and DC chargers is expected to grow with a CAGR of 35% and 45%, respectively, from 2020 to 2030. Such drastic growth in the EV charging infrastructure will directly impact the distribution grid in terms of higher grid capacity demand and grid flexibility.

Looking Ahead

The U.S. is the largest market in North America and one of the largest markets at a global level, accounting for around 17% in terms of revenue. It has the world’s largest installed base of distribution transformers, with 43% share by units. The distribution transformer market in the U.S. is significantly marked by the presence of pole-mounted distribution transformers with an average size that is smaller than 50 kVA.

From the insulation type, the U.S. has the largest installed base of dry-type distribution transformers (accounting for 30% in terms of units) relative to the global figure (accounting for 15% in terms of units). With the penetration of wind generation in the capacity mix of the country, which is expected in the future, the percentage share of dry-type distribution transformers in the installed base is expected to further increase in the future.

Distribution Transformers Service Overview

The research presented in this article is from PTR's Distribution Transformer service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Distribution Transformers Market Research

Recent Insights

US Power Transformer Market Snapshot

US Power Transformer Market SnapshotMarket OverviewUSA to expand transmission systems by 60% by 2030 and may need to triple those systems by...

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

Europe Distribution Transformer Market: Navigating Changing Energy Dynamics

Europe's transition to clean energy is driving growth in the distribution transformer market. The growth is fueled by integrating renewable energy...