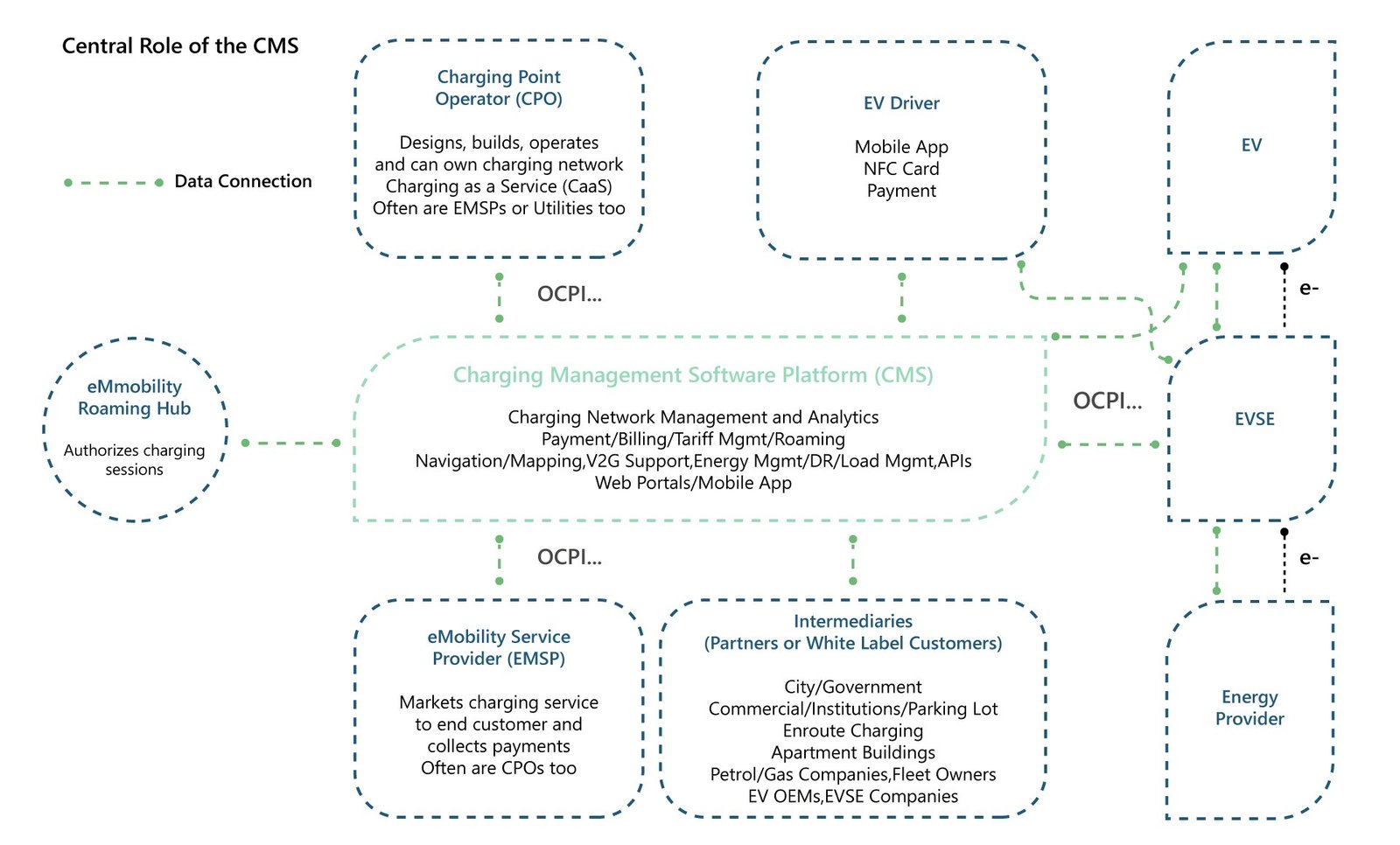

At the center of every EV charging network is some form of a CMS acting as a coordinator of activity and data between the users of EV charging and the entities that provide charging services. CMSs are cloud-based software platforms which act as a network operating system communicating with the EVSE charger, the driver (via an app), the EV, and the charging network and its partners. One very important feature of CMSs is that they enable interoperability between different chargers and networks when open protocols are used.

Figure 1 : Central Role of the CMS

Source: PTR Inc.

CMS Features

At its most robust, CMSs can enable a broad range of functionality that simplifies the charging experience for drivers, enables business models of charging networks and property owners, and assists with energy management and planning. CMS functionality is modularly enhanced by application program interface (API) linkages to a variety of backend functions providing a range of services.

- From the private EV owner’s perspective, a CMS enables the driver via an app to find an open charger, find an affordable charger considering tariffs (time-of-use, etc.), schedule its use for a certain time, facilitate navigation to that charger, and enable roaming between compatible partner networks. The CMS can also provide the user with the history of their charging activity and related trends.

- For eMobility Service Providers (EMSP), the charger network brands, a CMS enables the registration of new customers, management of accounts/profiles, charging data accumulation, and management of the payments process (account billing, credit card, mobile phone NFC, etc). Likewise, CMSs can also help providers penalize drivers that misuse chargers, like overstaying the allotted time.

- For EMSPs who also operate networks and for Charging Point Operators (CPO), entities that operate charging networks for others, CMSs help manage a range of operations and maintenance functions. A CMS communicates charger availability to customers and manages the application of tariffs. They can track charger usage, geographic charger loading, and energy consumption. Charger performance and health can be tracked including the application of remote diagnostics to detect and assess failures. Remote firmware and software updates can be supported as well.

- For fleet owners, enroute charging operators, and destination charging installations who don’t work with a CPO, having robust CMS is critical.

- CMSs can also enable processes like demand response, that time-shifts charging for load management or to take advantage of lower time-of-use (ToU) tariffs, and vehicle-to-grid (V2G) energy transfer.

CMS: Differentiation, Business Models, White Labeling, and a new SaaS Industry

The functionality and the “user experience” enabled by a good CMS have become a key differentiator amongst charging operators and their partners. At the same time, developing and maintaining a CMS has become prohibitively expensive for many vertically integrated operators. Therefore, a merchant CMS industry has emerged in the form of Software-as-a-Service (SaaS) offering. With these SaaS offerings, the R&D expense for developing and maintaining a CMS is amortized across many customers. SaaS CMSs are licensed and can be quickly customized with functionality modules, APIs to other services, and branding that creates or preserves a perceived differentiation. Recognizing the value in this approach, some in-house developed CMS systems of some vertically integrated CPOs/EMSPs are now being marketed independently from their network offerings.

Many of the business models behind the spread of charging points are being enabled by CMS-based open protocols as well as technology like roaming hubs that facilitate EVs charging on other networks. Amongst other benefits, these protocols allow CMSs to be agnostic to which EVSE equipment is used and provide a common communication language between different operations helping enable roaming. This has opened a range of business models that can operate in different segments of the value chain to the end customer. One entity can own the relationship with EV driver/fleet operator (say an EMSP), another can build and operate the charging networks (say a CPO), and others can build the EVSE and another the software like the CMS. This decoupling of value-add nodes in charging has led to the rise of so-called White Labeling where the brand name on the apps, management screens, and even the EVSE can be the name of the Fleet owner, for example, even though they technically might not have developed anything. Charging service revenues can also be split between the CPO and the property owner (where the EVSE is located) with the % splits based in part on who paid for the equipment and site prep. It should be noted that companies who have traditionally operated as EMSPs often now have CPO businesses, and vice versa.

Another item of note is that some regions are mandating that charging networks allow any EV, regardless of their charging network affiliation, be allowed charge on any public network. This is a development that is greatly enabled by open standards-based CMSs and the standardization of physical charging connectors.

Some Standards to Know About

CMSs use protocols to enable the communication of commands and data between entities in the charging microcosm. To support seamless interoperability between different CMSs and various EVSEs, an interface standard called Open Charge Point Protocol (OCPP) has emerged. The Open Charge Alliance (OCA) writes and publishes the OCPP. It is free to use and has a certification program for compatibility. An estimated 70% of chargers use OCPP today.

Another notable standard is the Open Charge Point Interface (OCPI) protocol. This is an open protocol that enables EV drivers to roam to various charging networks seamlessly (managed by the EV Roaming Foundation). The Open Smart Charging Protocol (OSCP) is open communication protocol between the CMS and the energy management system regarding a 24-hour forecast of accessible capacity of the grid. ISO 15118 is a common communication protocol between the EV and charger. It supports V2G operation.

CMSs as an Enabler of Additional Revenues

In realty the economics of selling charging services can be challenging. Capital payback and positive RoIs can take many years for public charger networks, even with incentives. To address this, APIs supported by CMSs can enable point-of-sale style services like advertising. API enabled ad impressions on the EVSE display or mobile phone app adds to charging service revenue streams.

Another revenue stream can be from the sale of aggregated data about charging patterns, energy usage, and other useful metrics to third parties such as utilities and municipalities. Utilities are also interested in financially incentivizing charging networks to support demand response programs to enable smoothing of shift peak demand.

CMS Players

There is a spectrum of CMS offerings on the market today ranging from custom versions for proprietary networks from vertically integrated companies through to licensable versions from independent companies.

There are more than 25 unique CMSs on the market today. Some are proprietary to EMPSs or CPOs (like Tesla and ChargePoint). Examples of pure-play merchant CMS companies include: Ampeco (Bulgaria), ChargeLab (Canada), Driivz (Israel), eDRV (US), and Greenflux (Netherlands), Tridens Technology (Slovenia).

Adjoining the functionality of CMSs are a variety of other 3rd party services from others including payment services/gateways, roaming hubs, mapping and navigation tools, energy management load planning tools, and V2G management tools.

Market Outlook

The growth of the CMS market is tied to the rapid deployment of destination, enroute, and workplace charging points. Given the strong focus by governments to incentivize the build out of charging capability, non-residential versions are expected to witness a 10x growth in charge points through 2030. Even EV owners with chargers at home will need to interface with public or private chargers at some point and a robust CMS is needed for that. PTR estimates the EVSE SaaS market is valued USD 451M in 2022 and is forecasted to grow a 31% CAGR reaching USD 3.9B by 2030.

EV Charging Infrastructure Service Overview

The research presented in this article is from PTR's EV Charging Infrastructure market research. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

EV Charging Infrastructure Market Research

Recent Insights

European Electric Vehicle Charging Infrastructure (EVCI) Services Market Landscape

This infographic gives an overview of the electric vehicle charging infrastructure (EVCI) services market in the European region. It highlights the...

Exploring the European EVCI Services Market Key Players and Emerging Trends

There has been a significant surge in the development of EVCI due to the widespread adoption of EVs in Europe. By 2030, it is expected that Europe...

Global EV Market: Analysis of EV Sales Slowdown in 2023

• EV sales were impacted adversely in 2023 on account of various factors, including price disparity, consumer perception and supply chain...