• EMEA region is actively pursuing deployment of renewables in order to meet the growing energy demand.

• Europe is set to become first climate neutral continent by 2050 as per the EU green deal.

• SVC technology has the highest share in terms of installed base in the EMEA market as the technology completely dominated the region’s FACTS market till 2000.

EMEA region is actively pursuing deployment of renewables in order to meet the growing energy demand while curtailing global rise in temperature as stipulated under the Paris Agreement. The uptake of renewables has led to grid reliability and stability issues including voltage instability, loss of inertia in the system and power quality issues. In order to deal with these technical issues, grid operators are moving towards deployment of technologies that support the grid for instance FACTS. FACTS technology helps maintain the voltage levels, provide reactive power support and inertia to the grid, and assists in frequency stabilization. The FACTS technologies that have gained substantial traction in the region last year include STATCOM and synchronous condensers.

Renewable Adoption Targets

European countries are expanding their renewable energy targets for instance Germany and France while countries in the middle east that are beginning their transition towards renewable energy sources from conventional generation have set their clean energy targets especially Kingdom of Saudi Arabia and United Arab Emirates.

Europe is set to become first climate neutral continent by 2050 as per the EU green deal. European union has set a target to increase the share of renewables in the capacity mix to 40% by 2030. Germany is moving to accelerate the development of offshore wind farms in the country and has set a target to install 30 GW of offshore wind generation capacity by 2030 which is a 50% increase from the earlier target. This is followed by an offshore wind generation capacity target of 40 GW by 2035 and 70 GW by 2045. Similarly, France is aiming to reduce the share of nuclear energy in the generation capacity mix from 70% to 50% by 2035 followed by shutdown of its last coal power plant by 2022. The demand and supply gap in France is planned to be bridged with renewables and flexible electricity generation capacity.

On the other hand, middle eastern countries have also initiated transitioning towards renewable energy sources from conventional generation with UAE and KSA setting a target of achieving 30% and 50% share of renewable energy in the capacity mix of their respective countries.

Figure 1: Key Renewable Generation Expansion Plans in the EMEA.

Source: Power Technology Research

Technology Trends in EMEA

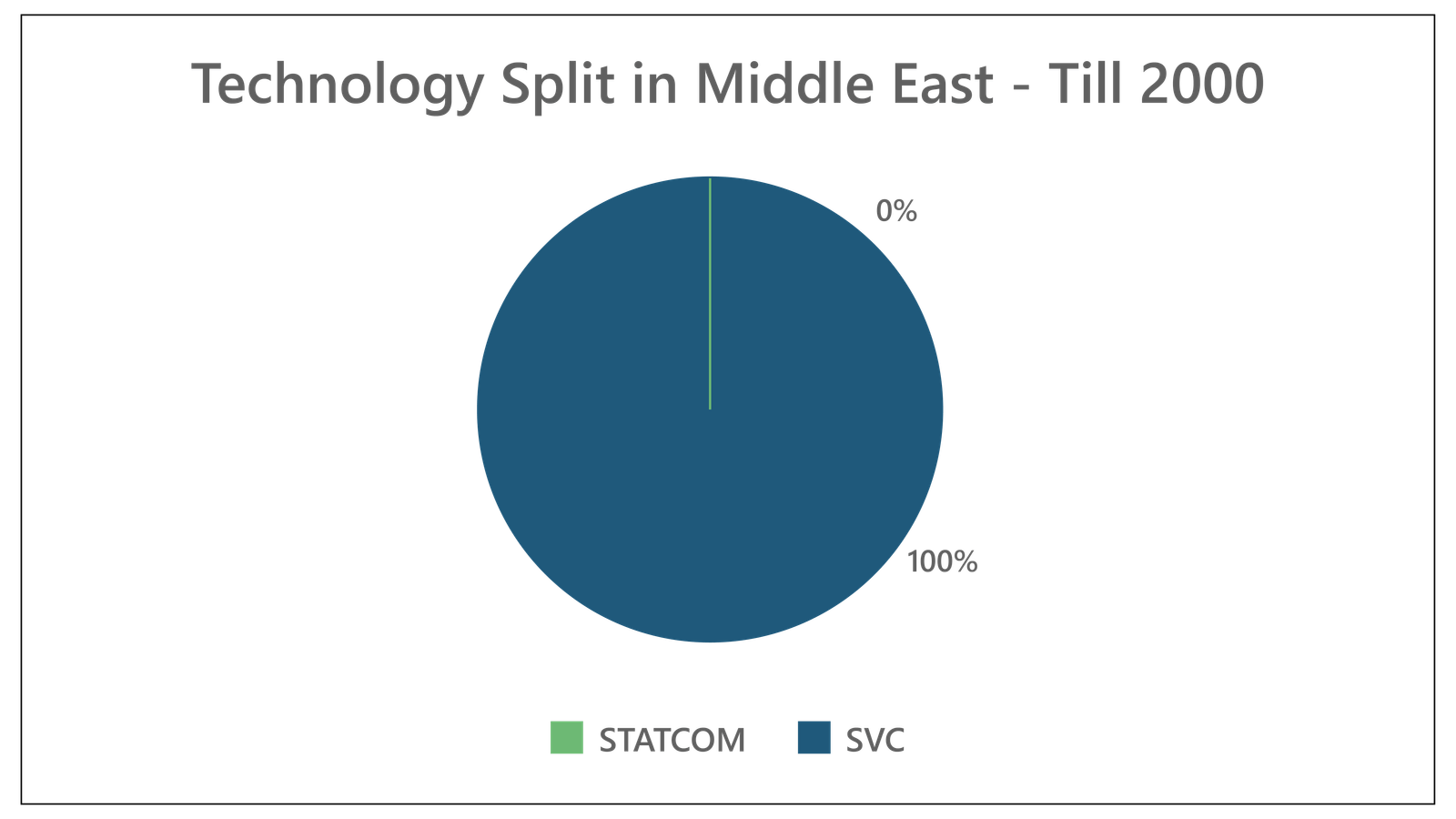

SVC technology has the highest share in terms of installed base in the EMEA market as the technology completely dominated the region’s FACTS market till 2000 along with a couple of STATCOM projects in Nordics. The dominance still continues due to the affordability and reduced complexity that is associated with the SVC technology as compared to STATCOM. However, the STATCOM technology gained traction in the last decade as it found application in the utility sector. STATCOM has an advantage over SVCs in terms of less harmonic distortions, compact size, and quick response.

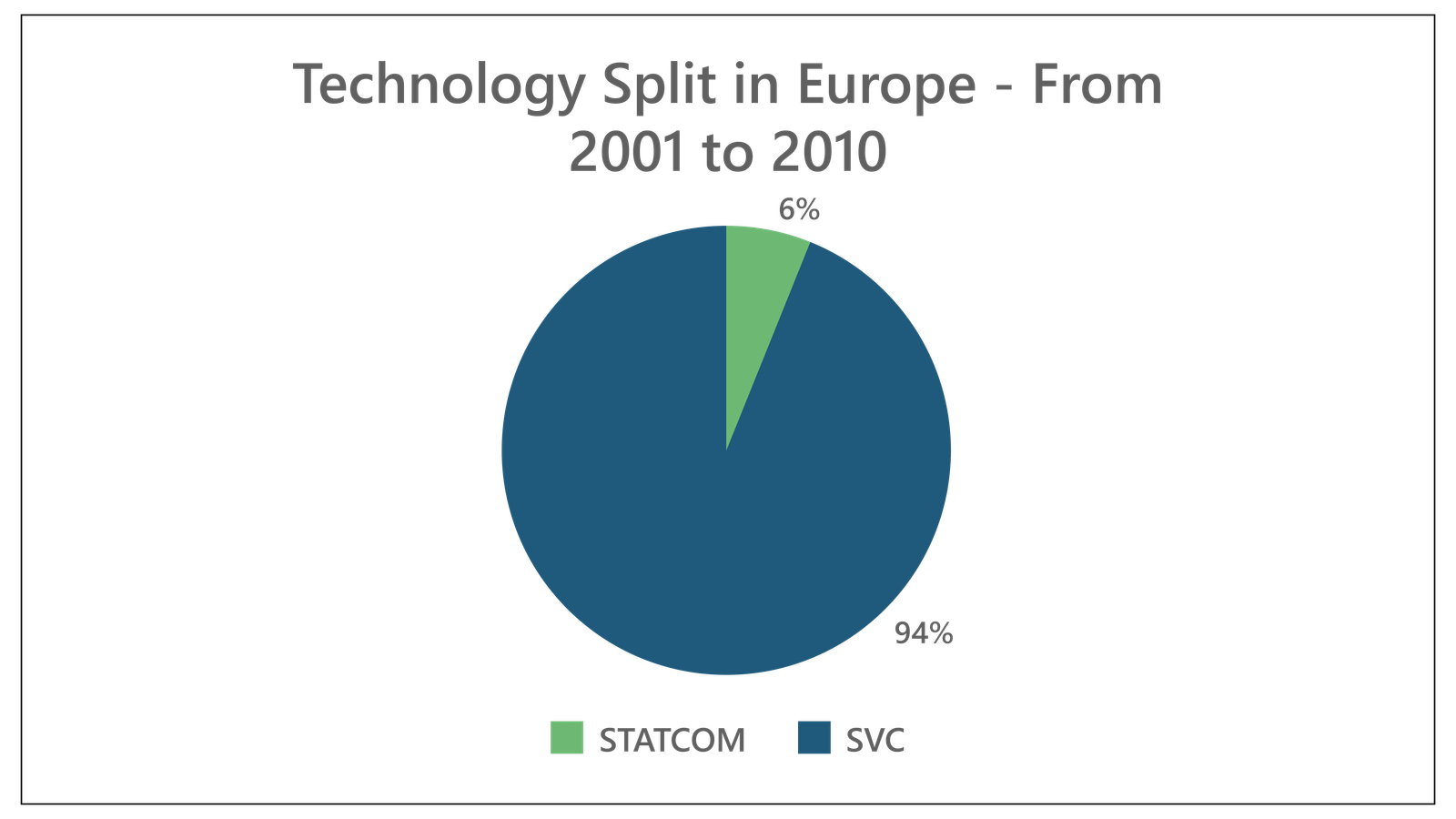

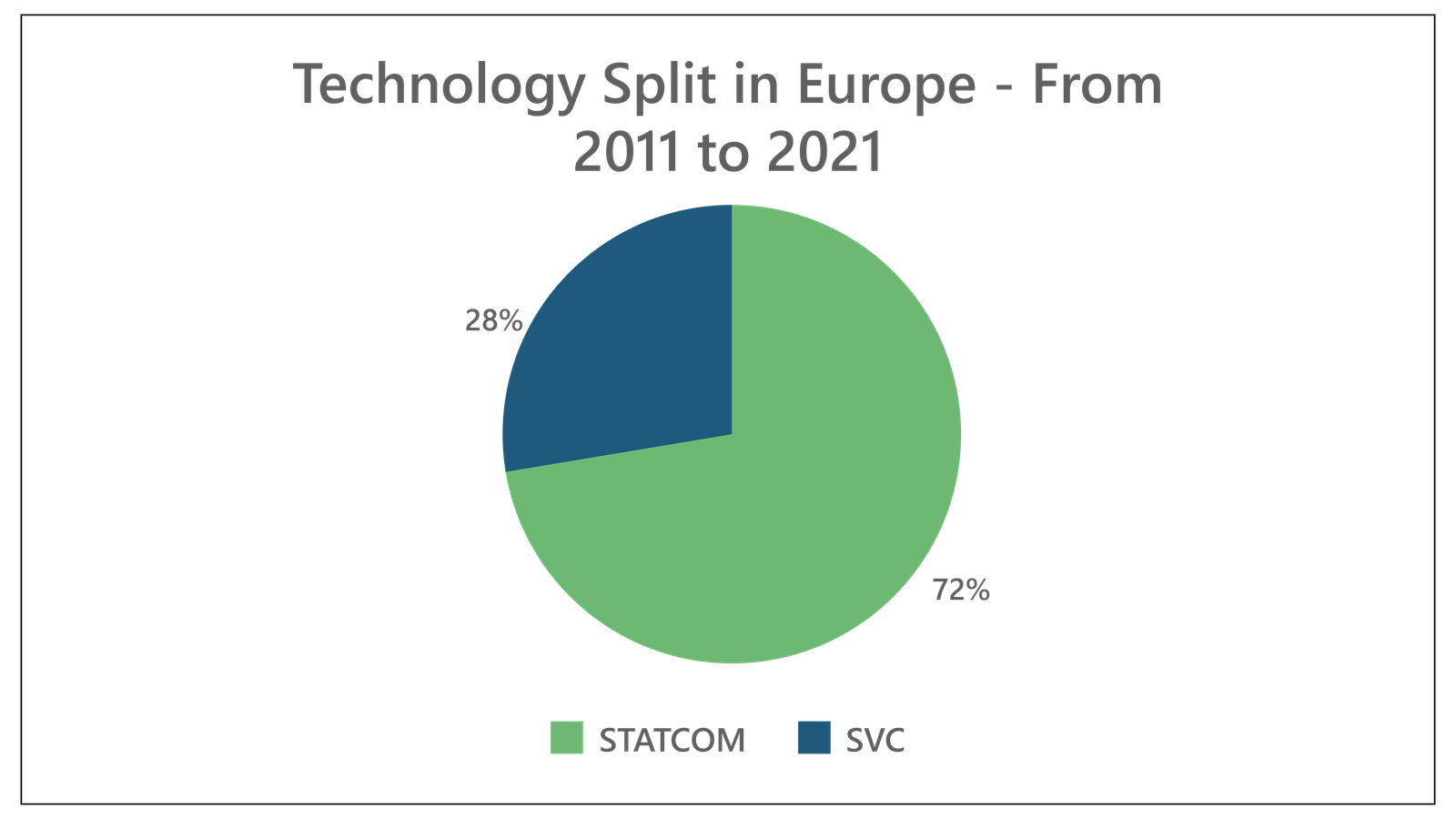

In Europe, SVC technology dominated the market till 2000 with a minuscule percentage of STATCOM deployed in the region accounting for only 1%. From 2001-2010 SVC continued to dominate the European FACTS market but the STATCOM technology picked pace with market share increasing from 1-5%. From 2011 to 2021, the STATCOM technology gained significant traction in Europe and began to dominate Europe’s FACTS market while SVC technology lost dominance for the first time.

Figure 2: Technology Split in Europe till 2000.

Source: Power Technology Research

Figure 3: Technology Split in Europe from 2001-2010.

Source: Power Technology Research

Figure 4: Technology Split in Europe from 2011-2021.

Source: Power Technology Research

Figure 5: Technology Split in Middle East till 2000.

Source: Power Technology Research

Figure 6: Technology Split in Middle East from 2001 till 2010.

Source: Power Technology Research

Figure 7: Technology Split in Middle East from 2011 till 2021.

Source: Power Technology Research

Looking Ahead

EMEA leads the other regions in term of new contracts awarded for the FACTS across the globe, accounting for nearly 78%. During 1st quarter of 2021, FACTS technologies gained popularity in the Middle East Region with couple of tenders floated by Saudi Electric Company (SEC) as the year moved on FACTS tenders increased in numbers to support upcoming renewable integration in Europe. In the coming years, the EMEA FACTS market will be driven by STATCOM technology which will support integration of upcoming renewable generation and interconnections in the region. In 2021, nine new STATCOM contracts are awarded by the utilities in the EMEA while the total projects awarded account for 27,2021 MVAR capacity.

Flexible AC Transmission Service Overview

The research presented in this article is from PTR's Flexible AC Transmission service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Flexible AC Transmission SystemsMarket Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

Renewable Revolution Catalyst for the EU’s FACTS Market Growth

The Russia-Ukraine war has served as a wake-up call for the EU member states to decrease their dependence on Russian energy supplies. Due to the...