• The installed base of distribution transformers in North America is one of the oldest in the world; the market is largely driven by replacements.

• In terms of units, the North American distribution transformer market accounts for more than 30% of the installed base of the global distribution transformer market.

• It is expected that the installed base of distribution transformers is expected to grow with a CAGR of 1.1% in 2021-2027.

The installed base of distribution transformers in North America is one of the oldest in the world; the market is largely driven by replacements. This is mainly because the majority of investments in the U.S. electricity infrastructure were made from the 1950s to 1980s, so the majority of the transformer have reached average life. According to Power Technology Research, the U.S. has an aging transformer fleet, with 70% of the distribution transformer fleet more than 25 years old, and with around 15% of the installed base already having passed the average life expectancy of 35 years.

The Installed Base of Distribution Transformers in North America

In terms of units, the North American distribution transformer market accounts for around 60% of the installed base of the global distribution transformer market. The concentration of such a huge installed base in North America is a consequence of the large number of small-sized, pole mounted transformers in the region. In contrast, pad mounted MV/LV transformers are much less frequently installed next to end users.

Figure 1: Percentage share of distribution transformers in the world (in terms of units

Source: Power Technology Research

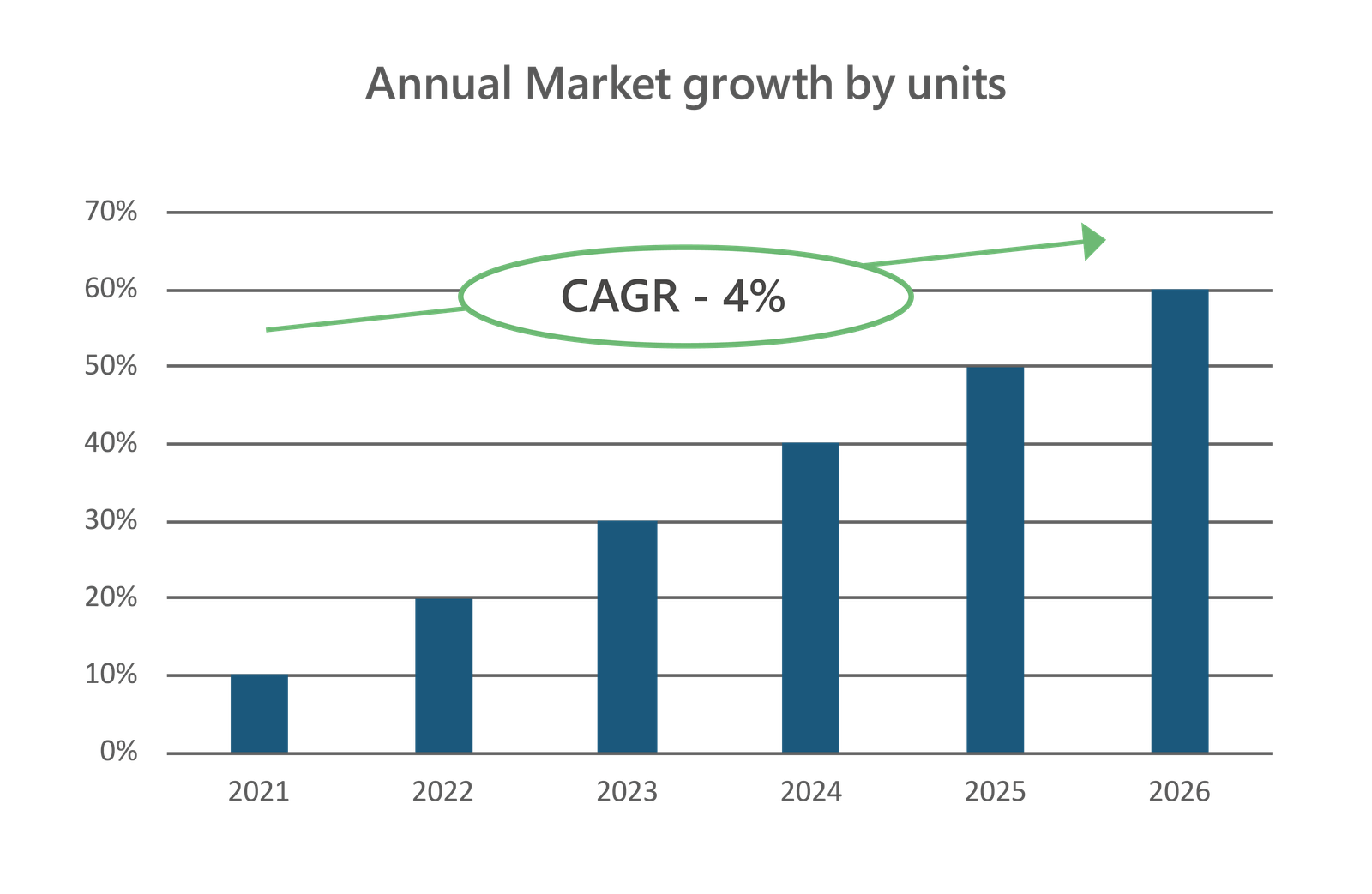

Figure 2: Growth in the distribution transformers market of North America from 2021-2026 (in terms of capacity).

Source: Power Technology Research

It is significant to note that voltages above 24kV are rarely found in North America in the MV/LV category, while 1-12 kV distribution transformers dominate the North American market. The region also has one of the largest installed base of dry type transformers. The share of dry type transformers in North America as compared with oil type transformers is one of the highest in the world, with dry type accounting for around 14% of the installed base of total distribution transformers in US. The dry type transformers are transformers that use natural air as cooling medium whereas oil type transformers use oil as a cooling medium.

Annual Market Driver in North American Distribution Transformer Market

Utilities in the region are investing in upgrading infrastructure and replacing old transformers to reduce the impact of power outages for its distribution customers, in addition to enabling economic growth and preparing for the impacts of climate change.

According to the Energy Information Administration of the U.S., in 2019, for instance, customers in the U.S. faced an average of 3.2 hours of power outage during major events, and 1.5 hours of outage without major event, totaling nearly 5 hours. If major events in the U.S. are included, the average outage of 4.7 hours in 2019 was nearly half of the average outage in 2017, a year marked by hurricanes, wildfires, and severe storms. Utilities in the U.S. compete with each other to improve SAIDI (System Average Interruption Duration Index) and SAIFI (System Average Interruption Frequency Index) values in order to remain financially viable and to grow. System Average Interruption Duration Index (SAIDI) measures the total time an average customer experiences a non-momentary power interruption in a one-year period, while System Average Interruption Frequency Index (SAIFI) measures the frequency of interruptions over a period.

Under the Biden Infrastructure bill, the U.S. Department of Energy will be investing $61 Million in smart buildings to improve grid resilience and facilitate renewable energy, thus driving the annual market.

The increased penetration of renewable energy generation in the grid is behind the expansion of the distribution grid in the US and Canada, resulting in the growth of the annual distribution transformer market.

Electricity Alliance Canada aims to enable, promote, and advocate for the increased use of renewable electricity throughout the Canadian economy to help achieve Canada’s net-zero emissions target. In Canada, more incentives in the future are expected to promote the use of Electrical Vehicles (EVs); ergo, more electric chargers and related grid upgradations will also be required, driving the demand for distribution transformers.

In Mexico, the demand for distribution transformers in the country is mainly driven by increased urbanization and industrialization. Moreover, due to the development of decentralized generation (wind, solar) and new uses (Electromobility), the distribution grid is undergoing expansions and replacements. The increased penetration of renewables in the energy mix of the country is also a driving factor in the growth of the annual distribution transformer market.

Looking Ahead

The distribution transformers market of North America is mainly driven by replacements but owing to the penetration of electric vehicles and renewables in North America’s electricity grid, it is expected that the installed base of distribution transformers will grow with a CAGR of 1.2% from 2021-2027. Biden’s Infrastructure Bill in the U.S., urbanization and industrialization in Mexico, combined with the adoption of renewables and incentives for EVs in Canada will be the key drivers of demand for distribution transformers in future.

Distribution Transformers Service Overview

The research presented in this article is from PTR's Distribution Transformer service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Distribution Transformers Market Research

Recent Insights

US Power Transformer Market Snapshot

US Power Transformer Market SnapshotMarket OverviewUSA to expand transmission systems by 60% by 2030 and may need to triple those systems by...

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

Europe Distribution Transformer Market: Navigating Changing Energy Dynamics

Europe's transition to clean energy is driving growth in the distribution transformer market. The growth is fueled by integrating renewable energy...