• India is increasingly achieving the addition of renewable energy sources in its energy mix and will require flexible assets, including energy storage, to maintain grid stability.

• For the first time, India included energy storage obligation along with renewable energy obligation for the distribution utilities.

In pursuit of its climate goals, India is rapidly moving towards the deployment of renewable generation across the country which, owing to the intermittent nature of the renewables, will create the need for energy storage in the country. This article discusses the developments in the energy storage sector, the main market drivers, and the barriers faced by this sector in India.

According to the International Energy Agency (IEA), India is the world’s third-largest energy consumer and meets most of its electricity demand through coal-fired generation. Coal accounts for almost 71% of the generation mix, followed by 20% renewables (including large hydro), while natural gas and nuclear constitute 4.4% and 2.5% of the generation mix, respectively. If we exclude large hydro, renewables only account for around 10%, with solar and wind accounting for 3% and 4% of the overall generation mix.

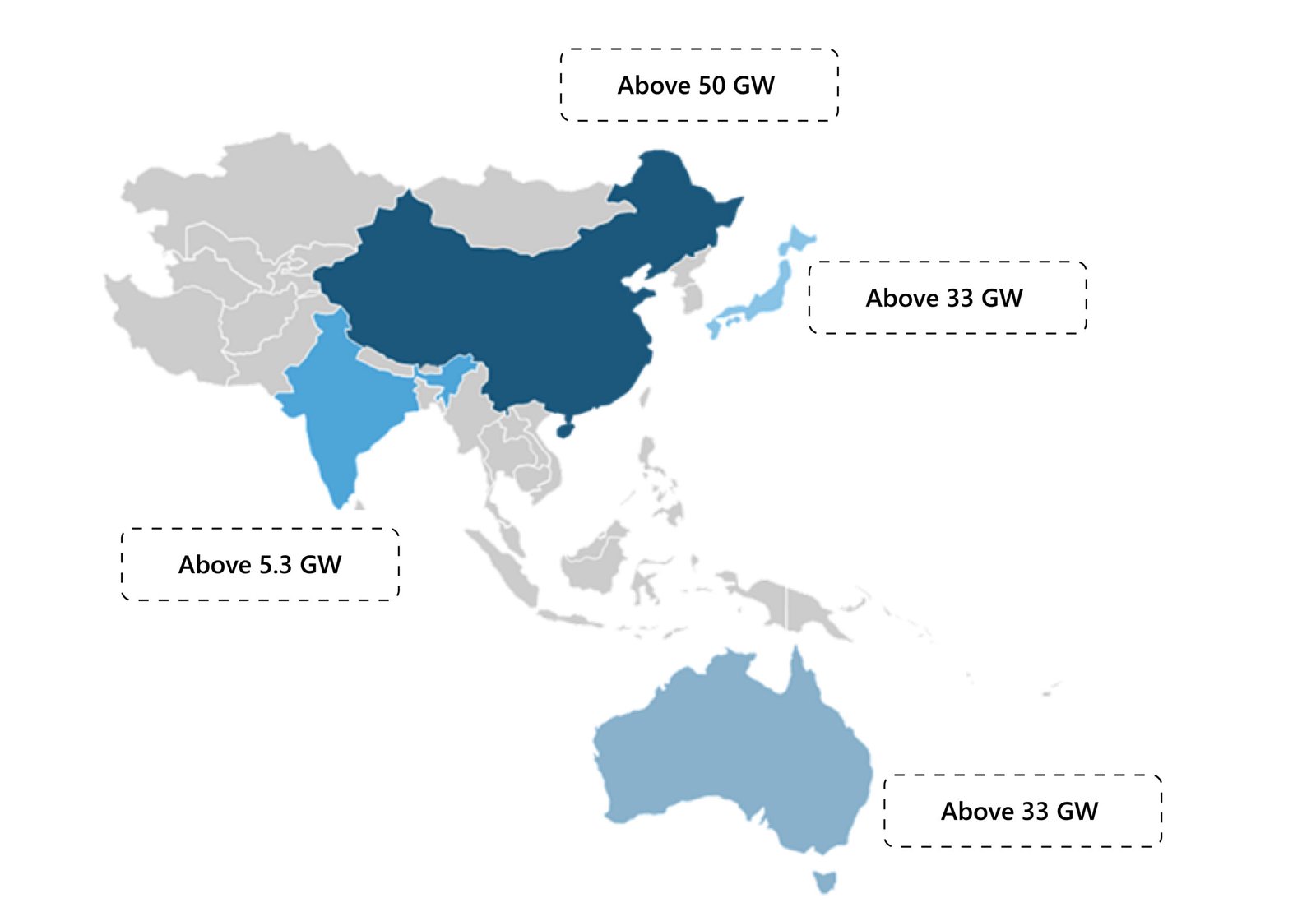

The addition of intermittent renewable energy sources in the electricity grid system raises the need for ensuring flexibility and stability in the grid during the high and low surcharge periods. Energy storage is one of the most flexible technologies that can provide the grid system’s required stability. Major countries in the APAC region, such as China and Australia, are deploying energy storage (ESS) technologies such as battery energy storage (BESS) and pumped hydro at an accelerated and larger scale.

The map below highlights the installed base capacity of energy storage projects in major countries of APAC.

Figure 1: Overview of Installed Base of Energy Storage in APAC

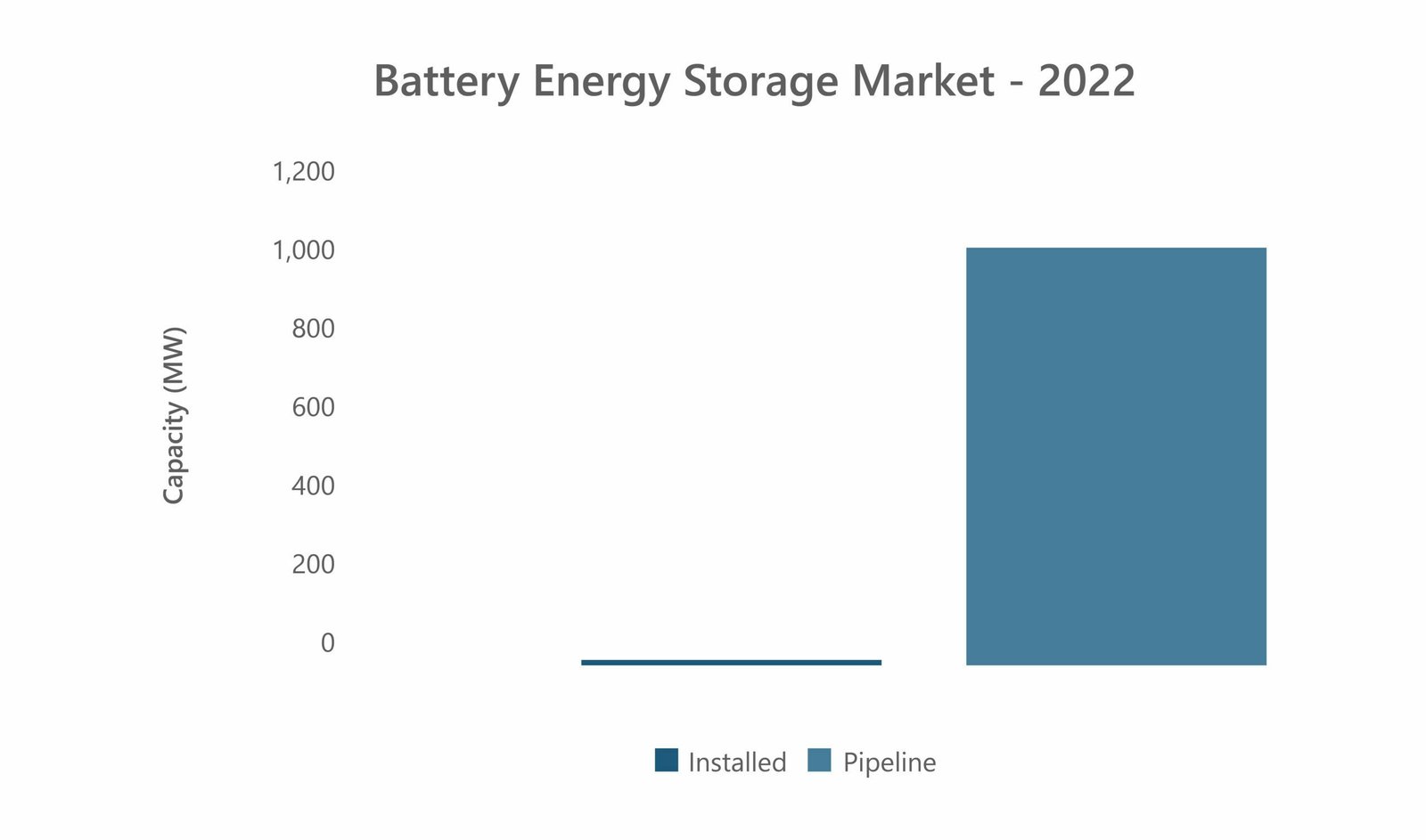

The figure included below highlights the development of two dominant splits of energy storage technologies in India.

Figure 2: Overview of the Mechanical Energy Storage Market in India

Figure 3: Overview of the Battery Energy Storage Market in India

A significant amount of effort is needed in order to increase the pace of deployment of battery energy storage projects in the country. Most encouragingly, India did show signs of development in its energy storage market in 2022.

Developments

• Energy Storage Obligation Policy

In 2022, India’s energy storage sector experienced significant developments, including the issuance of government guidelines for the use of batteries in energy generation, transmission, and distribution. The Ministry of Power also released an Energy Storage Obligation, while companies such as Reliance New Energy, Ola Electric Mobility, and Rajesh Exports signed an agreement under the Production-Linked Incentive program. Major tenders were also issued, including JSW Renew Energy Five Limited winning an auction to set up 500 MW/1000 MWh standalone battery energy storage projects, and Greenko Energies winning a tender to set up 3,000 MWh capacity energy storage systems. Additionally, bids were invited for the design and installation of a 250 MW/500 MWh grid-connected standalone battery energy storage system.

• NTPC Launched a 250 MW BESS Tender

State-owned power producer NTPC has announced a tender for a 250 MW/500 MWh battery energy storage system to be connected to India’s Inter-State Transmission System. The tender is part of NTPC’s plan to deploy at least 1,000 MWh of battery storage at some of its thermal power plant sites, while also seeking to expand its renewable energy portfolio. NTPC’s announcement follows a similar solicitation by the Solar Energy Corporation of India for 500 MW/1,000 MWh of battery storage. Both tenders have generated significant interest in India’s energy storage market.

• Partnership between O2 Power and Powin Energy

O2 Power, which is one of the rapidly expanding renewable energy producers in India, has entered a memorandum of understanding with Powin, a leading global company that specializes in the development, production, and integration of safe and adaptable battery energy storage solutions. The purpose of the agreement is to offer tailored and competitive battery storage solutions for the Indian renewable energy market.

Barriers to the Development of the ESS Market

Despite some encouraging developments in energy storage, some barriers extant in the current landscape threaten to impede further growth in the market. Some are highlighted below:

High Upfront Costs:

Various taxes in terms of import duties and GST are implemented on lithium-ion batteries, which are the key component for an energy storage project. The imposition of these taxes increases the overall cost of an ESS system in India.

Lack of Business Cases:

India will need to introduce a comprehensive regulatory framework and competitive electricity markets for the participation of batteries to generate revenues. In 2022, the regulations were revised by Central Electricity Regulatory Commission, allowing energy storage to participate in tertiary reserve ancillary services (mFRR).

However, energy storage systems are still not allowed to participate in primary and secondary reserve markets. But consultations are underway for the participation of energy storage in the primary reserve under the India Electricity Grid Code (IEGC).

Lack of Regulatory Framework for ESS:

India would need to establish a framework to simplify the operation and management of the battery energy storage projects. One identified barrier by the trade association of the Indian energy storage market is that renewable energy developers are not eligible to provide energy storage as a service through power purchase agreements.

Looking Ahead

India’s gradual incline to renewable energy has created new market opportunities for the nation’s energy storage sector. India must use flexible assets, such as energy storage, to maintain grid stability in order to meet the ambitious goal of 450 GW of renewable energy capacity by 2030. Although the nation is obtaining significant progress in the energy storage sector—launching tenders, requiring distribution utilities to use energy storage, and developing an ambitious pipeline of BESS projects totaling about 1 GW—it still faces obstacles like high upfront costs and a lack of legislation for energy storage. Nonetheless, the energy storage industry in India is positioned for significant growth in the next years owing to the government’s assistance through funds and auctions as well as the increasing need for renewable energy.

Energy Storage Service Overview

The research presented in this article is from PTR's Energy Storage service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Energy Storage Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

COP through the Ages

This infographic takes a cursory glance at the most significant achievements of the Conference of Parties through the years and offers a chance for...