• Payback periods for shore power need to be shorter in the UK than on the continent primarily due to the private ownership structure of the ports in the country.

• Despite facing challenges, the UK shore power market is still poised to become one of the most important markets in Europe in the coming years.

The ports and shipping industry of the UK is the second largest in Europe, boasting 125 ports with cargo handling capacity all over the country. These ports are handling approximately 95% of the UK’s trade, accounting for around 500m tons of freight and beyond 60m international and domestic passenger journeys in a year (as of 2019 data).

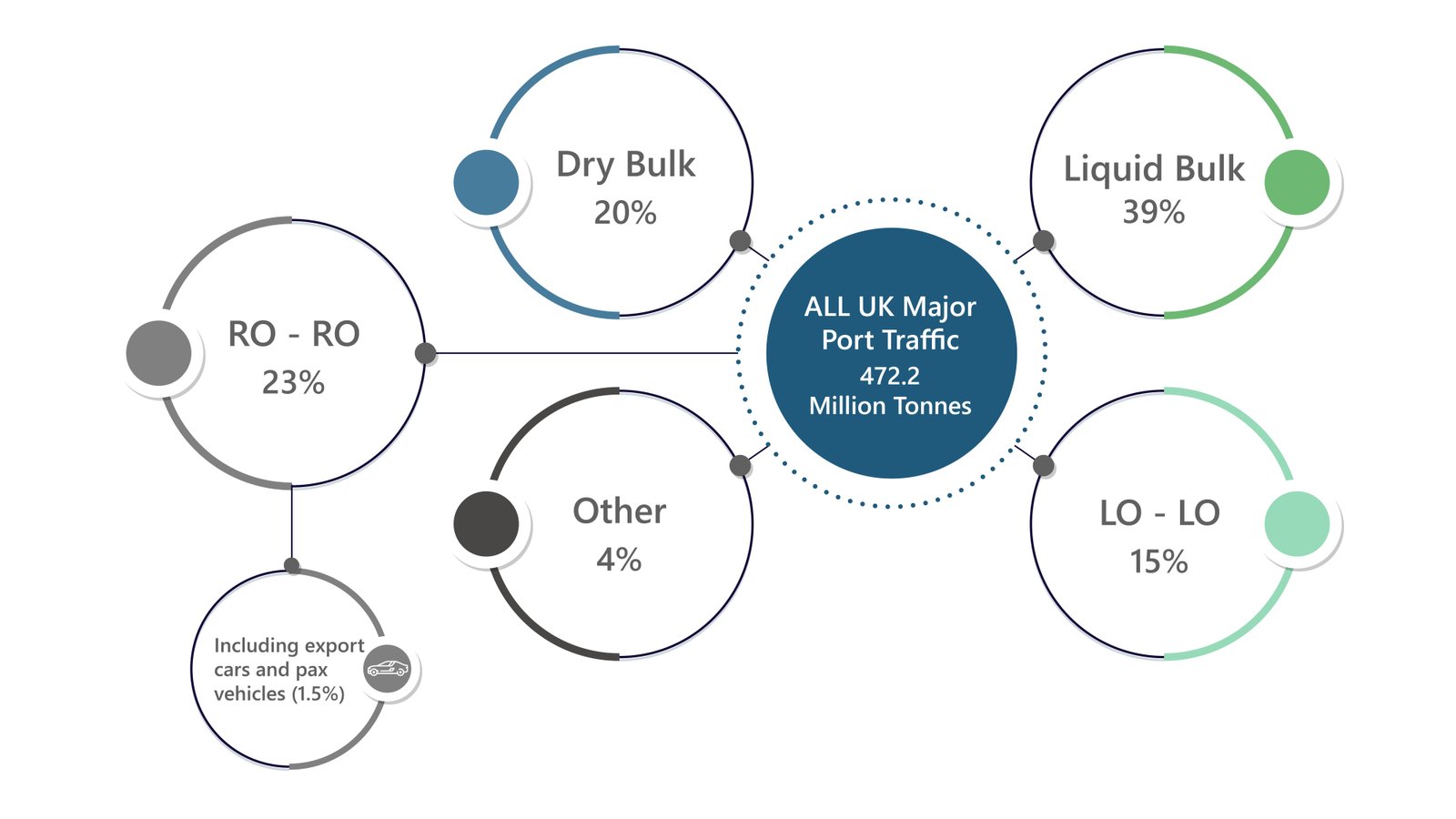

The ownership structure of ports in the UK is segmented into private, municipal, and trust. All these ownership models are open for market forces and are operated independently as standalone enterprises that are not only capable of financing themselves but also do not rely on government support or subsidy. On the other hand, the majority of the vessel traffic in the UK consists of cargo vessels. A more in-depth breakdown of the vessel traffic, according to the UK’s Department of Transport, is as follows:

1) Liquid bulk (39%)

2) Ro-Ro (23%)

3) Dry Bulk (20%)

4) Lo-Lo (15%)

5) Other (4%)

Figure 1: Breakdown of majority of the vessel traffic in the UK

Source: Department for Transport Port Freight Statistics (of UK)

Figure 2: Major vessel traffic on main ports of the UK.

Source: Marine Traffic

As far as vessel traffic on major ports in the UK is concerned, in the vessel type 2 category for the Port of Portsmouth, Port of London, and Port of Southampton, containers are the most frequent visitors whereas, in the vessel type 1 category, yachts, ferries, and cruises are the most frequent visitors. At the Port of Liverpool, the majority of the traffic in the vessel type 1 category is container while tankers are the most prevalent in the vessel type 2 category.

Entry Barriers in the UK

In the ports and shipping industry of the UK, ports are usually owned by the private sector which renders it difficult for port authorities to invest in shore power, an industry that relies on subsidies. In continental Europe, on the other hand, the majority of the ports are owned by the public sector, which makes it easier for them to withdraw state financing (in some countries, not all) for projects with high CapEx. Furthermore, in continental Europe, the environmental benefits of technologies like shore power are also accounted for in business cases, rendering longer payback periods acceptable to business leaders and policy makers alike.

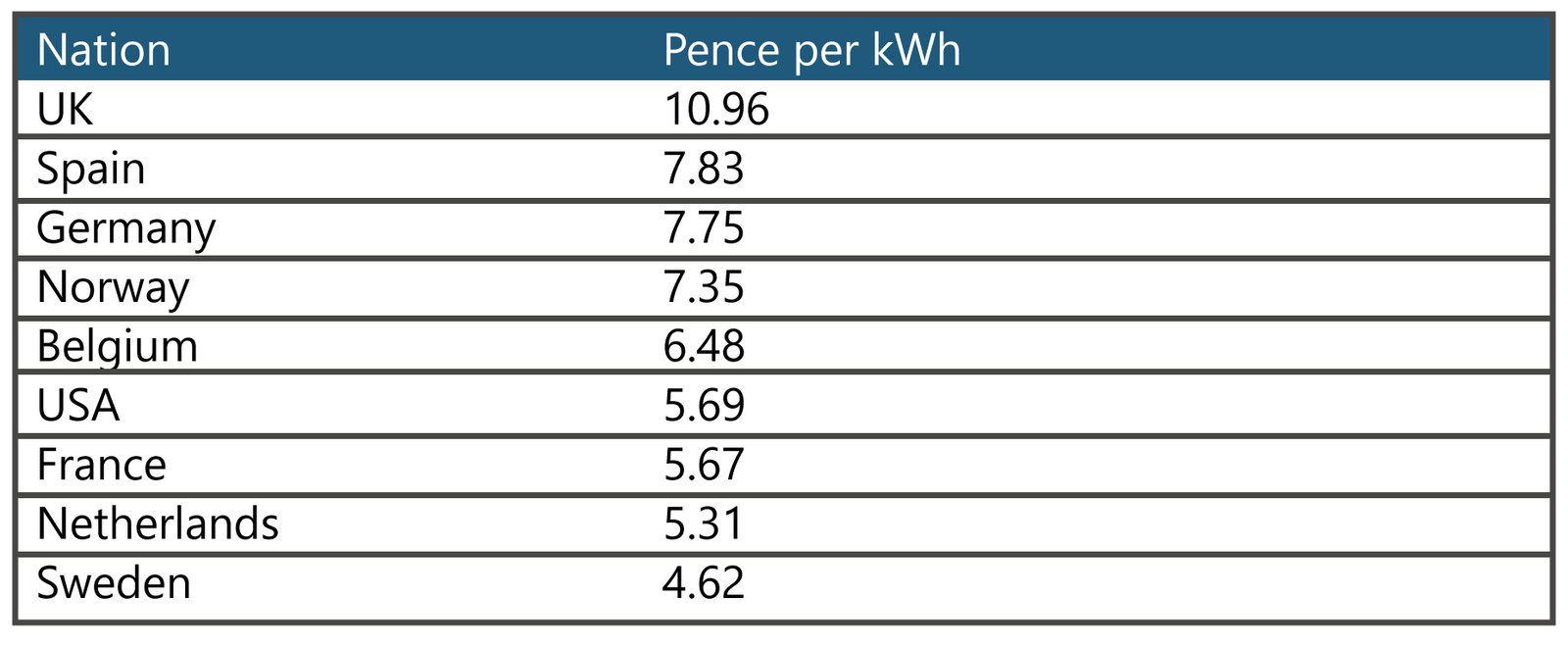

Payback periods for shore power need to be shorter in the UK than on the continent primarily due to the private ownership structure of the ports in the country. As of now, payback periods are longer due to low operating margins for ports and high capital costs for the shower power systems. The longer payback period problem is further complicated by the electricity tariff in the UK, which is the highest in the region.

On the other hand, ports and shipping companies are still reeling from the detrimental impact of the Covid-19 pandemic. The impact is compounded by the spike in energy prices globally, followed by rampant inflation that disincentivized the deployment of shore power systems without significant tax reliefs.

Figure 3: Price of electricity for industrial usage before tax in selected countries supporting shore power.

Source: British Ports Association

Moving Forward

Despite facing challenges, the UK shore power market is still poised to become one of the most important markets in Europe in the coming years. On 7 February 2022, the UK government launched a call for evidence to gather information on the costs, benefits, vessel emissions and options for increasing the use of shore power in the UK. The UK Chamber of Shipping is urging the British government to make shore power installation and use mandatory at the country’s seaports. The chamber also plans to prioritize shore power for sectors with predictable port calls and the greatest possible impact on emissions reductions, particularly for vessel classes that spend long periods near the pier including containerships, passenger vessels, tugs, and OSVs. In addition to mandated shore power requirements for ports, the Chamber has urged that the government fund infrastructure and shipboard equipment, akin to the UK’s investments in electric car charging stations.

Shore to Ship Service Overview

The research presented in this article is from PTR's Shore to Ship service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Shore to Ship Power Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

Unveiling the Transformative Journey of Port Electrification

OPS installation is on the rise globally as countries prioritize their environmental objectives and seek to minimize the ecological impact of...