• Power transformers are a critical and the most vulnerable component in an electricity grid, especially with the ongoing digitalization of the grid infrastructure and ever-evolving cyber security threats.

• The US lacks the production capacity to meet the demand for power transformers originating locally and relies on imports from foreign countries.

• A trend towards localization is being observed in the US power transformer market but it is not an overnight process.

In addition to being a critical component, power transformers are also the most vulnerable component in an electricity grid, especially with the ongoing digitalization of grid infrastructure and ever-evolving cyber security threats. The U.S. electricity grid, which relies greatly on power transformers, is responsible for supplying power to residential, commercial, and industrial customers, along with supplying the power required to support military and defense installations, including bases, arsenals, and laboratories.

Sophisticated military equipment, such as fighter jets and naval vessels, also rely on transformers of various types and capacities to provide the correct voltage within subsystems. Furthermore, the failure of a single power transformer unit can cause loss of load over a large service area and the replacement requires time because of the massive costs involved, high lead time, and difficulty to transport LPTs.

These transformers are not just crucial for the economy but are vital for national security as well, leading successive U.S. governments to take measures focused on reducing reliance on foreign countries, in this regard. There have been certain government measures that were not sustainable and were counterproductive, so they were later revoked. At present, the demand for power transformers in the U.S. is met through U.S.-based and international companies, which align their business models with the ever-evolving realities of the U.S. transformer market, legal or otherwise.

Key Suppliers of Power Transformers in the U.S.

Key suppliers of power transformers in the U.S. market are segmented into U.S.-based companies (with HQs in the U.S.) and international companies (which may have manufacturing facilities in the U.S. but are based elsewhere). U.S.-based companies include GE, VA Transformer, and Pennsylvania Transformer Technology. On the other hand, the international companies active in the U.S. power transformer market are Hitachi Energy, WEG, Hammond Power Solutions, Siemens Energy, Hyosung, Hyundai Power Transformers USA, and JSHP.

It is significant to note that manufacturing facilities of power transformers in the U.S. lack the production capacity to meet the demand for power transformers originating locally and rely on imports from foreign countries. According to Power Technology Research, an overwhelming majority of the demand for large power transformers, accounting for 82% in terms of units, is met through imports, predominantly from Mexico, Austria, and China. Similarly, 28% of the demand (in terms of units) for medium power transformers in the U.S. is met through imports (largely from Mexico, South Korea, and Austria) while 29% (in terms of units) of the demand for small power transformers is catered through imports (largely from Mexico, Canada, and South Korea).

Figure 1: Timeline for anti-dumping duties in the US.

Source: Power Technology Research

Such great dependence on imports from foreign countries, especially when it comes to large power transformers has pushed governments to take measures focused on promoting the localization of the U.S. power transformer market.

Government Measures to Promote Localization

AK Steel is the only producer of Grain Oriented Steel (GOES) in the U.S., which is produced at the facilities in Zanesville, Ohio and Butler, Pennsylvania. GOES is critical for the performance of transformers and accounts for around 25% of the transformer production costs. Despite being the sole producer in the local market of the U.S., AK Steel’s operations were not profitable, partially due to low-cost imports, and was on the brink of being shut down. If AK Steel went out of business, the U.S. would have lost the ability to produce transformers of any power handling capacity without imports from abroad. According to the report, ‘The Effect of Imports on Transformers and Transformer Components on the National Security’ by the Department of Commerce, the imports of GOES along with other steel products from foreign countries posed a national security threat which was addressed by imposing 25% tariffs on imports of steel products from most countries. This move resulted in a significant drop in the imports of GOES in 2019, which were down by 56% as compared to 2018. The demand was met locally by AK Steel.

On May 1st, 2020, an executive order (EO13920) was issued by President Trump that prohibited federal agencies and U.S. citizens from purchasing, transferring, or installing bulk power system (BPS) equipment in which any foreign country or foreign national had an interest. Under the executive order, the energy secretary was authorized to prepare a list of pre-qualified suppliers as well as identify equipment already installed by “prohibited suppliers” and devise a systematic replacement strategy. It is significant to note that, in the U.S., vendor approval is solely dependent on executive departments, despite the compliance with standards, certifications, and quality.

The executive order was, in some ways, counterproductive and a cause of concern for utilities. They started fearing delays in the delivery of orders as local power transformer manufacturing facilities lacked the capacity to meet the demand in the absence of foreign suppliers. Additionally, foreign market players feared losing their market share in one of the biggest power transformer markets in the world.

Therefore, on January 20th, 2021, President Joe Biden issued another executive order which, in part, suspended the executive order (EO 13920) issued by Trump for 90 days. On April 20th, 2021, the U.S. Department of Energy to maintain a stable policy environment repealed the December 2020 Prohibition Order.

Government measures in the U.S., focused on the localization of the power transformers market, have influenced market players that are acquiring manufacturing facilities and making investments to increase production capacity.

Expansion and Acquisition of Manufacturing Facilities in the U.S.

In recent years, the expansion of local manufacturing facilities and setting up of new facilities, both by local and international players, is being observed in the U.S. power transformers market. This is expected to reduce the reliance on imports in the coming years. WEG, Eaton, and Hyundai Power Transformers USA announced plans to increase production facility while Hyosung HICO (Korea) acquired Mitsubishi’s manufacturing facility and Virginia Transformer acquired the Portugal-based EFACEC. In 2020, WEG announced plans to expand the power transformer manufacturing facility in Missouri, with an investment of USD 10m. These expansion plans are in line with the company’s efforts to become a leader in the regional transformer market and increase their market share. WEG owns several manufacturing facilities in the world and has been an active participant of the transformer market in the U.S. since 1977.

In 2020, Eaton announced a USD 24m expansion plan of its Waukesha operations, under which it planned to expand its power systems division facility at 2300, Badger Drive. The work began in fall 2020 and was completed in 2021.

In 2018, Hyundai Power Transformers USA announced investment plans of USD 33m focused on increasing production at its manufacturing facility in Montgomery. As per its claims, the expansion project was expected to turn the production facility into a smart factory and boost the production of power transformers by more than 60%. The expanded production began in 2019.

Hyosung HICO (Korea) purchased Mitsubishi’s manufacturing facility in Memphis in 2019 and announced plans to invest USD 103m in the plant. This manufacturing facility was opened in 2020 and is the only plant in the U.S. with a capability to produce transformers up to ultra-high voltage range (765 kV).

Portugal-based EFACEC, which briefly manufactured large power transformers in the U.S., sold its plant in Rincon, Georgia to Virginia Transformer in 2014.

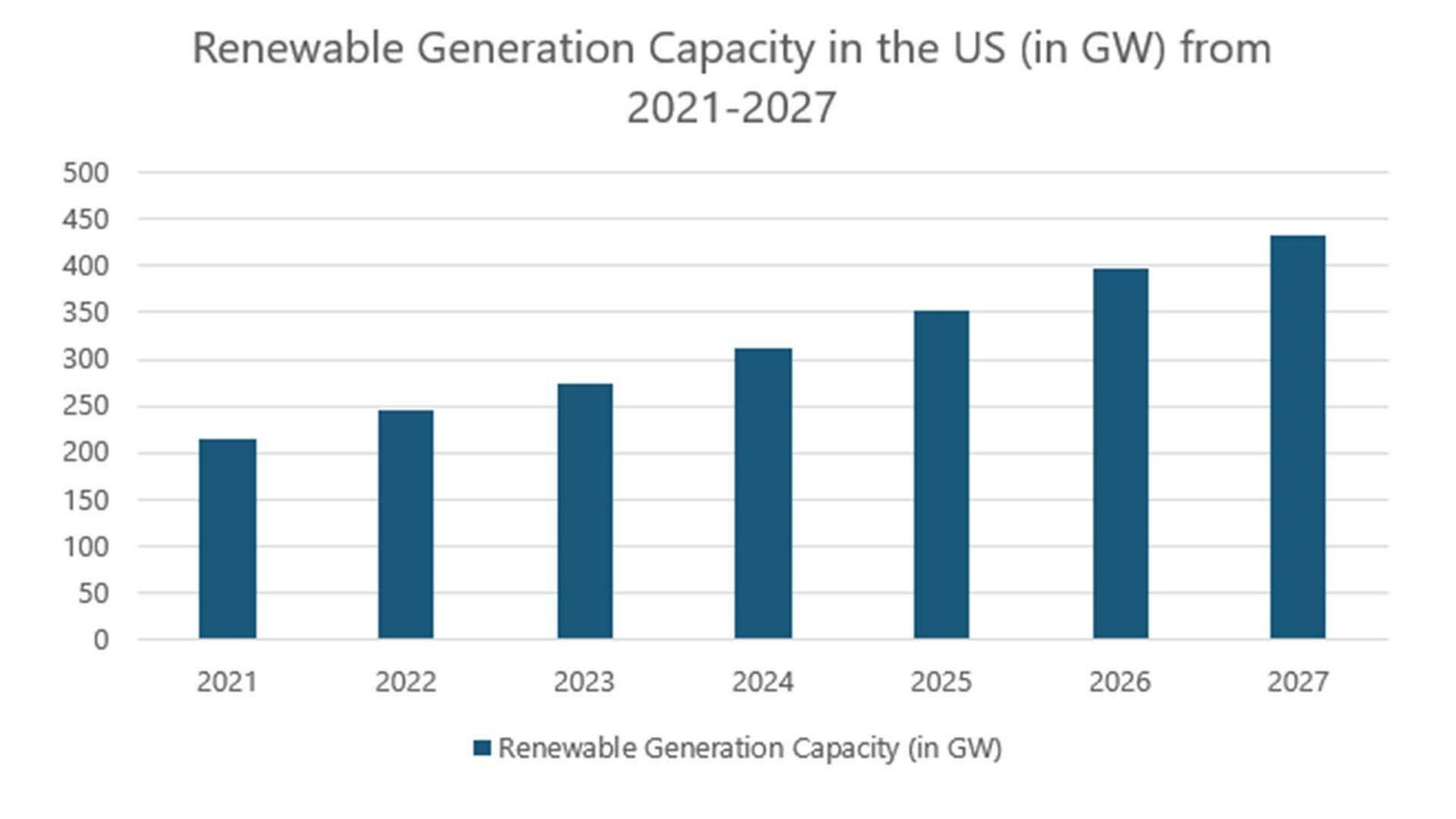

Figure 2: Renewable generation capacity in the U.S. from 2021-2027.

Source: Power Technology Research

Looking Ahead

The U.S. power transformer market is expected to grow, at a much faster rate, with a CAGR of 7.2% in terms of MVA capacity from 2021-2027. Key demand drivers in the power transformer market in the U.S. include the substantial increase in the power generation of the country, Biden’s Bipartisan Infrastructure Bill, and the aging U.S. transformer fleet.

Power generation capacity in the U.S. is expected to grow from approximately 1,160 GW in 2021 to 1,350 GW in 2027. A substantial increase in the renewable generation capacity is also expected and, as per the forecasts, the share of renewable generation capacity will increase from 18% in 2021 to 31% in 2027 with a CAGR of 12.4%. This massive growth in the power generation capacity would require proportionate growth in the transmission and distribution grid facilities as well, including power transformers.

The U.S. has an aging transformer fleet, with more than 70% power transformers older than 25 years and approximately 15% already exceeding the average life expectancy of 40 years. This is indicative of the fact that the transformer market of the country is primarily replacement driven.

On the other hand, Biden has passed a Bipartisan Infrastructure Bill in the U.S. which has set aside USD 65b for the upgradation of the power infrastructure, including the installation of thousands of miles of new and resilient transmission lines to facilitate the expansion of renewables in the country.

Lastly, local players should prepare to meet this growing demand for power transformers over the next few years, due to the factors explained earlier. If they are unable to do that, despite the strict policies and initiatives by the U.S. government to promote localization, utilities and companies will have no choice but to rely on imports to meet the demand. While a trend towards localization is being observed, it should be noted that this is not an overnight process owing to constraints related to available capacity and the capability of local suppliers.

Power Transformer Service Overview

The research presented in this article is from PTR's Power Transformer service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Power Transformer Market Research

Recent Insights

US Power Transformer Market Snapshot

US Power Transformer Market SnapshotMarket OverviewUSA to expand transmission systems by 60% by 2030 and may need to triple those systems by...

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

Europe Distribution Transformer Market: Navigating Changing Energy Dynamics

Europe's transition to clean energy is driving growth in the distribution transformer market. The growth is fueled by integrating renewable energy...