- Grid codes are getting stricter requiring consumers to maintain a higher power factor.

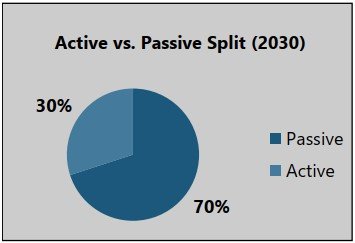

- In general, active power factor correction solutions market will grow faster than passive solutions in the next decade.

- The price of both active and passive solutions will decrease in the coming years everywhere, except for South America.

Power Factor Correction (PFC) refers to a series of methods which are employed to improve an electronic device’s power factor. This not only improves the power quality of the system, followed by the reduction of the load on the electrical distribution system, but also improves the energy efficiency and ensures a reduction in electricity costs. In addition, PFC also decreases the likelihood of grid instability and failure of electric equipment.

Hence, globally, grid codes are getting stricter, and are requiring that certain power factor be met by consumers, especially industrial, or face high penalties.

The power factor of a device can be poor because of displacement and/or distortion between the current and voltages waves.

- Displacement occurs when voltage and current waves of a circuit are out of phase mainly due to reactive elements in the circuit like capacitors and inductors.

- Distortion takes place when non-linear circuits for instance rectifiers alters the shape of sinusoidal wave.

Under passive PFC, the power factor is improved by filtering out harmonics using passive devices like inductors and capacitors, but these can only be used in low power applications. In active PFC, a switching converter, employing active devices such as thyristors, IGBTs, IGCTs, is used to modulate the distorted wave. The only harmonics present in the new signal are the ones at the switching frequencies which can easily be filtered out.

Figure 1: Regional market split in the LV PFC market in 2020.

Source: Power Technology Research.

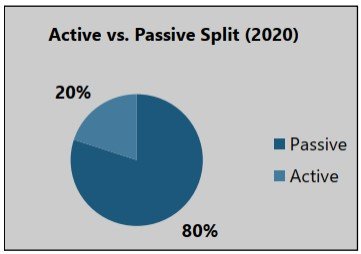

Figure 2: Active versus Passive split in the global market in 2020.

Source: Power Technology Research.

Figure 3: Active versus Passive split in the global market in 2030.

Source: Power Technology Research.

China

In China, active solutions will grow faster than the passive solutions and the preference is due to:

- Faster response relative to passive.

- Better performance as compared to passive.

- Lower price than before.

- Smaller size and more effective for light load.

- No chance for overcompensation.

- High frequency switch mode PFC will reduce the size of the bulky capacitor and inductor, resulting in cost reduction and high-power density of the power system.

Another reason for the faster growth of active solutions in the market is because prices are decreasing at a faster pace than for passive solutions. Also, more efficient solutions will be available in the market that will deliver double the power density with same price, resulting in lower price/kVAR.

It is significant to note that in the next decade, the Low Voltage (LV) PFC market in China will remain the same due to efficient greenfield solutions. In China, a Power Factor (PF) of at least 0.98 needs to be maintained, or utilities will impose penalties so the excess power will not reduce the pressure on utilities.

India

In India, as grid codes become stricter the PFC market is growing. Generally, value-based clients in India prefer traditional active PFC panels but moving forward, many organizations are showing interest in SVG, Active filer, Hybrid and Real Time Power Factor Correction (RTPFC) on the low voltage side. As far as technological advancements are concerned, it is important to note the evolution of hybrid systems, where active and passive systems are operating in unison.

The LV PFC market will grow since the tariff structure of the country is moving towards kVAh billing. Even though active solutions will grow faster relative to passive, the PFC market will still be more inclined towards passive solutions. Growth in the active PFC market is being hampered by the following factors:

- The high cost of equipment.

- High maintenance cost.

- Providers and integrators have less experience in active PFC.

Europe

In Europe, the LV PFC market will grow concurrently with the EV charging infrastructure which is, in turn, driven by the growth in EVs. The active fleet of passenger EVs in Europe is expected to grow from 3.5 million to 22 million by 2026.

The largest growth in PFC will come from the process industry as it automates and leads to greater electrical disturbances. Additionally, there is huge growth in robotics, especially in the automotive and manufacturing industry, and this tends to create a lot of harmonics.

As far as pricing is concerned in the region, there will be differences as active solutions are more expensive purely due to speed and reliability. However, if the overall lifecycle costs are considered, the active solutions will come out as the superior solution in most cases.

USA

In the U.S., the large number of EVs with high power fast charging stations will drive the LV PFC market. It is expected that in 10 years, internal combustion powered vehicles will be less than 25% of the new purchases. The LV PFC requirement in the oil and gas sector will decline whereas the requirement in the mining industry will increase as it moves towards automation. Data centers will also continue to generate a demand for LV PFC solutions.

The active PFC market is set to grow faster, compared to the passive market, due to higher efficiency requirements and the overall need for reducing the carbon footprint. Active solutions that provide PFC and harmonics reduction will continue to become more widespread.

Looking Ahead

Generally, prices will decrease for both active and passive PFC solutions, but active solutions will decline at a much faster pace everywhere except in South America. There, prices will increase mostly because active PFC solutions are imported into the region from other countries.

New power factor regulations and grid codes will continue to be the primary drivers for growth of the PFC global market. Other factors will include an increase in EVs, manufacturing, automation, buildings, and datacenters. However, it is important to note that although active solutions market will significantly gain higher share in the next 10 years, the passive PFC market is not going to vanish.

More about our Services

Recent Insights

Medium Voltage Switchgear Supply and Demand

In the article, the authors, Saqib Saeed, CPO & Abdullah Kamran, Analyst at PTR Inc. elucidates that medium voltage (MV) switchgear, operating between 1 kV and 42 kV, is essential for controlling, protecting, and isolating electrical equipment. Valued at...

Europe’s Distribution Transformer Market: Adapting to the Impact of Energy Transition

The article authored b Eyman Ikhlaq, Analyst at PTR Inc. highlights that the European distribution transformer market is poised for substantial growth, driven by Europe's commitment to decarbonization, the integration of renewable energy sources, and the increasing...

Europe’s Renewable Revolution

Azhar Fayaz, Senior Analyst at PTR, emphasizes in his article that global initiatives like COP 28 have heightened the urgency for decarbonizing energy systems, positioning Europe at the forefront of the renewable energy transition. The continent's ambitious plan aims...

Ensuring Grid Reliability: Integrating Digital HV Switchgear and Artificial Intelligence

The article by Saifa Khalid, Senior Analyst, and Saad Habib, Analyst at PTR Inc., highlights the evolution of the U.S. high-voltage (HV) switchgear market, driven by advancements in smart grid technology, renewable energy deployment, and the increasing adoption of...