• The share of distributed energy resources is growing at a rapid pace as countries push hard to meet their clean energy and energy efficiency targets.

• Australian Energy Market Operator has shown strong inclination towards the development of the market for virtual power plants with a plan to include VPP as a major shareholder in the energy mix of the country.

• But there are still challenges that hinder the deployment of virtual power plants for instance regulations that deal with the enrollment and tracking of VPPs by NEMO and energy companies do not exist.

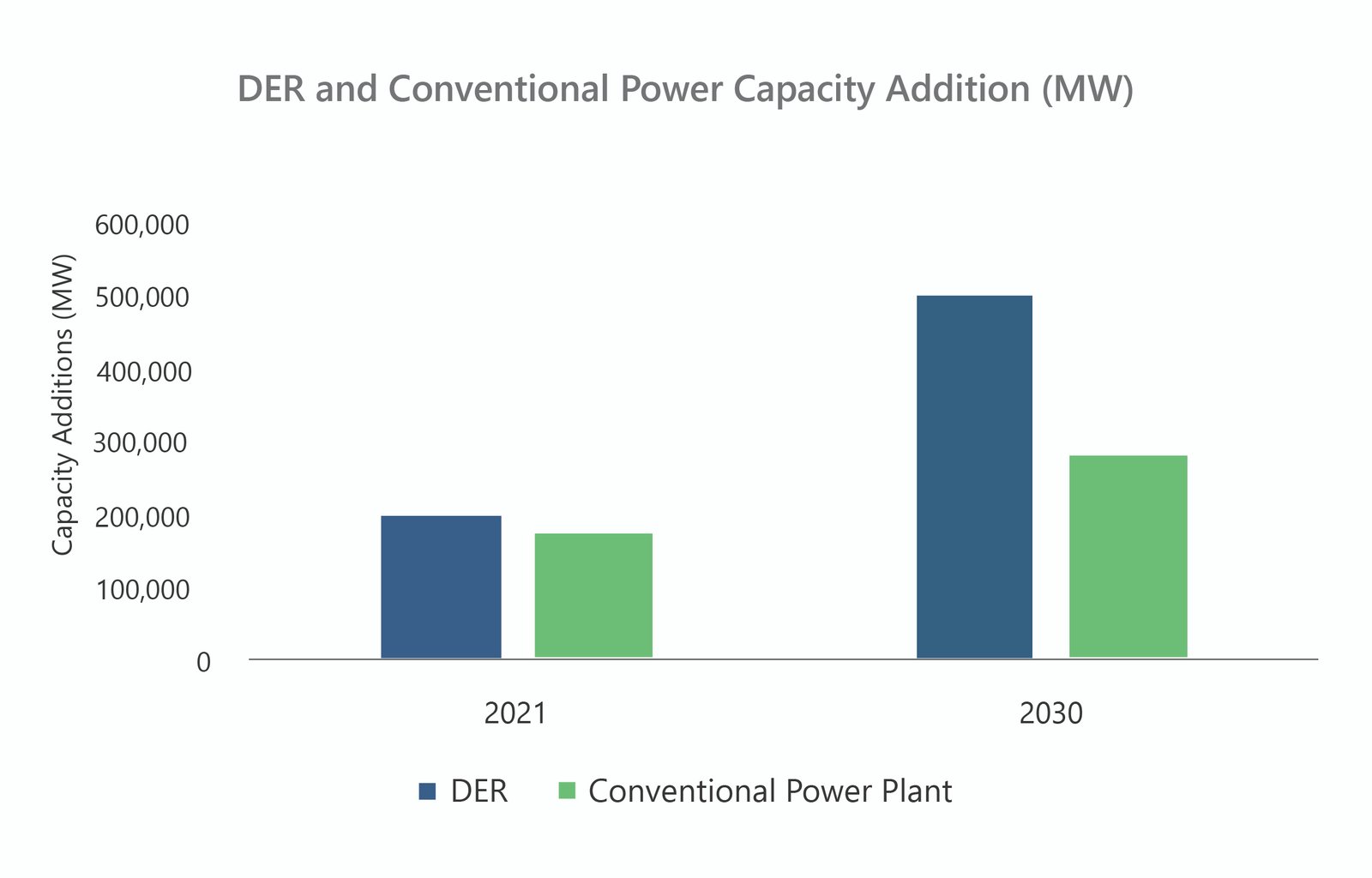

Globally the share of distributed energy resources is growing at a rapid pace as countries push hard to meet their clean energy and energy efficiency targets set to combat climate change. As per the estimates of PTR, cumulative annual electric power injecting capability of distributed energy resources for instance utility scale renewables, grid edge devices including rooftop PV solar, battery storage units, electric vehicles, combined heat and power units, and controllable smart home appliances exceeded power generation capacity from conventional power plants (thermal and nuclear) all over the world for the first time in 2021.

According to PTR, in 2021 the DER electric power generation capacity additions accounted for around 200 GW whereas the conventional power plants accounted for only 170 GW. Keeping in mind the global renewable energy expansion targets as well as the electrification of the transport sector, it is expected that the global DER electric power generation capacity will reach around 500 GW by 2030.

Figure 1: DER and conventional power generation capacity addition.

Source: PTR Inc.

The increasing difference between the DER power generation capacity and generation capacity from conventional power plants in recent years has created room for the deployment of innovative technological solutions for instance AI powered grid flexibility services especially virtual power plants. Virtual power plant is a ‘system of systems that relies on an advanced software platform, based on Artificial Intelligence (AI) driven predictive models, that can optimally orchestrate the dispatch of distributed energy resources such as wind farms, solar parks, storage units, and flexible controllable loads.’

Current Landscape of VPP in Australia

Australian Energy Market Operator has shown strong inclination towards the development of the market for virtual power plants with a plan to include VPP as a major shareholder in the energy mix of the country. In 2021, VPP Demonstration Project was initiated by AEMO under which 700 MW of VPP capacity was to be installed till 2022. But it is significant to note Australia lagged by a fair margin as it managed to install only 31 MW of the VPP capacity. The majority of the capacity was installed in South Australia which accounted for 28 MW of VPP capacity. These projects demonstrated that VPP capacity can be deployed for frequency control and ancillary services (FCAS) which accounts for 3% of the contingency FCAS market.

In Southern Australia, SA Power Networks’ VPP project steered by Tesla aggregated approximately 50,000 residential batteries that enabled optimal management of renewable energy resources. Similarly, Zeppelin Bend Pty Ltd, which operates in the regions of New South Wales and Queensland including key utilities, for instance Ausgrid, Essential and Endeavour Energy enabled network operators to cater to the issue of hosting capacity.

Australia a Potential Market for VPP

PTR believes that Australia is a potential market for the deployment virtual power plants due to high energy consumption per capita and Electricity Network Transformation Roadmap.

Energy consumption per capita

Energy consumption per capita in Australia is 25% higher than the average of the member countries of the Organization for Economic Cooperation and Development (OECD), accounting for 8,930 kWh. The higher energy per capita consumption in turn creates opportunity for flexible loads in the service areas of utilities to serve as assets for the grid through VPP.

Electricity Network Transformation Roadmap

Electricity market of Australia is becoming increasingly decentralized as the share of generation from renewable energy resources is increasing. It is expected that the share of generation from renewable energy will account for 45% of the country’s total generation by 2050 up from 12% in 2021. Furthermore, it is significant to note that majority of the renewable generation target will be achieved through installation of rooftop solar and residential battery energy storage units which is expected to account for 124 GW and 126 GWh by 2050.That is the reason Australia stands out as a potential market for virtual power plants globally.

Figure 2: Current and future landscape of solar PV and residential battery storage in Australia.

Source: PTR Inc.

Outlook of VPP in Australia

With the ongoing massive deployment of rooftop solar and residential battery storage across all states in Australia, the country is well placed to become one of the global leaders in terms of VPP deployment in the future. It is estimated that Australia will have around 9 GW of VPP capacity by 2030. The majority of the VPP capacity in the country will be provided by the states of Victoria and Queensland. Victoria’s energy company aims to deploy VPP capacity of 2 GW through residential storage and solar rooftop in the next four years.

Furthermore, Transgrid and Ergon Energy Networks are also moving to build VPP aggregation platforms in Southern Australia and Queensland, respectively.

Figure 3: Projection of VPP capacity in Australia (2021-2030), and identification of key renewable energy sources contributing in VPP.

Source: PTR Inc.

Looking Ahead

Australia is a potential market for the deployment of VPP capacity to deal with the issues linked with grid congestion and to increase grid flexibility. Australia’s high energy consumption per capita (even higher than certain European countries) and deployment of renewables under Electricity Network Transformation Roadmap makes it better placed to widely adopt virtual power plants. But there are still challenges that hinder the deployment of virtual power plants for instance regulations that deal with the enrollment and tracking of VPPs by NEMO and energy companies do not exist. Furthermore, the present business model is failing to attract battery owners as there is no set framework that deals with the monetization for that particular segment in the VPP programs. PTR believes in order to pave way for widespread adoption of VPP, Australia requires to remove the aforementioned bottlenecks.

AI in Power Grid Service Overview

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

AI in Power Grid Market Research

Recent Insights

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

COP through the Ages

This infographic takes a cursory glance at the most significant achievements of the Conference of Parties through the years and offers a chance for...

Eyes on the Automobile Sector: Companies with Near-Term Goals of 1.5-degrees

In the wake of burgeoning climate threats, it is becoming ever-important to keep a track of how companies are making progress. Using data from...