• Germany is one of the leading countries in Europe in terms of adoption of renewable energy and has made significant effort over the years in order to move towards a more sustainable energy system.

• Over the next 10 years, four transmission system operators including Amprion, 50Hertz, TenneT, and TransnetBW have assessed that in order to ensure grid stability during the energy transition, Germany will require 70 STATCOMs.

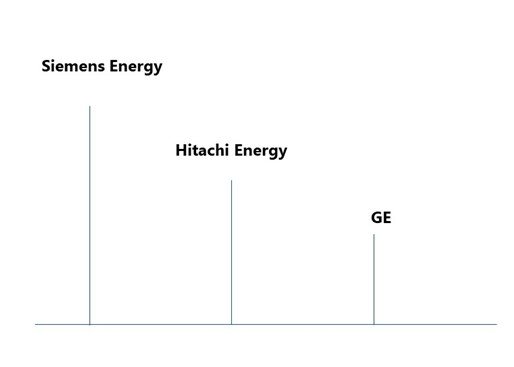

• There are a number of FACTS OEMs that are currently active in the German FACTS market but as far as utility scale FACTS market is concerned, Siemens, Hitachi Energy and GE lead it.

Germany is one of the leading countries in Europe in terms of adoption of renewable energy and has made significant effort over the years in order to move towards a more sustainable energy system. Energiewende which is energy transition policy of Germany, plans to increase the share of renewable energy in the energy mix of the country and phase out generation from conventional resources especially nuclear power. Recently in April 2023, Germany has shutdown the last nuclear power plant in Munich and has set aggressive future targets for renewable generation in the country.

As per the estimates of PTR, it is expected that the cumulative renewable generation capacity (including solar and wind generation capacity only) will increase from around 85 GW in 2022 to 144 GW in 2030. With renewables, solar generation capacity is forecasted to increase from 18 GW in 2022 to 44 GW in 2030 (more than double) whereas wind generation capacity is forecasted to increase from 67 GW in 2022 to 100 GW in 2030.

A significant surge in the deployment of renewable energy followed by phase out of conventional generation leads to grid stability and power quality issues which are dealt with installation of flexible AC transmission system devices.

Figure 1: Outlook of renewable energy in Germany.

Source: PTR Inc

Challenges and Innovations in Adapting Power Systems to Renewable Energy

As mentioned earlier, widespread deployment of renewable energy and phase out of conventional generation (in case of Germany it is nuclear generation) leads to grid stability and power quality issues. In Germany to deal with these issues, FACTS devices including Static Synchronous Compensators (STATCOMs), and Static VAR Compensators (SVCs) have been installed.

Renewable Energy Penetration

Due to the intermittent nature of generation from renewable energy resources including wind and solar, grid stability issues are caused. The inherent nature of renewable generation causes voltage and frequency fluctuations which when deviating from a specified range stirs instability and even leads to grid blackouts.

Closure of Conventional Power Plants

Germany has recently shut down last nuclear power plant in the country and is expected to further reduce the share of conventional generation as it moves towards its long-term clean energy goals. One of the challenges that arise from the shutdown of conventional generation or from significant reduction in its share from the generation mix is that it shrinks the supply of reactive power which in turn leads to voltage stability issues. Additionally, conventional power plants provide significant inertia to the grid due to presence of rotating mass in conventional generators which provides inertial response.

Current and Historical Landscape of FACTS in Germany

Germany has emerged as a major player in the global FACTS market in recent years. As per the estimates of PTR, Germany’s commitment to renewable energy, grid modernization requirements, and increasing electrification has led to growth in the local FACTS market. Over the next 10 years, four transmission system operators including Amprion, 50Hertz, TenneT, and TransnetBW have assessed that in order to ensure grid stability during the energy transition, Germany will require 70 STATCOMs.

It is noteworthy that in the early days, Germany largely deployed Static VAR Compensators (SVCs) and Thyristor Controlled Series Capacitors (TCSCs) to improve the performance of transmission system. However, in recent years, Germany’s TSOs have moved towards deploying modern FACTS devices especially STATCOMs as they provide quicker response and have smaller footprint.

Figure 2: Technology split of FACTS devices in Germany from 2017 to 2022.

Source: PTR Inc

Key players in FACTS market

There are a number of FACTS OEMs that are currently active in the German FACTS market but as far as utility scale FACTS market is concerned, Siemens, Hitachi Energy and GE lead it. If we look at the orders from 2017 onwards till 2022, it is evident that majority of orders by German TSOs were won by Siemens Energy which was followed by Hitachi Energy and GE.

In recent years PTR has observed increased Chinese participation in the European market and it is expected that Chinese will soon have a share in Germany’s FACTS market.

Figure 3: Ranking of players in the FACTS market of Germany.

Source: PTR Inc

Looking Forward

German Transmission System Operators (TSOs) are increasingly embracing the implementation of Gen 2 STATCOMs or E-STATCOMs. This innovative technology, referred to as the Static Synchronous Compensator with Energy Storage, holds tremendous potential in swiftly providing reactive power support and effectively smoothing power fluctuations.

In addition to SVCs and STATCOMs, another FACTS device known as synchronous condensers is gaining traction in the German power grids. TenneT has awarded two projects to Siemens Energy which will incorporate Synchronous Condensers and are expected to be commissioned by 2025. Anticipated developments suggest a notable rise in the penetration of Synchronous Condensers within the German market in the coming years.

While the utility sector has predominantly utilized STATCOMs in recent times, the upcoming years will witness a significant shift. With the growing prominence of renewable energy generation, a majority of future STATCOM installations are expected to cater specifically to renewable energy applications, surpassing other sectors. However, most of the STATCOMs will be deployed by utilities to facilitate the injection of renewables in their network.

Flexible AC Transmission Service Overview

The research presented in this article is from PTR's Flexible AC Transmission service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Flexible AC Transmission Systems Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

Renewable Revolution Catalyst for the EU’s FACTS Market Growth

The Russia-Ukraine war has served as a wake-up call for the EU member states to decrease their dependence on Russian energy supplies. Due to the...