The effects of Covid’19 have been felt globally. According to the June 2020 Global Economic Prospects report by the World Bank, the global economy (in terms of GDP) is expected to contract by 5.2% in 2020. Advanced economies are expected to shrink by 7%, and developing economies are expected to contract by 2.5%. This is the weakest economic forecast for these countries in the last 60 years.

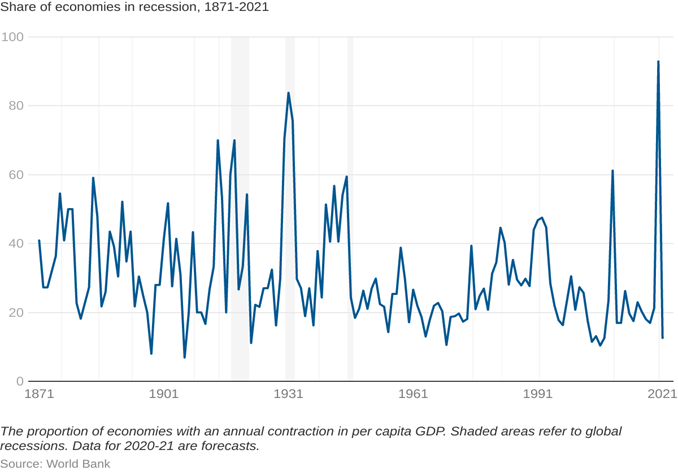

The chart below shows the proportion of economies in contraction per capita GDP.

Recession across the globe

East Asia will grow by a low 0.5%, while South Asia will contract by 2.7%, and the Middle East by 4.7%. This will result in a rise in poverty resulting from lost employment, mounting debts and generally tight financial conditions.

Economic effects of Covid-19

Chief Financial Economist at Jefferies, Aneta Markowska, underscored the importance of the rise in consumer spending in May in the United States. This does not mean, however, that one should expect a V shaped recovery: fiscal support was withdrawn in the US before the economy could fully recover, and there is a growing possibility of multiple waves of Covid’19. Activity in the Sun Belt States peaked in mid-June, and has steadily contracted since then, leading researchers to believe in a W- shaped recovery. For states in the northeast that opened late, the recovery is still V shaped, and therefore the overall national recovery can be said to be flattening. The White House is now considering a second stimulus check in order to stimulate consumer activity. Economy is expected to contract for the rest of the year, and Markowska predicts that it will take about two years for economy to recover from Covid-19 completely.

According to a report by the European Commission, while Covid-19 has caused unprecedented shock to the economy of the European Union, the impact is varying across various regions.

The impact on the GDP is, on average, -6.44%, and dropping employment rates are highly correlated with the drop in GDP. The regions that rely on tourism are the worst hit by the pandemic. The disposable income of households across the US is expected to drop by about 5.9%.

Nevertheless, policy interventions, as through the European Recovery Package could absorb most of the economic shock, especially for countries that have financial constraints. The recovery package is designed to help countries recover from this pandemic and prepare for the future.

According to Chief European Financial Economist David Owen, recovery is highly unpredictable. Both the national governments and the Central Banks are trying to distribute the burden fairly amongst each other.

The stock markets

On Thursday, in the Statement on Longer-Run Goals and Monetary Policy Strategy, Federal Reserve’s Chair, Jerome Powell, indicated an overhauled strategy, which should keep the interest rates lower for a long period of time. This resulted in the yields on long term bonds rising, and the dollar strengthening against its peers. Powell also indicated that the Fed may continue to pump money into the economy, even if the rate of inflation rises above its target.

On the same day, S&P 500 continued its record climb, and has recovered spectacularly after the Fed helped erase its pandemic loses. Financial and real estate sectors seem to benefit the greatest from this rise, with banks benefiting from higher yields. It is important to note for the real economy that the that wages may be allowed to increase, which would help low income households.

This was the composition of the S&P 500 over the last 20 years, up until the pandemic:

This was the composition of the S&P 500 over the last 20 years, up until the pandemic:

S&P composition from 2001-2019

This, however, changed during the pandemic. Now, the composition consists of mostly technology stocks:

S&P 500 composition, 2020

S&P 500 composition from 2001 – 2019. Source: Forbes

S&P 500 composition 2020. Source: Forbes

Even during the dot com boom, tech stocks did not dominate the markets in this way. However, the boom of the tech stocks will not last forever, and investors are now looking for other options.

Energy and industrial companies tend to do better when the markets are emerging from downturns, and now that markets across the globe are opening, all eyes are on these sectors. Such stocks tend to gain value during times of inflation, which is expected as the global economy strengthens. This is especially true for Europe, since it has a bigger share of energy and industrial stocks than USA.

According to David Kelly, chief global strategist, J.P. Morgan Asset Management: “When we move from surviving the pandemic to thriving in the rebound, European stocks ought to do better”.

This has been reiterated by BlackRock in a research note published recently. They also expect cyclical European stocks (such as energy and market sector stocks) to gain value.

It is evident that renewable energy is growing at an exponential rate, and the International Energy Agency (IEA) makes a conservative prediction of renewable energy generating capacity growing by 50% till 2024.

Another indicator of the performance of the energy sector is the S&P 500 Energy. While the yearly return has been a dismal -34.75%, these stocks are gaining value everyday, even as some countries are going into smart lockdowns again.

Below is the chart for the performance of S&P 500 energy stocks in the past six months.

Performance of the S&P 500 energy stocks. Source: www. spglobal.com

Looking at the market trends, some of the top performing alternative energy stocks are:

- Renewable Energy Group Inc: Company gives a strong first quarter performance despite the pandemic.

- Canadian Solar Inc: The company has recently agreed to sell power to Amazon and will help the ecommerce giant achieve its goals.

- Jinko Solar Holding Ltd: is a Chinese energy company that manufactures solar wafers, cells and modules.

The table below shows the price to earnings ratios of these three companies.

|

Best Value Alternative Energy Stocks |

|||

|

|

Price ($) |

Market Cap ($B) |

12-Month Trailing P/E Ratio |

|

Renewable Energy Group Inc. (REGI) |

31.84 |

1.2 |

2.7 |

|

Canadian Solar Inc. (CSIQ) |

19.23 |

1.1 |

3.9 |

|

JinkoSolar Holding Co. Ltd. (JKS) |

18.05 |

0.8 |

9.3 |

Source: Ycharts and Investopedia

More on our Private Equity Offering:

Contact:

Advisory & Client Relations (Private Equity)

+1-408-400 3214