The global economy witnessed an unprecedented decline owing to COVID-19 and associated lockdowns in the year 2020. The most widespread lockdown was in the month of April when almost the whole world came to a complete halt. Following lockdown in April, global economies started to reopen in June/July and showed growth but there will be a slowdown in Q4 owing to lockdowns in response to second wave of the pandemic.

In view of the underlying situation, the International Monetary Fund (IMF), the World Bank and the International Energy Agency (IEA)have revised their forecasts regarding global economy and application verticals.

New Analysis: Impact of Covid-19 on Power Grid Equipment Market

The IMF has indicated that the global GDP growth will fall by -4.4 % where the World Bank forecasts a contraction of the global economy by 5.2 %, which is biggest since World War II (1939-1945).

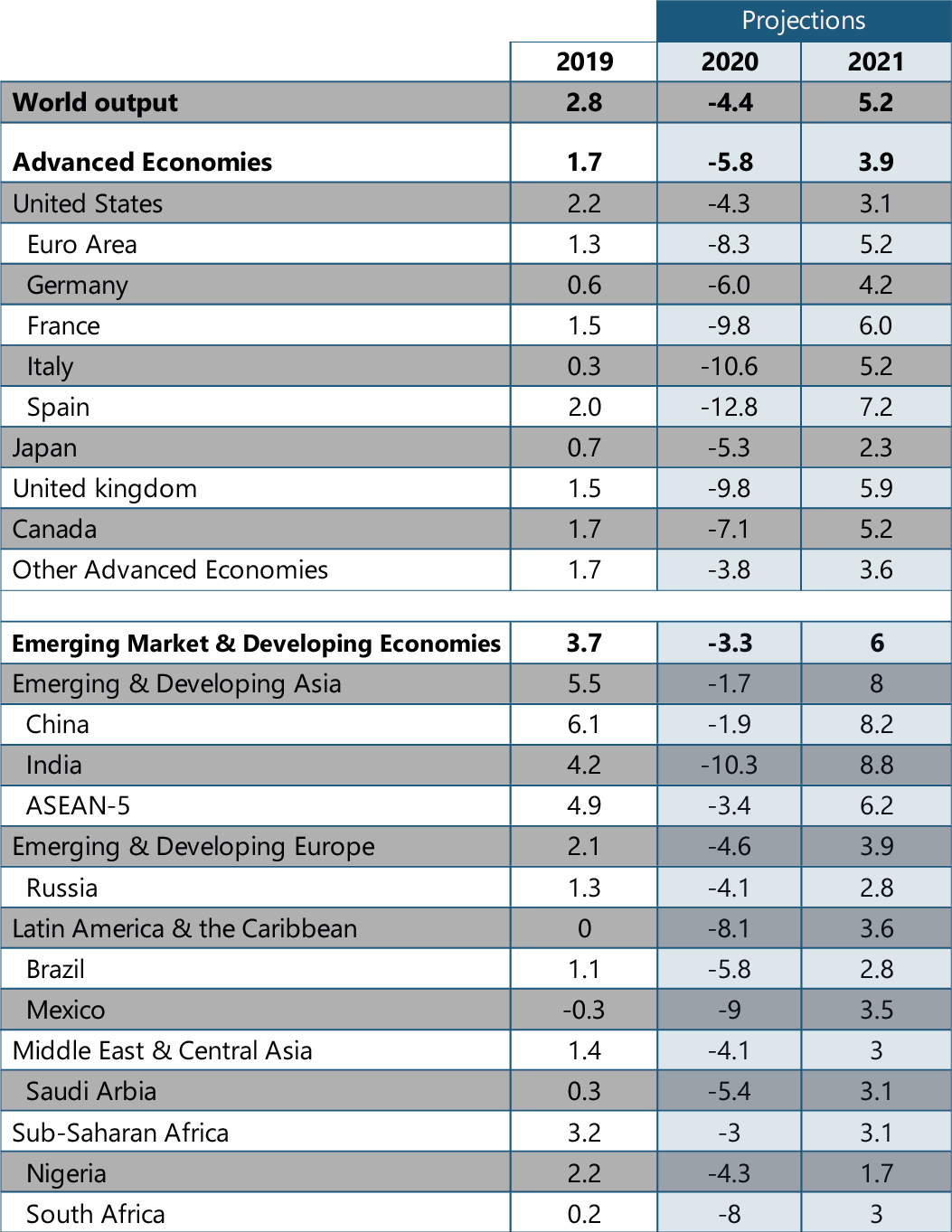

Further estimates by IMF shows advanced economies are projected to contract by 5.8 percent where emerging market and developing economies will show a GDP growth of -3.3 percent in 2020. In 2021, Global Economy is expected to rebound and grow at 5.2 percent followed by relative slow growth in 2022.

Among advanced economies the highest contraction is observed in Spain, Italy, France and UK where India among the emerging and developing economies observed highest contraction. The details of which are shown in the figure below.

Figure 1: Data: IMF economic projections of advanced and developing economies.

However, the economic outlook of China looks promising in all future scenarios and it is expected to grow 10 percent over the period 2020-2021 (1.9 percent growth in 2020 and 8.2 percent growth in 2021).

The global economic crash was reflected in application verticals as well, for instance generation, transmission, distribution and Industry.

Investments in the Power Sector are expected to decline by 10 percent in response to COVID-19 in 2020. The solar sector, which was expected to witness unprecedented growth because of decline in the fossil fuel industry triggered by COVID-19, was the worst hit sector. The IEA states that investments in solar are expected to decline by 21. This is compared to a 11 percent decline in the investments in conventional coal.”

Wind on the other hand witnessed the least amount of decline in in investments (-2 %). Electricity demand, although decreased, didn’t entirely collapse. Residential electricity demand witnessed an increase where industrial demand was severely impacted by COVID as manufacturing and production centers were shutdown.

Wholesale electricity prices are low along with decrease in LNG and CO2 prices. This may place pressure on the generation sector but in certain markets this added pressure will be offset by reduced fossil fuel prices.

The Upstream Oil and Gas (O&G) sector was severely impacted with investments in the sector falling from around 480 billion USD in 2019 to 320 billion USD in 2020. The industry had to respond to the sharp decline in oil demand owing to lockdowns associated with the pandemic which brought the global economy to a complete halt in April, 2020.

In such circumstances, reduction in the price of fuel acts as a stabilizing mechanism but consumers couldn’t take advantage of low fuel prices because of mobility restrictions. The crisis forced production to a complete halt because storage capacities in countries were saturated and even led to negative prices at times.

Natural Gas consumption and prices consequently declined (prices were already low before crisis) but this sector was not as severely impacted as O&G. Markets oversupplied with gas are also showing signs of strain owing to saturated storage capacity which may worsen at the end of the year. Where crisis in the O&G sector has also led to reduction in demand of chemicals.

In the Automobile Sector, the lockdown in China and the associated shutdown of industries manufacturing automobile parts have led to large scale manufacturing interruptions across Europe. With the closure of assembly plants in United States future pressure was added to the already troubled global automotive supply base. The most recent quarter has shown a degree of rebound from the bottom.

This has placed companies at a risk of bankruptcy which may require governments and banks to intervene. Companies may also divert capital to carry out operations.

When it comes to the Mining and Metals sector, it was severely impacted by isolated outbreaks at sites and government mandated lockdowns for instance in Peru and South Africa. Demand of copper, iron ore and zinc stayed on the lower side where gold which usually gains from higher levels of certainty was an exception to this trend.

Despite the reopening of China’s manufacturing plants demand for aforementioned commodities (iron ore, zinc and copper) is expected to stay on the lower side for at least a few quarters. Energy constitutes 20-25 percent of operating costs of mining sector and reduction in the energy prices will provide much needed breather to the mining industry.

Moving Forward:

The drug maker Pfizer on 9th November announced the early results of the trials of the Covid-19 vaccine which has more than 90 percent efficacy. Pfizer vaccine is expected to have logistic problems as it has to be stored 93 degrees under Fahrenheit to maintain its efficacy further complicating its global distribution. Other companies in U.S. are close to the announcement of vaccine and this has met globally with felicitations. There will be a limited supply initially, but supply will increase in upcoming weeks and months.

Investor confidence globally will see a sudden spike as we have seen in the U.S. where the stock market rose with the announcement of the vaccine success. Here we need to be clear that not all stocks will see a rise for instance stay at home stocks declined following announcement. Although the damage to the economy has already been done and it will take time to recover but one thing that we can be sure of that 2021 will not be a repetition of 2020.

With more than 90 percent success in the Moderna’s Covid-19 vaccine the investor confidence will see sudden spike as we have seen in US the stock markets climbed soon after Pfizer announced its vaccine success. We need to be clear that not all stocks will see a rise for instance it was observed that stay at home stocks declined following the announcement of Pfizer vaccine. There will be a limited supply initially, but supply will increase in upcoming weeks and months. It is now a question of logistics and supply chain than anything else. Although the economic damage has been already done but the vaccine will smooth the recovery process and hopefully world will not see the repeat telecast of 2020 anytime soon.

Recent Insights

Medium Voltage Switchgear Supply and Demand

In the article, the authors, Saqib Saeed, CPO & Abdullah Kamran, Analyst at PTR Inc. elucidates that medium voltage (MV) switchgear, operating between 1 kV and 42 kV, is essential for controlling, protecting, and isolating electrical equipment. Valued at...

Europe’s Distribution Transformer Market: Adapting to the Impact of Energy Transition

The article authored b Eyman Ikhlaq, Analyst at PTR Inc. highlights that the European distribution transformer market is poised for substantial growth, driven by Europe's commitment to decarbonization, the integration of renewable energy sources, and the increasing...

Europe’s Renewable Revolution

Azhar Fayaz, Senior Analyst at PTR, emphasizes in his article that global initiatives like COP 28 have heightened the urgency for decarbonizing energy systems, positioning Europe at the forefront of the renewable energy transition. The continent's ambitious plan aims...

Ensuring Grid Reliability: Integrating Digital HV Switchgear and Artificial Intelligence

The article by Saifa Khalid, Senior Analyst, and Saad Habib, Analyst at PTR Inc., highlights the evolution of the U.S. high-voltage (HV) switchgear market, driven by advancements in smart grid technology, renewable energy deployment, and the increasing adoption of...