Around 90,000 marine vessels carry out over 90% of the global trade through oceans. Ships, like all fossil fuel powered modes of transportation, emit carbon dioxide and, therefore, contribute considerably towards global emissions and climate change. More than 3% of the carbon dioxide emissions worldwide are caused by the shipping industry, which continues to grow rapidly to date [1]. If the global shipping industry were considered a country, it would be the sixth largest contributor of greenhouse gas emissions. Only the U.S., China, Russia, India, and Japan emit more CO2 than the entire global maritime fleet [1].

With regards to the European Union, 77% of the external trade and 35% of all the trade by value between EU members states is carried out by sea, rendering maritime transport a key component of the international supply chain. Despite a drop in shipping activity in 2020 due to Covid-19, the sector is expected to grow strongly over the coming decades, fueled by rising demand for primary resources and container shipping.

This led the European Environment Agency and the European Maritime Safety Agency to publish the European Maritime Transport Environment Report in 2021 which, in essence, was the first comprehensive health check of the sector. The report indicated that ships emit 13.5% of the all-greenhouse gas emissions from transport in the EU, while emissions from road transport and aviation accounted for 71% and 14.4% respectively. In addition to CO2 emissions, ships that call in European ports contributed around 1.63 million tons of SO2 emissions in 2019. [2]

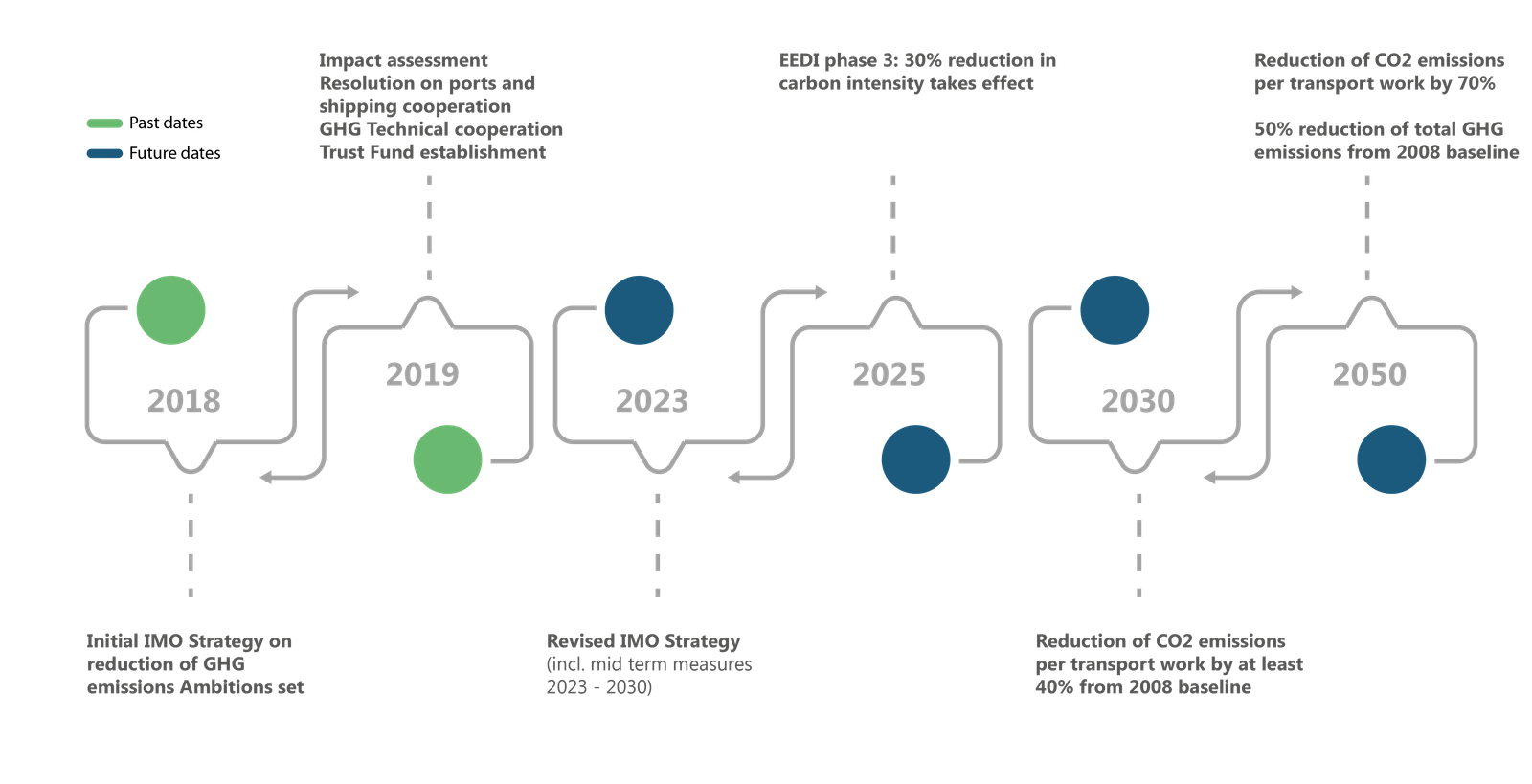

Figure 1: IMO timetable to reduce GHG emissions.

Source: IMO

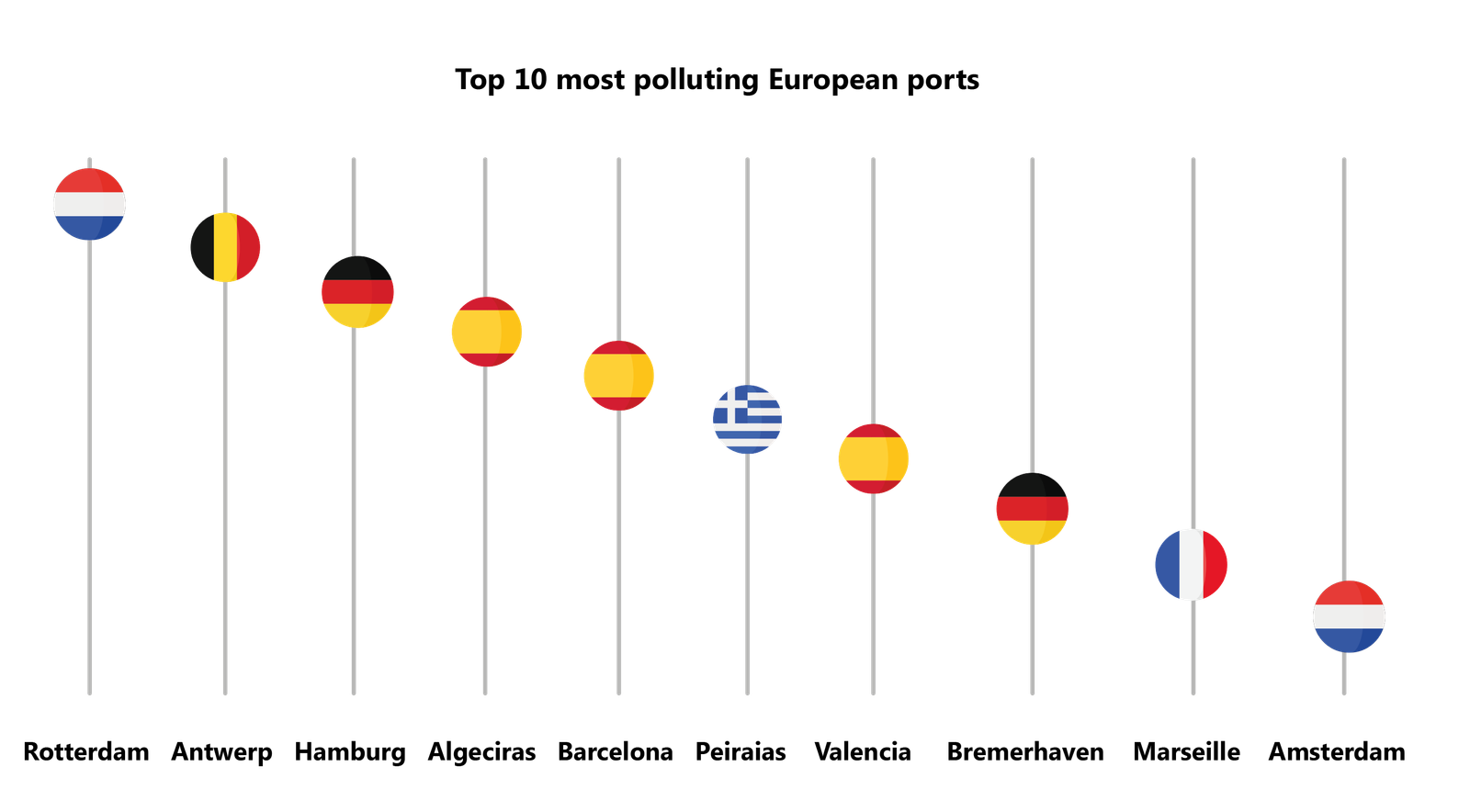

Figure 2: Top 10 most polluting European ports.

Source: Estimates by T&E based on the EU shipping MRV and Eurostat (2018).

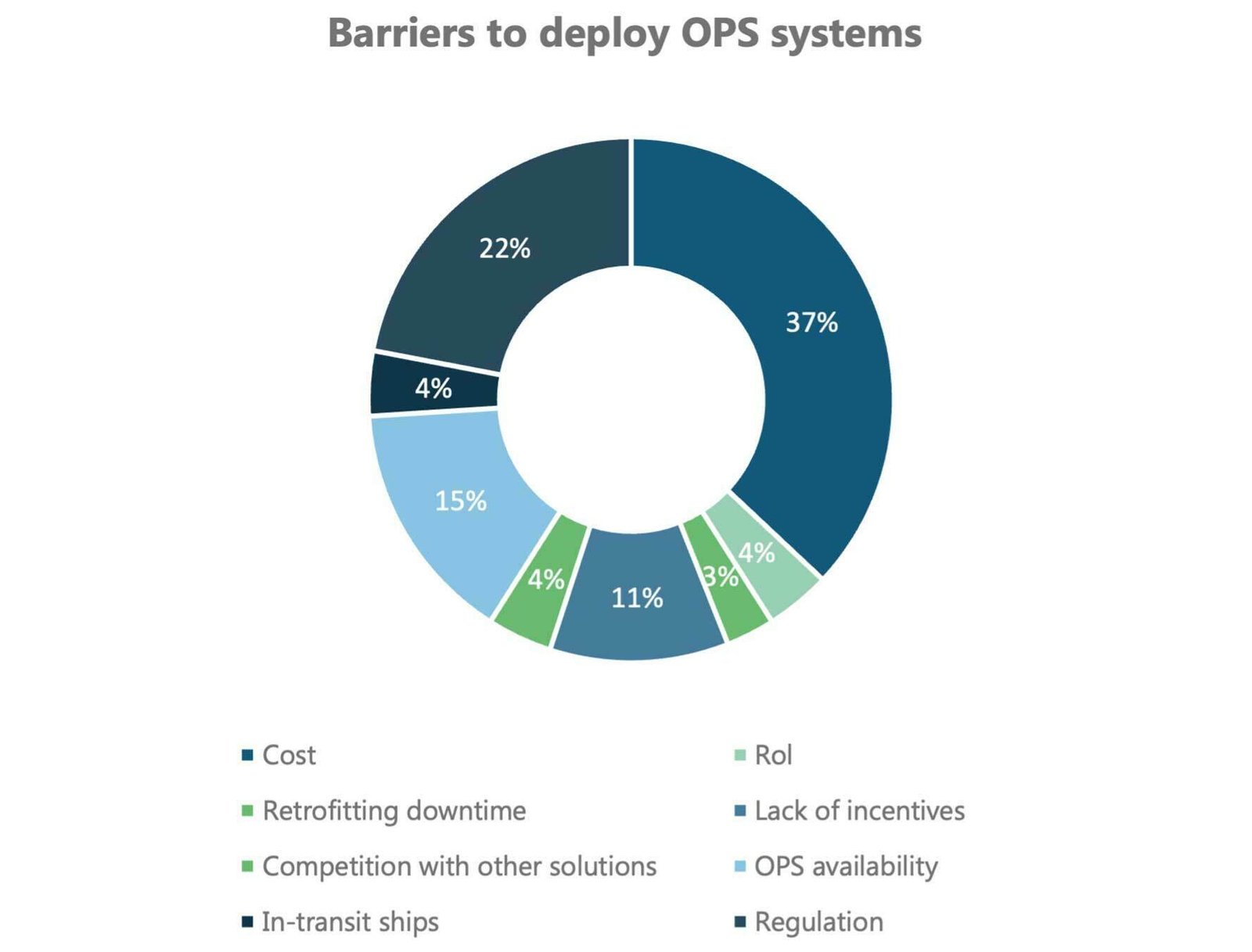

Figure 3: Main barriers for ship owners to deploy OPS systems.

Source: Port of Barcelona

European Port Initiatives

Environmental concerns associated with the maritime industry, directives, and potential regulations have pushed European ports to take initiatives focused on reducing CO2 emissions, which requires them to install shore-to-ship power systems. For instance, according to a new proposal for a regulation of the European parliament and the council on the deployment of alternative fuels infrastructure, TEN T core ports are required to ensure that at least one installation provides shore side electricity supply to inland waterway vessels by 1st January 2025. [3] The ports of Rotterdam, Valencia, Barcelona, and Hamburg are some of the most polluting ports in Europe where several shore power related initiatives, focused on reducing emissions, are currently underway.

Port of Rotterdam

The Port of Rotterdam Authority, along with the municipality of Rotterdam, are exploring possibilities to install more shore power connections at the port’s terminals to reduce CO2 emissions and meet the EU’s maritime targets. The port wants to install connections for containers, cruises, and liquid bulk vessels. This would mean that Rotterdam is aiming for several HV shore power systems in the future. The sites earmarked for such an installation include the terminals of Hutchison Ports ECT Rotterdam (ECT), APMT2, Vopak, and Cruiseport Rotterdam. [4] Currently, the technical and feasibility studies of these projects are being carried out, partly financed by EU funds.

As the Port of Rotterdam will be investing a huge sum of money to install HV systems, they would want to ensure that vessels berthing would use their systems. For this purpose, the port authority is partnering up with other ports, including those of Antwerp in Belgium, Bremen and Hamburg in Germany, and Le Havre in France, to develop and plan shore-based power facilities that would be compatible with each other so that vessels do not face any issues when they plug into other systems on these ports.

This should speed up the application of shore-side power and would also incentivize the vessel owners to invest in on-board systems to reap the subsidies offered by the EU. These ports are busy cargo hubs and there is a sizeable point-to-point traffic between these ports. This would also be beneficial for the ports themselves as it would enable them to collaborate with each other and share technical expertise on operating a new technology.

The Port Authority has calculated that the total energy demand, and therefore the consumption, of sea-going vessels from the planned terminals amounts to approximately 750-850GWh. This is equivalent to the energy consumption of 250,000 households, so the port expects to drastically reduce CO2 emissions with the installation of new systems [4]. The Port of Rotterdam is not new to shore power; in fact, it has been extensively using shore power for inland shipping for a decade now. The Stena Line terminal in Hoek van Holland has shore-based power and Heerema- a marine contractor- will commission a shore-based power installation at Landtong Rozenburg early next year for its offshore vessels. If all goes according to plan, the new shore power connections for cargo, cruise and liquid bulk vessels are planned to go online in 2023, drastically increasing the shore power capacity at Rotterdam. [4]

Port of Valencia

The Valencia Port Authority has finalized specifications for the construction of a new electrical substation, with a base tender budget of more than USD 6.1m This substation will be equipped with gas insulated switchgear, and two 132 kV/20 kV transformers, with the total apparent power of 60 MVA (30 MVA each) including the connections to docking terminals. [5] This substation will supply power to the shore-side power facilities under construction at new passenger terminal and container terminal, which will be in operation by 2025. This installation is part of the European Union-funded programme, (EALING), which aims to equip European ports’ electrical network for the supply of shore-side electricity to vessels by 2025. [5]

Port of Barcelona

The Port of Barcelona is finally going ahead with its pilot project to supply electricity to container vessels berthed at the Hutchison Ports BEST terminal through its new shore power connection. The port is calling this project “Phase Zero” of the Wharf Electrification Plan. The tender states that around USD 6m is up for grabs for the installation of the shore power connection. [6]

Barcelona’s Wharf Electrification Plan will enable docked ships to connect to the general electricity grid with 100% renewable clean energy. Red Eléctrica, the company which operates the national electricity grid in Spain, confirmed the beginning of construction of the new Ronda Litoral Substation, where the Port of Barcelona will connect its shore power system. The system is rated at 220kV, that means it is most likely to be a low voltage system and will cater to cargo vessels which will dock at the port. [6]

Port of Hamburg

The European Commission has awarded a grant of USD 20.3m to Hamburg port authority to facilitate the deployment of onshore power supply for cruise vessels at HafenCity cruise terminal. This funding is incompliance with the Hamburg port authority’s ‘Clean Air Action Plan’ with the goal of radical 80% reduction of carbon emission in the city by 2050. The port authority shows a strong inclination to decarbonize the maritime operation through alternative fuel technologies such as shore power. In this spirit, the port aims to become a pioneer to offer shore power supply to all types of vessels which include passenger vessels, large container ships and cruise vessels docking at the port. Already, the port provides shore electricity to inland ferries at Landungsbrücken and cruise ships at Altona Cruise Terminal. It is the first time that the Hamburg port authority is receiving direct funding from the EU commission; in the past, shore power facilities at Hamburg were funded through the German Ministry of Economics and Energy as well as state aids. In Germany, the state governments of Schleswig-Holstein and Hamburg, Mecklenburg-Western Pomerania, Lower Saxony, and Bremen, along with the Ministry of Economics and Energy has signed a consortium agreement to provide shore power facilities for cruise and ferry vessels. The German government has also facilitated the ports to deploy shore power facilities by not only providing the state funds but also providing tax exemptions on electricity prices by lowering the EEG surcharge by 20 percent or 1.2 cents per kilowatt-hour.

Barriers to Entry in the Shore Power Industry

Regardless of the initiatives underway at several European ports, the shore power industry still faces barriers that impede growth in the market; these include the upfront cost of the system, ROI, retrofitting downtime, a lack of incentives, electricity prices, and the availability and lack of capacity in the local grid.

Cost: The upfront cost of the shore power system is reasonably high for many medium and small ports to afford themselves. HV systems are very expensive and require a serious amount of investment. Shore power systems consist of many subcomponents such as frequency converter, transformer, switchgears, and cables which all add to the costs for ports.

Return on Investment: ROI is a major concern for ports that have invested millions in installing new systems. Many ports find it difficult to attract enough traffic to break even; for instance, some ports in Norway were unable to fill a number of empty slots and, thus, could not break even.

Retrofitting Downtime: A system takes around six months to install on a pier, resulting in low port productivity during that time due to the ongoing construction work.

Lack of Incentives: Some countries have not invested much in technology, making it very difficult for ports to invest in the whole project by themselves. For instance, the UK does not have a national plan for shore power which inhibits its growth in the shore power market.

Electricity prices: Europe has one of the highest electricity prices globally, so ports need to purchase electricity at high prices, making shore power unfeasible in many European markets, especially in the absence of state subsidies. So, the diesel generator turns out to be more cost effective for shipping companies and on-board generators are preferred instead.

Availability: The technology is still scarce (available in the Europea and North America, that too very recently) and not many ports offer it globally so shipping companies do not have the incentive to invest in their on-board systems.

Lack of capacity in the local grid: Ships require a lot of electricity to sustain their normal transit operations. Most local utilities do not have the extra capacity to serve ports, thus creating a supply problem. This is most evident where ports are located in remote areas which lack a strong T&D Network or ports located in small towns and municipalities.

Looking Ahead

The market for decarbonization will certainly gain momentum in the coming years but it will not be uniform; countries with strong incentives and investments will take the lead as is the case with Norway for shore power, for example. At a policy level, the EU should introduce more standardization for shore power in order to make it easier for OEMs to mass produce such systems and achieve economies of scale, helping ports buy off shelf products rather than tailoring custom-made systems. This would certainly bring the cost of owning, operating, and maintaining the system down and make it much more affordable for ports to expand their shore power offerings.

Additionally, Power Technology Research believes that shore power technology has the ability to improve the air quality levels for port cities and make their ports quieter. If the barriers mentioned earlier are addressed at the local government level, as well, it will further improve the cost effectiveness of shore power in the long run.

While currently in doldrums, the cost effectiveness of the technology will improve in the short run, as the energy crisis settles down.

Shore to Ship Service Overview

The research presented in this article is from PTR's Shore to Ship service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Shore to Ship Power Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

Unveiling the Transformative Journey of Port Electrification

OPS installation is on the rise globally as countries prioritize their environmental objectives and seek to minimize the ecological impact of...