The world is currently undergoing an energy transition, especially the advanced economies of Europe and North America, in the wake of climate change and the subsequent commitments made to tackle it at the regional and international level. The debate, however, is highly focused on the generation side of the subject, leaving transmission facilities, which are key enablers in achieving the desired transition, often overlooked. Historically, the majority of electricity over long distances has been transmitted through HVAC transmission lines and facilities. However, the advent and evolution of power electronics, coupled with the need to incorporate renewables with the grid have allowed for HVDC transmission systems to gain traction.

In 1954, the first ever mercury valve-based HVDC link (Gotland-1) was installed by ABB in Sweden. Later, the introduction of the thyristor valve-based converter stations not only provided a boost to the deployment of HVDC transmission systems globally but also completely replaced the market for the mercury arc valve-based HVDC systems. Further research into switching technologies led to the invention of IGBTs in 1980s. In 1997, the first IGBT valve converter HVDC system was installed by ABB in Gotland, Sweden.

Based on the type of switching element used in the DC converter stations, the HVDC market is segmented into two main technologies: Voltage Source Converter (VSC) and Line Commutated Converter (LCC). In the last decade, VSC HVDC out-played all previous technologies, especially in Europe (although adoption in the U.S. increased, too) due to the availability of IGBTs with large blocking voltages and modules with high current-handling capability, additional grid-support ancillary services, and less space requirement.

The Advantages of HVDC over HVAC

Electricity is transmitted over long distances through high voltage alternate current (HVAC) and high voltage direct current (HVDC) transmission lines. In certain situations, HVDC transmission is preferred over HVAC transmission. For example, where there is an underwater cable crossing, electricity needs to be transmitted over long distances in bulk, inter ties with low short circuit levels and for coupling of 50/60 Hz systems.

An HVAC link requires three transmission lines to carry the same power as an HVDC line. In addition, the capacitance between the active conductors and the surrounding earth or water restricts the length of HVAC cables. If an HVAC cable is too long, the reactive power consumed by the cable would absorb the entire current carrying capacity of the conductor and no usable power would be transmitted.

Applications of HVDC

The market for HVDC-based on applications may be segmented into three categories: bulk power transmission, interconnecting grids, and infeed urban areas. HVDC transmission systems are best suited for supplying electricity to densely populated urban areas, where significant obstruction could be caused by the density of overhead lines. Nowadays residential and commercial developments are opting for underground utility infrastructure- often required by law or done for aesthetic reasons only.

The HVDC transmission system is now becoming a popular choice for cross-border interconnections; for instance, submarine cables are being installed to transmit power across regions and countries along with overhead HVDC lines. SA.PE.I HVDC, connecting Sardinia with the Italian mainland, is one of the deepest subsea cables HVDC project running in the Tyrrhenian Sea, 1,600 meters below sea level. Other popular subsea cable projects are NordBalt (connecting Klaipėda in Lithuania with Nybro in Sweden), BritNed (connecting UK with Netherlands), and Skagerrak (connecting Denmark with Norway). In Europe, the subsea cables account for approximately 1444 km of HVDC connections, followed by underground cables and overhead lines covering the lengths of 397 km and 60 km, respectively.

HVDC to Integrate Offshore Wind with the Grid

The advancements in power electronics and industrial engineering have now enabled the installation of offshore wind energy plants further away from shore and in deeper waters with more wind potential. The main challenge, however, has been the ability to evacuate power from large offshore wind energy plants back to onshore grid facilities both efficiently and reliably. This has been greatly resolved with the latest HVDC transmission systems and has led the U.S. to explore tapping into offshore wind energy potential, while Europe is moving to expand already built offshore wind energy capacity.

The Current HVDC Landscape in North American Countries

The North American HVDC transmission market is largely driven by the U.S. and Canada, where the sweeping majority of the region’s HVDC transmission capacity is installed. The region’s overall HVDC transmission capacity accounts for more than 32 GW and the LCC HVDC technology leads in the region, as far as the technology split is concerned.

The U.S.

The U.S.’s current HVDC transmission capacity is around 20 GW. LCC HVDC technology leads the HVDC market in the country. The majority of HVDC interconnections are nationwide, with a few cross-border interconnection with neighboring countries. Some HVDC interconnections include the Atlantic Wind Connection (AWC)/ New Jersey Energy Link, Plains & Eastern Clean Line, and Mackinac B2B.

Canada

Canada’s current HVDC transmission capacity is around 12 GW. The Canadian HVDC market is totally dominated by LCC HVDC technology. The HVDC market in Canada experienced a boom in the 1980s and in the 2010s, where the majority of nationwide HVDC interconnection commenced their commercial operations. The first VSC HVDC system installed by ABB started its commercial operation in 2018. Recent HVDC transmission projects in Canada include Maritime Link (First and only VSC HVDC), Nelson River 3 (Manitoba Bipole), and Eastern Alberta Transmission line.

Mexico

Mexico has an insignificant HVDC market with only one project utilizing LCC HVDC technology. Railroad DC Tie is the only HVDC transmission project in Mexico, connecting the ERCOT grid in the U.S. with the Mexican national grid. Initially, it had a capacity of transmitting only 150 MW of electricity which was later enhanced to 300 MW in 2014.

Region-wise HVDC Technology Split

Overall, the HVDC transmission market of North America is dominated by the LCC HVDC technology. However, for the coming years, with the expansion of renewables, particularly offshore wind farms, more VSC HVDC systems have been proposed by TSOs to enhance the reliability and transmission capacity of the transmission grid.

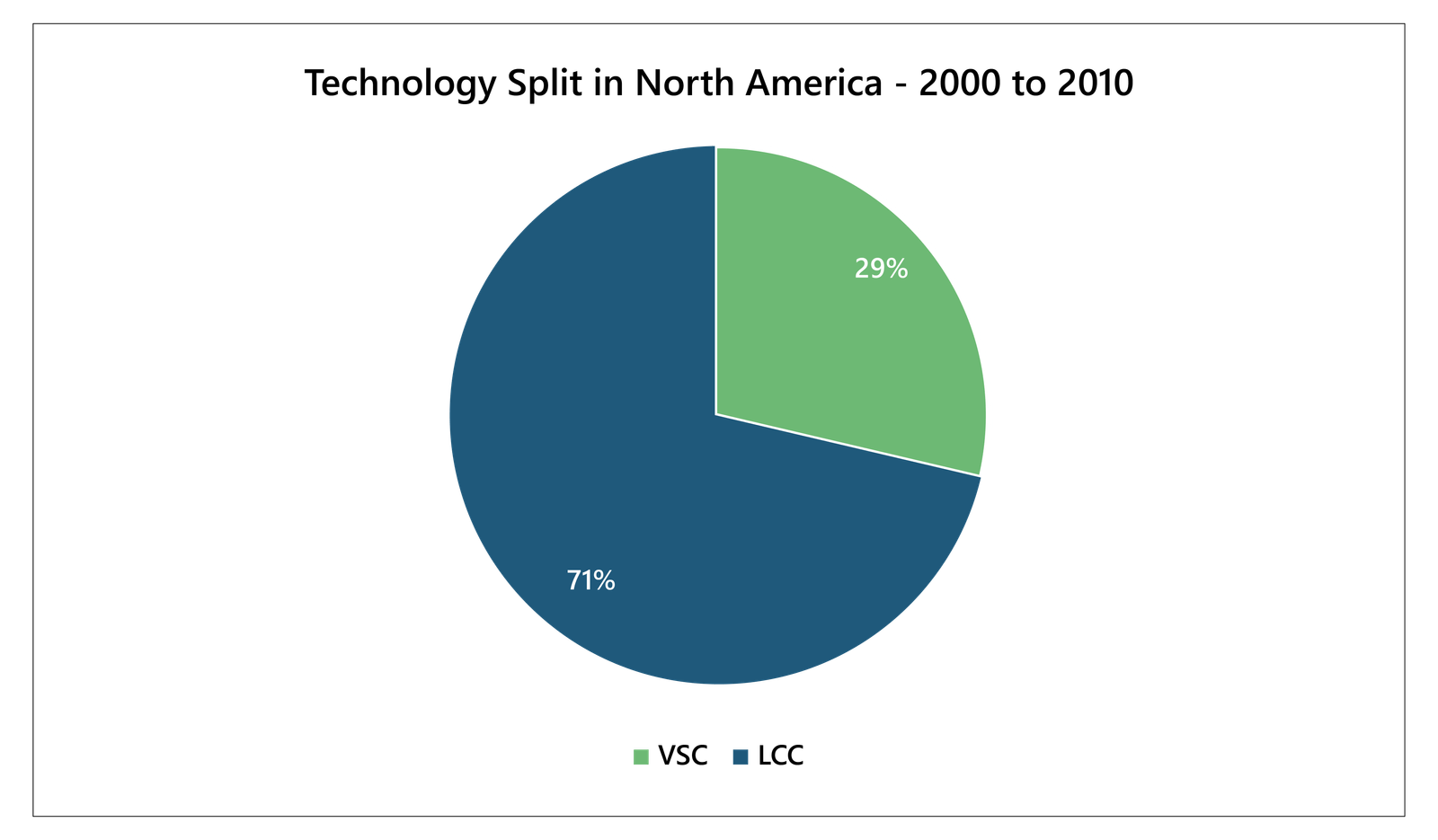

Till 2000, the technological split in the HVDC transmission systems market of North America was such that LCC HVDC systems accounted for 95% of the total installations, whereas a miniscule 5% of the systems were VSC HVDC systems. From 2000 onwards till 2010, the majority of the projects installed were still LCC HVDC systems, accounting for 71% of the total projects installed but VSC HVDC technology had grown, accounting for 29%. the change was more dramatic from 2011 to 2021, where 67% of the projects installed were LCC HVDC systems followed by VSC HVDC projects accounting for 33% of the total projects installed in that period.

Source: Power Technology Research

Fig 2: Technology split in North America till 2000.

Source: Power Technology Research

Fig 3: Technology split in North America from 2000-2010.

Source: Power Technology Research

Fig 4: Technology split in North America from 2011-2021.

Source: Power Technology Research

HVDC Market Drivers in North America

Renewable energy targets, specifically the planned expansion of offshore wind along with the proposed legislation (if approved) and the loan guarantees from the Department of Energy for transmission projects in the U.S., will be the main drivers of the HVDC transmission systems market in the region.

The share of renewables in the U.S.’ generation capacity mix is 25.4% and is expected to reach 80% of the capacity mix by 2030. On the other hand, Canada already has a 67.2% share of renewables in its generation capacity and is targeting to increase this to 90% by 2030. The majority of the expansion in the offshore wind energy segment within the renewable energy category in the region is planned in the U.S., leaving Canada and Mexico behind by a fair margin. Although the U.S. currently only has one offshore wind farm, which is off the coast of Rhode Island, the Biden administration has set a target to increase offshore wind energy capacity to 30 GW by 2030. New York, Massachusetts, New Jersey, Maryland, and Virginia will be spending around USD 55 Billion on 15 offshore wind energy projects in the next ten years. Canada currently has no wind energy plant installed; Mexico had one, but it is no longer operational.

In the U.S. the Electric Power Infrastructure Improvement Act was proposed in 2021, which would provide an investment credit of 30% for regionally significant transmission projects. According to the proposal, transmission projects that would qualify for the investment credit are:

• Overhead, underground or offshore transmission lines, including ancillary facilities.

• Minimum 500 MW and 275 kV capacity.

• AC or DC.

• Able to generate electricity in either a rural area or offshore.

• Commissioned by Dec. 31, 2031.

Similarly, applications for up to USD 5 Billion are being sought by the U.S. DOE’s Loan Program Office to assist in the development of innovative transmission projects alongside transmission projects owned by federally recognized tribal nations or Alaska Native Corporations. These transmission projects include HVDC systems, transmission to connect offshore wind, and facilities established alongside rail and highway routes.

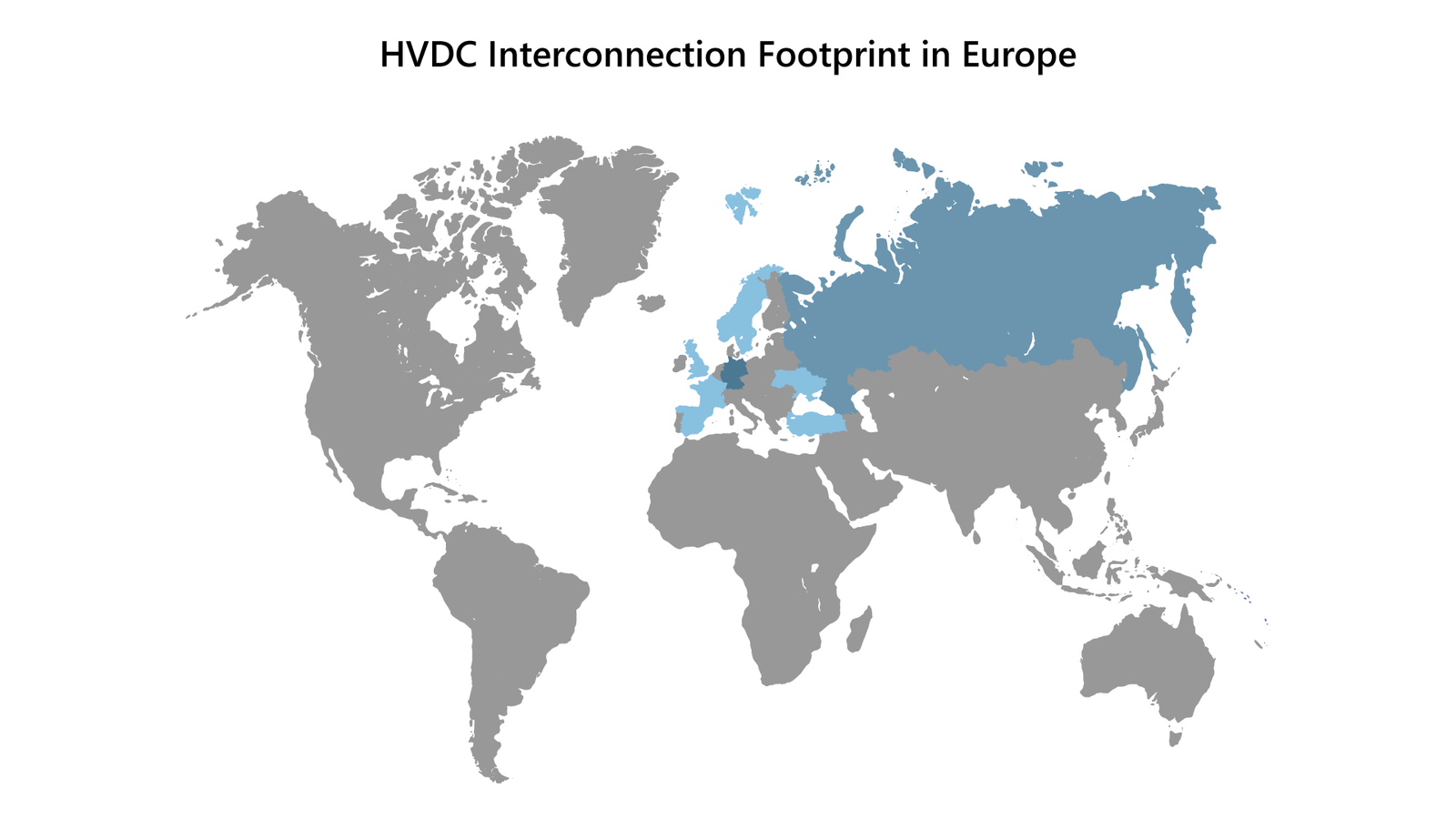

The Current HVDC Landscape in Key European Countries

According to Power Technology Research, Germany, the UK, Italy, Denmark, and France are the leading countries in Europe in terms of electric power transmission capacity through HVDC transmission lines. The region has a cumulative HVDC transmission installed capacity of around 43 GW, with Germany leading the region in terms of installed HVDC transmission capacity, followed by the UK and Italy.

Germany

Germany leads the HVDC capacity in Europe, with the capacity to transmit 11.25 GW of electricity. The German HVDC system is spread not only in the country itself but also has interconnections with neighboring countries such as Switzerland, Belgium, and Sweden. Some of the major HVDC projects in Germany include interconnection of offshore power plants in the North Sea region such as Borwin, Helwin, SylWin1, ALEGrO, and Baltic Cable.

The UK

Currently, the UK hosts 6.4 GW of transmission capacity through HVDC transmission lines and the country has several cross-border HVDC interconnections with France, the Netherlands, and Norway. In the installed base of HVDC transmission systems market of the UK, VSC HVDC systems dominate the LLC transmission systems. The country, however, is continuing to expand the transmission capacity through new HVDC projects to transmit electricity from the offshore wind farms in the North Sea back to shore.

Italy

The Italian HVDC transmission network has the capacity to deliver 3.7 GW of electricity from the generation center to load centers in the country. Italian HVDC is a mix of both LCC and VSC HVDC systems, with the majority of HVDC projects installed to transmit electricity within the country. Italy also has a couple of cross-border HVDC projects connecting the Italian grid with the grids of France and Montenegro.

Denmark

The Danish HVDC transmission landscape mainly comprises of cross-border HVDC interconnections with neighboring countries such as Sweden, Norway, and Germany and a couple of nationwide HVDC connections, totaling a transmission capacity of approximately 2 GW. The majority of these interconnection are connected via subsea cables transmitting electricity to and from Denmark. As far as the technology is concerned, Danish HVDC transmission systems utilize both LCC and VSC HVDC technology. However, the latest HVDC projects in the country are heavily tilted towards VSC HVDC technology.

France

The HVDC transmission systems market in France is in its early phase of development, with only one HVDC interconnection with Spain transmitting 2 GW of electricity between the two countries. As the French government is speeding up the installation of wind farms in pursuit of their net neutrality goals, it is expected that more HVDC connections will be required to transmit electricity from generation to load centers.

Region-wise HVDC Technology Split

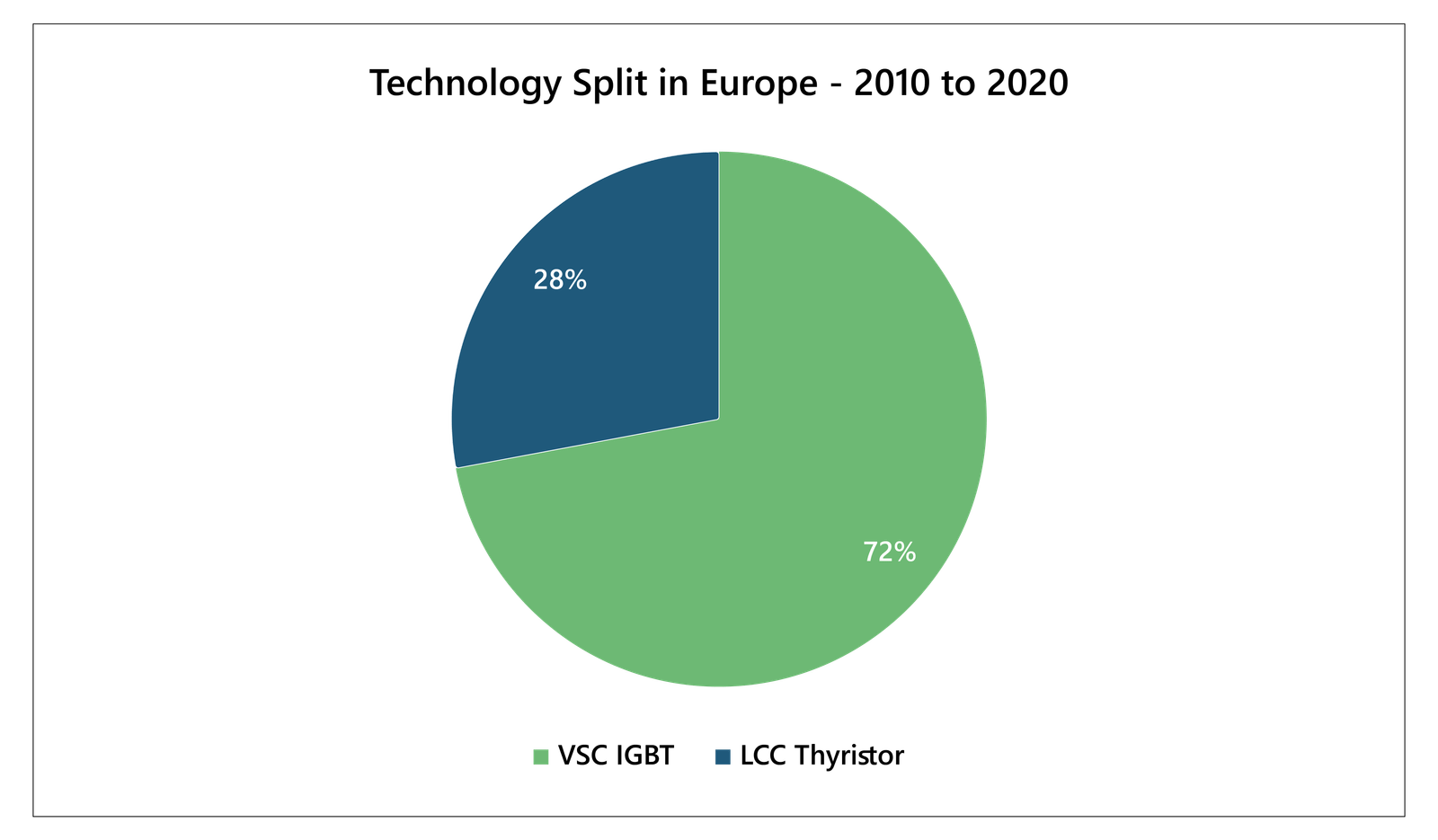

The technological split indicates that from the mid-1970s till 2000, the majority of the HVDC systems installed in Europe were LCC Thyristor HVDC systems. From 2001 onwards till 2010, however, the market for VSC IGBT systems experienced substantial growth in the region as these systems provided a quick switching response when compared to LCC Thyristor HVDC systems. VSC IGBT systems and LCC Thyristor systems accounted for 56% and 44% of the new installations from 2001-2010, respectively. From 2010-2020, 72% of the installations in the region were VSC IGBT-based while only 28% were LCC Thyristor based installations.

Fig 5: HVDC technology split in Europe till 2000.

Source: Power Technology Research

Fig 6: Technology split in Europe from 2001-2010.

Source: Power Technology Research

Fig 7: Technology split in Europe from 2010-2020.

Source: Power Technology Research

HVDC Market Drivers in Europe

Europe has huge potential for renewables, the realization of which will provide a great boost to the market for HVDC transmission systems. Several regulations passed in the EU, such as the Renewable Energy Directive and National Renewable Energy Action Plans (NREAP), are key driving factors in the transition to a low-carbon energy system. Europe is striving to become the first carbon neutral continent by 2050, and targets have been set accordingly for deployment of renewables in the region. It is considered that out of all renewable energy technologies, offshore renewable energy has the greatest scale-up potential.

The European Union has set a target to install at least 60 GW of cumulative offshore wind by 2030 and 300 GW of cumulative offshore wind capacity by 2050. The region holds promise for the deployment of offshore renewable energy projects at the sea basin level in the North, Baltic, Mediterranean, and Black seas, the Atlantic Ocean, and the EU’s outlying areas and overseas territories.

Moreover, the European Commission’s directive has set a target of at least 10% interconnection capacity by 2020 and 15% interconnection capacity by 2030 to transmit electricity to neighboring countries. As the region pursues offshore wind energy targets followed by interconnection capacity targets, the HVDC technology is expected to play a crucial role as compared to AC transmission systems because of the reasons discussed earlier.

European member states have also outlined their carbon neutrality goals which are aligned with the EU directives and the EU Green Deal. Efforts, both at the regional and the member state level, are underway; these are listed below:

Germany

Germany has set an ambitious goal to reduce CO2 emissions by 80% as well as increase the share of renewable energy in the total energy consumption of the country to 60%. In addition, Germany plans to generate 70% of the electricity from renewable sources of energy by 2050. The country is targeting a 30 GW of offshore wind energy cumulative capacity by 2030, which is 50% higher than the previous target. This is followed by a goal of 40 GW of cumulative offshore wind energy capacity by 2035 and 70 GW by 2045.

The UK

The new plan set out by the government is supposed to drastically reduce greenhouse gas emissions and achieve net neutrality by 2050. The UK has already made progress in emissions reductions as compared to levels in 1990. For instance, the country released 40% less emissions in 2019 as compared to 1990 levels. In addition, the UK is expected to be powered entirely by clean electricity, but this is subject to the security of supply constraints.

On the other hand, the UK plans to install 40 GW of offshore wind by 2030 along with onshore, solar, and other renewables.

Italy

The Italian government has set a target of reducing absolute emissions by 25% by 2030, from 2018 levels, and by 65% by 2040. Italy received USD 96 Billion worth of EU funds for the energy transition in the next five years. The Italian government will also explore acquisitions to accelerate the green revolution, and it has raised the target for renewable capacity to 60 GW by 2050. All these efforts are in accordance with the EU climate action plan and EU Green Deal targets of cutting 55% of emission by 2030.

Italy has an installed capacity of 10 GW of onshore wind energy with only one offshore wind farm in the Mediterranean Sea, which is under construction. As per the draft of the National Energy and Climate Plan (ENCP), submitted to the European Commission in January 2019, Italy has already pledged to reach 17.5 GW of onshore wind capacity and 900 MW of offshore by 2030.

Denmark

Denmark’s parliament approved the proposal to legally bind CO2 emissions reduction targets in June 2020, including 70% reduction in emissions by 2030 compared to 1990s levels of emission, followed by net zero emissions by 2050. The majority of the electricity in the country is already generated from renewable resources and the country has set a deadline to put an end to the extraction of oil and gas by 2030.

Denmark has also been benefitting from the exports associated with renewables, including the export of wind power equipment and even the energy itself to neighboring countries. It also plans to produce more electricity from offshore wind energy islands as well as existing islands. It includes a plan for an artificial island 80 kilometers from the Danish cost in the North Sea, largely owned by the government but with a considerable share of technology and expertise from the private sector.

The private sector in Denmark is heavily involved in the country’s decarbonization efforts, with climate partnerships with 13 industries, including the CEOs of some of the country’s major corporations. The financial services industry is also increasingly focused on the issue, with the pension industry pledging to spend USD 55 Billion in green assets.

France

France plans to reduce greenhouse gas emissions to 55% by 2030 and go carbon-neutral by 2050, in accordance with the 2015 Paris Agreement. It is also planning to invest in wind farms to generate green electricity and plans to install 40 GW of offshore wind capacity (cumulative) by 2050.

The French Energy Transition for Green Growth Law, passed in 2015, required the EDF to shutdown older reactors to bring new ones online. However, under a draft energy and climate bill in 2019, France will now delay the reduction in the electricity generation from nuclear to 50% of the electricity mix from 2025 to 2035. This delay underlines the continued need for HVDC transmission links through which the EDF transmits power to neighboring countries, especially during peak demand.

Fig 8: HVDC interconnection footprint in Europe.

Source: Power Technology Research

Fig 9: Future HVDC potential in top 5 European countries in terms of HVDC installed base.

Source: Power Technology Research

Moving Forward

Recent developments in the EU indicate that there is enormous potential for the deployment of renewables which will provide a boost to the market for HVDC transmission systems, needed to transmit power over long distances. The major driving force in this regard are several policies that are already in place such as the EU’s Renewable Energy Directive and National Renewable Energy Action Plan (NREAP) that support the transition to a low carbon energy system.

The development of offshore wind power plants is especially gaining a lot of traction in the North Sea and Baltic Sea regions, which would, in turn, provide a push to the HVDC transmission systems market in the region. According to Power Technology Research, Germany is planning to add around 16 GW of HVDC transmission capacity by 2035 focused on strengthening their nationwide HVDC infrastructure along with cross-border HVDC interconnections with Norway, Switzerland, and Italy. The UK has already been quite active in developing HVDC interconnections and plans to add 24 GW of HVDC transmission capacity by 2030.

Italy is expected to install 5 GW of HVDC transmission capacity, linking the country with Switzerland, Slovenia, and Montenegro by 2030. Denmark is also investing in HVDC infrastructure and plans to add 3.6 GW of electricity transmission capacity with cross-border interconnections with the UK, Poland, and Germany. France is currently constructing HVDC interconnections with Spain and the UK which will increase the HVDC transmission capacity of the country by 5.4 GW. All of these HVDC interconnections between major European countries are expected to boost the efficiency and reliability of the electricity transmission networks in Europe.

Secondly, in the North American region, the majority of the activity in the HVDC transmission systems market in the coming years will be seen in the U.S. as it plans to install around 39 GW of HVDC transmission capacity till 2030. Furthermore, the VSC HVDC systems market is expected to overtake the LCC HVDC systems market in North America because it provides a higher response rate, making it the most viable technology to integrate offshore wind farms with load centers. Upcoming HVDC transmission projects in the country include the Atlantic Link, Great Basin HVDC, Lake Erie HVDC Connector, and Sunzia HVDC link.

Canada is expected to install 4 GW of HVDC transmission capacity in the upcoming years, the majority of which will be cross-border HVDC transmission capacity needed to import clean electricity to Canada from the U.S.. Prominent upcoming projects include the New England Clean Power Link and Champlain Hudson Power Express.

Currently, no offshore wind farms exist in Canada but projects with a cumulative capacity of more than 3.6 GW have been proposed. This includes 400 MW NaiKun Project in Hectate Strait and the five projects proposed by Beothuk Energy for Atlantic Canada with a cumulative capacity of 3200 MW: two off the coast of Newfoundland and Labrador, and one each off the shores of Nova Scotia, Prince Edward Island, and New Brunswick. This proposed offshore wind energy expansion is expected to drive the HVDC transmission systems market of Canada in the future.

To conclude, the HVDC transmission systems markets of North America and Europe will be primarily driven by the U.S. and the EU member states. The roll-out of renewable energy resources, especially the offshore wind energy segment within the renewable category, will play a crucial role in this regard. However, the future technology split in the HVDC transmission systems market of North America and Europe is expected to be tilted towards the VSC HVDC technology.

High Voltage Direct Current Service Overview

The research presented in this article is from PTR's High Voltage Direct Current service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

High Voltage Direct Current Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

HVDC as the Backbone of Offshore Wind Expansion in the North Sea

This infographic discusses how the expansion of offshore wind in the North Sea will drive the HVDC market in Europe.HVDC as the Backbone of Offshore...

Powering Europe’s Future: The Surge of Interconnected HVDC Networks

The European HVDC market is poised for significant growth as it aligns with the expansion of offshore wind projects. European countries are planning...