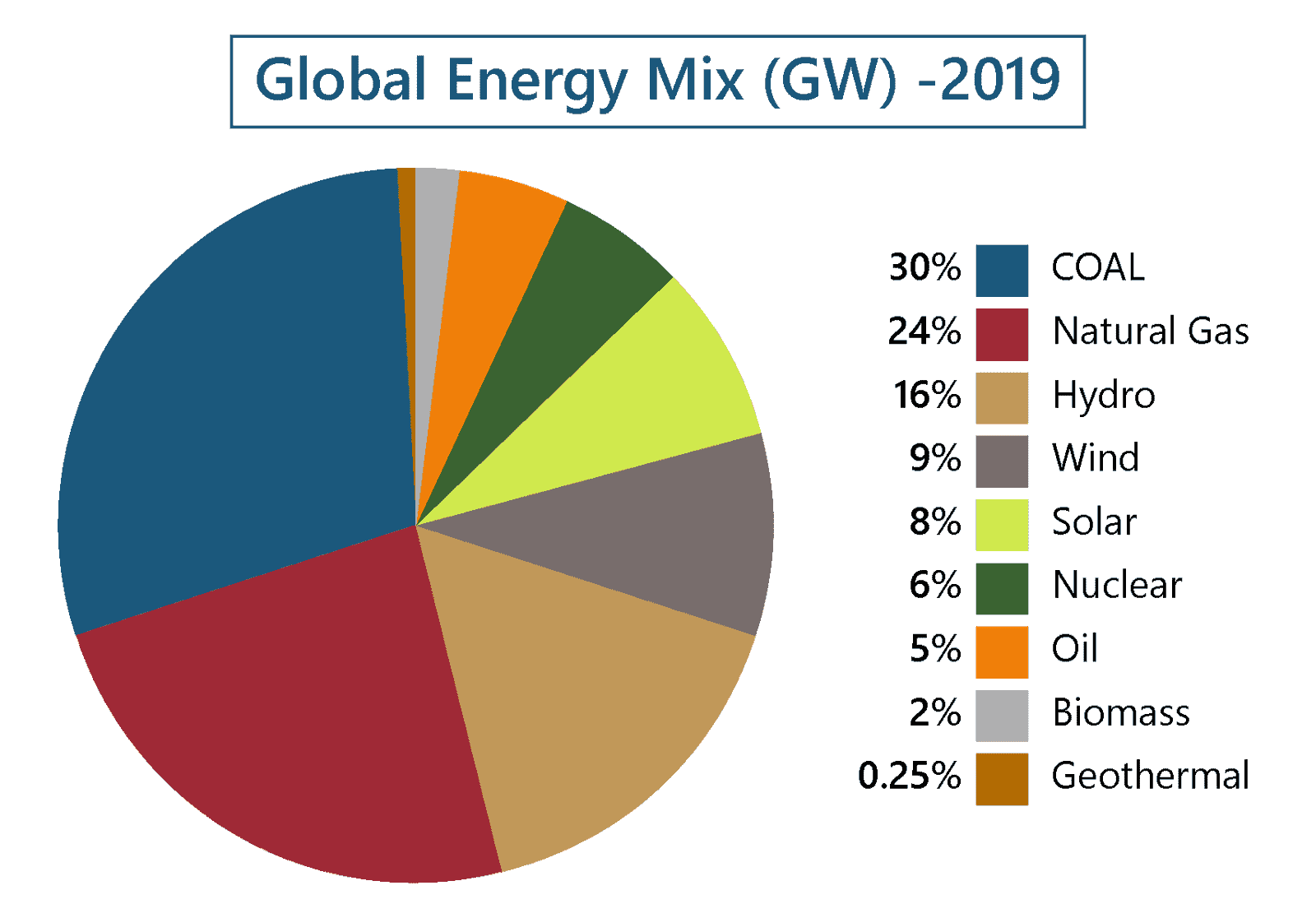

Energy sector investments are transforming rapidly, and there is fierce competition within the private equity sector to find the opportunities with highest returns. Firms are aiming to achieve lower cost of capital and greater efficiency, especially within the wind power and solar energy domains, which form 17% of the global energy mix today and are the segment with strongest growth. According to research by UNEP, private equity investments in the renewable energy sector have increased to $282.2 billion in 2019, with China and the United States leading the way.

With more and more PE firms venturing into the energy sector, a data driven approach to investing in this sector is crucial and pays off in the long term.

Firms today do not gain a competitive edge by simply hiring financial experts; they are using insights from subject matter experts within the fields they are choosing to invest in. Private equity firms, where executives are of the consensus that it’s beneficial to hire expert analysts from external resources are more successful in the long run due to their access to specialized sector knowledge.

This is an effective cost and time saving measure since this way the firms have more time to focus on managing their current portfolios and generating revenues. Europe seems to take the lead on this trend. According to PwC, 70% of the PE firms in Europe are actively outsourcing, while the figure stands at 30 to 40% for the US.

Getting an external perspective, especially when expanding to new geographical regions is required for firms to responsibly commit investment. One of the best sources of data to help with deal sourcing and thorough due diligence is to turn towards the experts in the field – those who excel at market research. Investment analysts deal with multiple sources of information, and market research arranges that information into reliable, standardized, and comparable data.

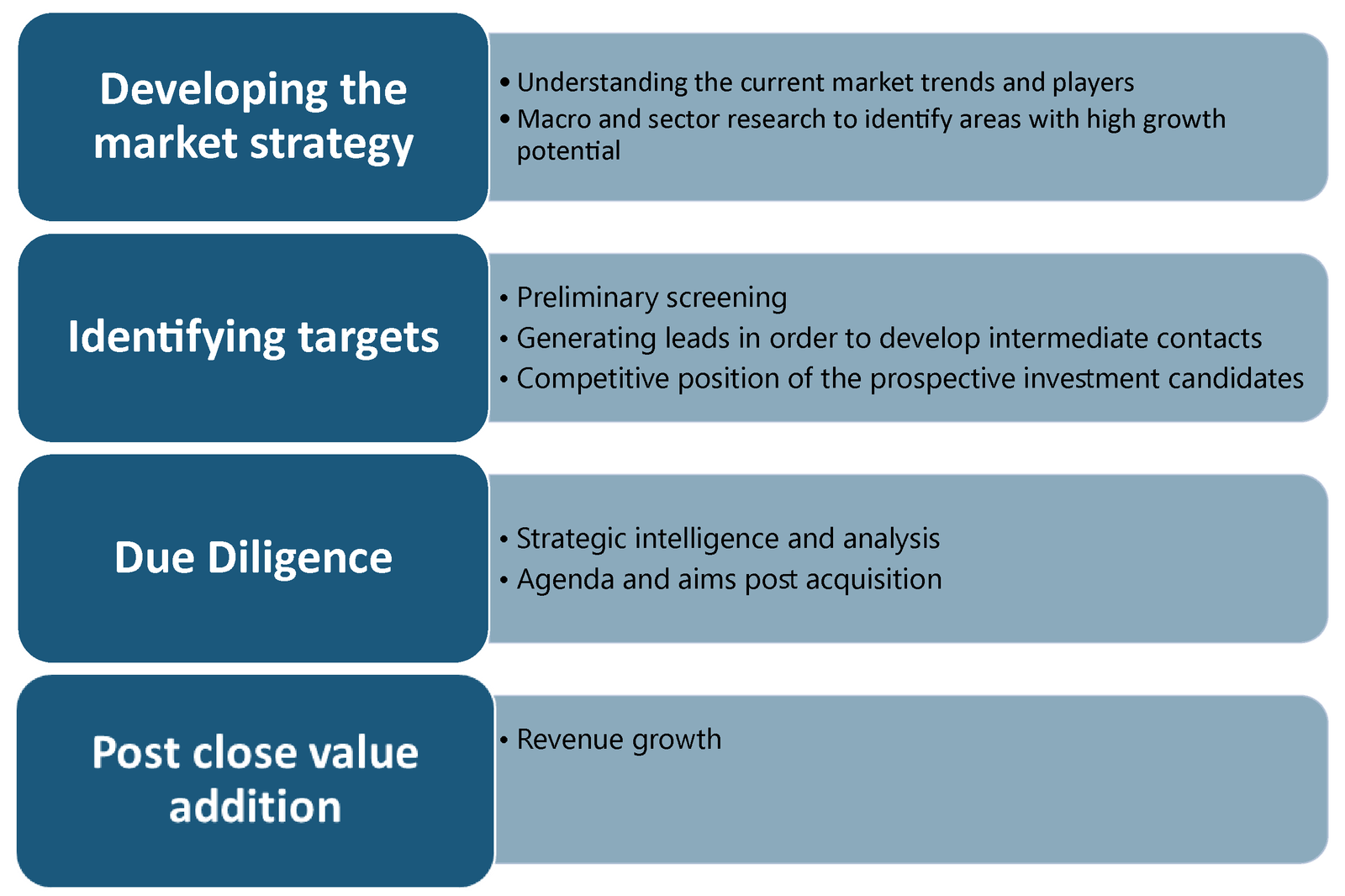

Market research is primarily used by private equity firms for pre deal solutions but can apply to post deal activities as well. An analysis of the current market situation and the macroeconomic and sectoral trends can give invaluable insight into future revenue projections of the prospects. Generally, investment firms use market intelligence in the following ways:

Market intelligence also helps firms make informed business decisions, using high quality data. As part of their due diligence, firms like to have a holistic view of the markets, and for that they turn to sectoral market research. In research for the energy sector, for instance, firms look to answer the following questions:

- what are the main industry trends of this rapidly growing industry, and what are the key macroeconomic indicators?

- how are the firms within this sector positioned in the value chain? For example, which companies are the project owners, the equity owners, and the software and technology providers?

- Market sizing forecasts to understand market potential (future cashflows of prospects).

- Competitive Analysis – Market positioning and analysis.

With so much dependence on market research, it is important for firms to understand how to choose the most reliable and high-quality market research.

- Independent and Unbiased

Sometimes market research is sponsored by companies, which can influence the results reported. There have been many market studies that parrot the beliefs of the sponsoring company rather than reporting an unbiased appraisal of the market landscape. It is imperative to select a firm for market research that has a track record of unbiased research.

- Actionable Insights

The best market research guides real strategic and tactical decisions directly. It should not be just numbers without any context. For example: Should we raise prices? (or from the seller’s perspective: should we demand a discount?). Market research that characterizes the supply and demand dynamics is very useful.

- Business Analytics and Independent Benchmarks

Business analytics can help automate the scrutiny of one’s data like shipment volumes, prices, deal terms, inventory levels, etc. But the problem is that without independent benchmarks you have no idea if you have a competitive advantage or not.

- Accuracy and quality data collection techniques

Another measure of good research is knowing how accurate past market sizing and forecasts have been. No forecast can be perfect, however, the assumptions and the identified “Influence factors” behind the forecast can be very valuable.

- Transparency

Good B2B research need not be elusive. When you enlist a market research company to help with your valuable decision making, identifying a good one will pay off in the long run. Do not be afraid to ask questions and check the company’s methodology and granularity of its data and ensure that the experts at the firm are independent and are available to answer your questions.

By recognizing and investing in good market research, private equity firms can save in hours of due diligence. Such an analysis, based on reliable data, can help a firm make better informed business decisions, resulting in revenues that run well into millions of dollars. Market intelligence also helps firms manage the risk of their portfolios. Using good market research, therefore, has now become one of the first steps that investment firms take when evaluating a new business.

More on our Private Equity Offering:

Contact:

Advisory & Client Relations (Private Equity)

+1-408-400 3214