• In the last decade African countries have been significantly pushing to increase the electricity generation capacity with a special focus on renewables (solar and wind) and to expand the grid infrastructure.

• FACTS in now playing the role of an enabler for region’s electrification goals and energy transition from fossil fuel fired generation to generation from renewable resources.

• Power Technology Research predicts that the FACTS market of Africa in coming years is expected to gain traction as STATCOM and SVC units are deployed in the mining and renewable sectors.

In the last decade African countries have been significantly pushing to increase the electricity generation capacity with a special focus on renewables (solar and wind) and to expand the grid infrastructure needed for transmission of power. This tilt towards increasing the electricity generation capacity followed by expansion of grid infrastructure is influenced by Sustainable Development Goal 7 that stresses on the provision of ‘affordable, reliable, sustainable and modern energy’ for all by 2030. Till 2020, African countries including Algeria, South Africa, Ethiopia, Mozambique, Tanzania, Morocco, Kenya, Ghana, and Nigeria cumulatively installed 12 GW of renewable generation capacity along with the expansion in the grid infrastructure.

This in turn presented substantial opportunities for growth in the region’s FACTS market. FACTS in now playing the role of an enabler for region’s electrification goals and energy transition from fossil fuel fired generation to generation from renewable resources including solar and wind.

Evolution of FACTS Technology

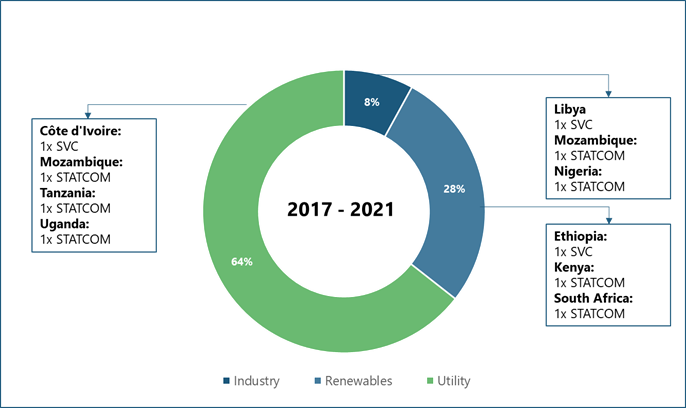

Historically in the African FACTS market significant presence of SVC technology is observed with STATCOM coming into sight only in 2011. As per the estimates of Power Technology Research till 2010 all the FACTS deployments in the region were SVC and from 2011 onwards till 2021 56% of the FACTS deployments were STATCOM while only 44% were SVC. Most of the demand for SVC is originated from the utility and the mining sector in the countries like Zimbabwe, South Africa, and Libya while STATCOM gained traction especially in the last five years to support the expansion in the mining sector.

Figure 1: Landscape of the SVC and STATCOM Deployments in African FACTS Market.

Source: Power Technology Research

Key Deployments of FACTS in Africa

Over the last 5 years, nearly 2,000 MVAr of FACTS devices are deployed in the region. In recent years, FACTS deployments have aided African grid expansion projects and the integration of intermittent renewables in Africa. Few of the key FACTS deployment in the region are as follows:

• In 2017, a STATCOM was deployed to support the integration of wind farm in South Africa.

• In 2017, a STATCOM was deployed at steel mill in Ogun, Nigeria to support grid to cater the electricity intensified load such as arc furnaces.

• In 2018, an SVC project was deployed at MAN substation to provide grid compliance in Cote d’Ivoire. This project supported CLSG grid expansion project connecting 12 substations across four countries in West Africa region, utilizing the generation of hydropower resources to cater the need of electricity.

• Water-cooled STATCOM and a GIS (Gas Insulated Switchgear) bay were deployed at a mining site in Mozambique in 2021, making it one of only a few cases around the world to support grid reliability.

• Recently, in 2022, a STATCOM was installed at a GIS substation in Ghana to support grid voltage stability in response to the country’s increasing load demand.

Figure 2: Technology Trend in Key Application Verticals Over the Last Five Years.

Source: Power Technology Research

Looking Ahead

To meet Sustainable Development Goal 7 that focuses on the provision of ‘affordable, reliable, sustainable and modern energy’ for all by 2030, Africa as a region is deploying additional generation capacity including conventional and renewable generation assets followed by expansion of electricity grid network. In pursuit of these goals, regional countries such as South Africa, Mozambique, and Tanzania plan to reach cumulative renewable generation capacities of 19 GW, 90 MW and 6 GW in the next 5-10 years. Power Technology Research predicts that the FACTS market of Africa in coming years is expected to gain traction as STATCOM and SVC units are deployed in the mining and renewable sectors specially to support the grid and ensure reliability.

It is significant to note that in the African FACTS market during the last decade emergence of Chinese OEMs (original equipment manufacturers) for instance NR-Electric and RXPE have been observed. These OEMs have carved a place in the African market mainly because their products match the functional and financial requirements of the region’s growing mining industry. However, global giants including Siemens Energy, GE, ABB (ASEA Brown Boveri) continue to hold a substantial presence in the region especially with regards to the FACTS installed in the past. But the emergence of Chinese OEMs has demonstrated that Africa presents a level playing field for FACTS OEMs of Asia and Europe.

Flexible AC Transmission Service Overview

The research presented in this article is from PTR's Flexible AC Transmission service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Flexible AC Transmission Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

Renewable Revolution Catalyst for the EU’s FACTS Market Growth

The Russia-Ukraine war has served as a wake-up call for the EU member states to decrease their dependence on Russian energy supplies. Due to the...