China is dominating in emerging power equipment markets around the world. Some of the highest growth markets around the world, including Africa, South East Asia and China are being served by Chinese T&D manufacturers. Part of the reason is extensive investment and funding by China in a lot of these markets, which comes with a precondition of Chinese manufacturers providing the equipment and services on these infrastructure projects. China has already invested $13B from 2010-2015 in African Transmission and Distribution infrastructure projects. Pakistan is by far the biggest in terms of Chinese aid. A sum of $35B has been promised by China for multiple power generation and transmission projects under China Pakistan Economic Corridor (CPEC) agreement. The investment is spread over 17 power generation projects and one HVDC transmission project.

Chinese companies, under CPEC, will be working on four wind power projects of 300MW capacity, one solar power project of 900MW, three hydro power projects of 2,714MW, five coal projects in Thar Sindh 3,960MW and four imported coal projects of 4,260MW in total along with a ±660kV HVDC transmission line between Sindh and Punjab. These projects are of strategic importance for china to expand their influence in the region. Working with Pakistan enables shorter supply routes, and quick development of the western province of Xinjiang (Capital Kashgar).

No. of Projects by Generation Technology

Source: CPEC, Power Technology Research

Matiari-Lahore HVDC Project:

One of the key projects in CPEC is the ±660 kV Bipolar Matiari-Lahore HVDC transmission line project, which will transmit 4,000 MW of electricity. This project is the first ever HVDC transmission line in Pakistan and it will also be the first transmission line project in the country being developed by the private sector. Previously all the transmission work was carried out by TSO, National Transmission Dispatch Company (NTDC), itself. The project includes two converter stations and two electrode-grounding stations at Matiari/Lahore, three repeater stations and a transmission line.

Matiari-Lahore HVDC Transmission Line-Planned Route

Source: CPEC, NTDC

This connection will evacuate 4000MW of electricity power from seven projects under CPEC: 1,320 MW Port-Qasim Coal Project (Karachi), 1,320 MW Shanghai Electric Coal Project (Thar), 660MW Engro Coal Project (Thar), 1,320 MW HUBCO Coal Project (Baluchistan) and 330MW Siddique Sons Energy (Karachi). 1,320 MW Port-Qasim Coal Project Karachi’s Phase-I of 660 MW would be functioning by 2018 and Phase-II of same capacity would be on the grid by 2020. 1,320 MW Shanghai Electric Coal Project with Phase-I & II of 660 MW each would be completed in 2018 and 2020 respectively. Engro Coal Project Unit I &II 330 MW each would be functioning fully in 2019 and 1320 MW HUBCO Coal Project would be completed by 2020.

Turnkey solution by Chinese Manufacturers:

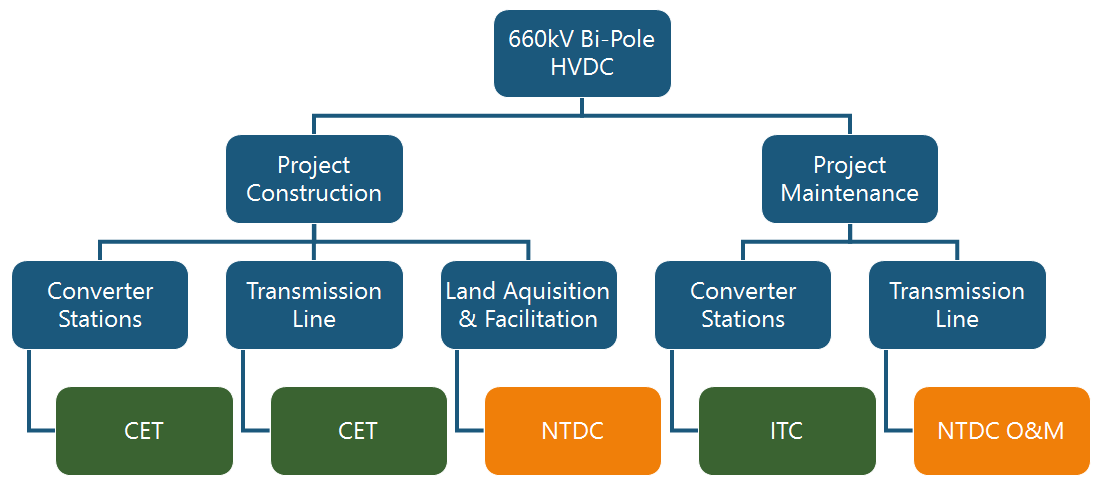

The project is being developed by China Electric power equipment and Technology (CET), a subsidiary of State Grid Corp of China (SGCC), who will build the converter stations and the transmission line. National Transmission and Dispatch Company (NTDC), Pakistan’s only TSO, will provide the land and other facilitation against the respective expense which will be provided by CET. The project will be delivered on a turnkey basis, under Built, Own, Operate and Transfer (BOOT) program. After 25 years, the infrastructure will be handed over to NTDC to own and operate. The Private Power and Infrastructure Board (PPIB) has approved the issuance of letter of interest to CET which will trigger the process for financial arrangements by the contractor. With a cooperation agreement, Independent Transmission Company (ITC) will be responsible for operation and maintenance (O&M) of the converter stations, and NTDC will take responsibility of O&M of transmission line. To avoid the conflict of interest, NTDC will incorporate the special purpose vehicle with name of NTDC O&M Company to carry out these O&M activities.

Companies Awarded Construction and Maintenance of the Project

Source: Power Technology Research

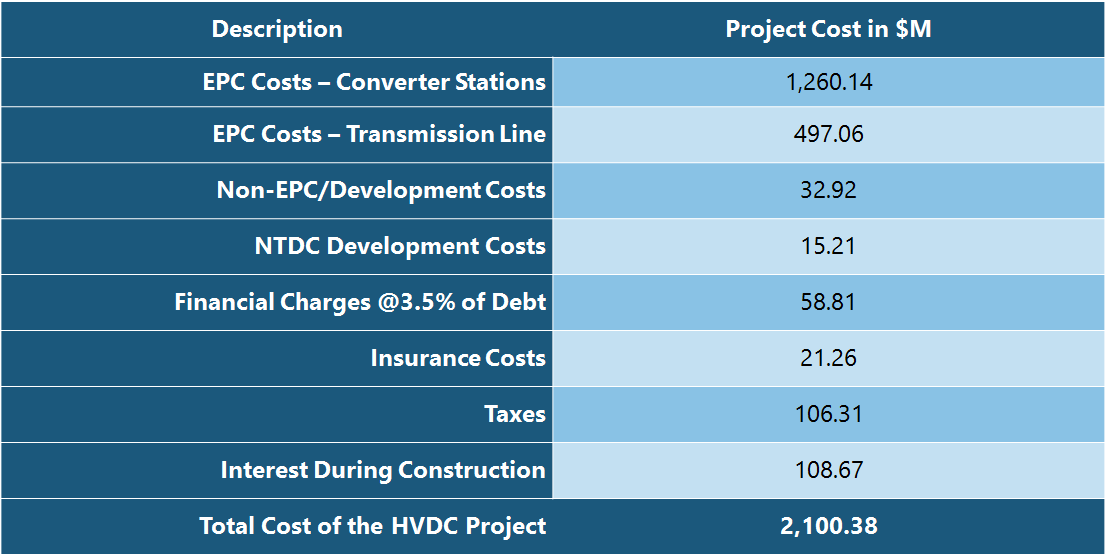

Cost Breakdown:

The contract is worth over $2.1B, out of which $1.8B is EPC costs ($1.3B converter stations, $0.5B transmission line), around $32M are the non-EPC costs, and the rest is overhead including insurance, interest and taxes. Annual O&M costs of the HVDC line are estimated to be $77M ($38M Fixed O&M ITC-Foreign, $20M Fixed O&M ITC-local, $17M Fixed O&M transmission line, $2.5M land lease cost). The project is being developed without competitive bidding since it is a government-to-government deal as part of the CPEC. Once the transmission line starts commercial operation, the end-consumers will have to pay additional amount in their bill which will include the cost of debt servicing of the loan (to be arranged from china EXIM bank) along with O&M costs.

Matiari-Lahore HVDC Project – Cost Breakdown

Source: NEPRA, Power Technology Research

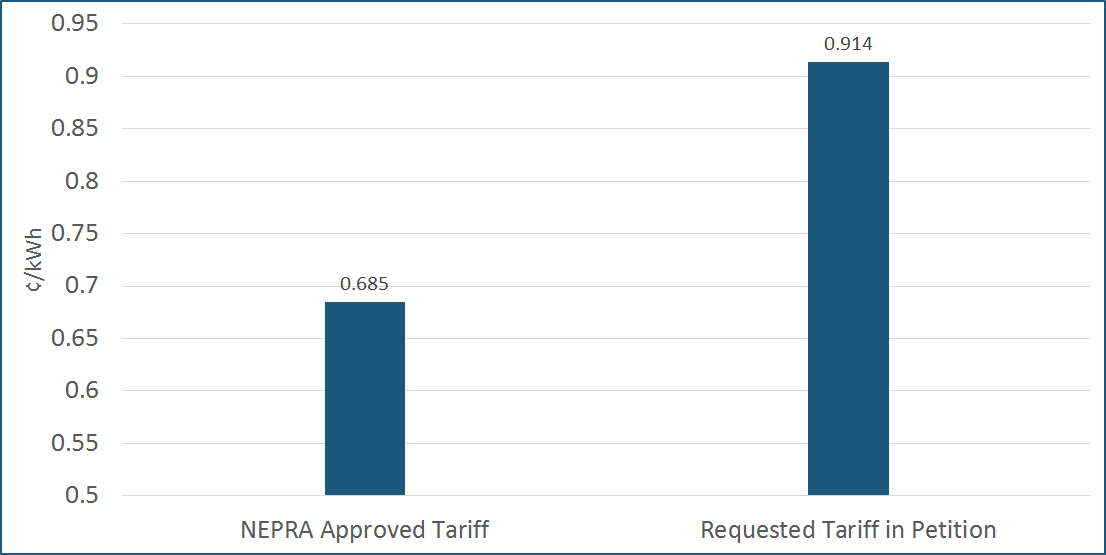

Tariff Rate Pending:

At the time of this article, in mid-July, feasibility studies of the project and converter station land acquisition have been completed. An initial decision on the tariff was made by National Electric Power Regulatory Authority (NEPRA). The tariff approved in this decision was PKR0.71/kWh ($0.685/kWh). However, CET had reservations on the tariff, based on which, the government has filed a petition with NEPRA to increase the tariff to PKR0.946/kWh ($0.914/kWh) to promote the foreign investment. According the government, Chinese investors are reluctant to go forward with the current determined tariff by NEPRA. The decision on the petition is still pending.

Source: NEPRA, Power Technology Research

The project is expected to take 27 months from the start date, with an expected Commercial Operation Date (COD) being end of 2018 or early 2019. However, based on interviews conducted by PTR, and considering the issues with tariff and current progress of the project, current COD seems very optimistic and PTR expects a three to four-year timeline.

Hope remains for non-Chinese players:

Like HVDC in Pakistan, all the power plant projects, including the generation step-up substations, will be supplied by the Chinese suppliers as part of the CPEC deal. These projects are being awarded on a turnkey basis, with the Chinese suppliers providing a complete solution. As a joint working group comprising senior officials from the two countries is working on the CPEC plan, several other projects of power distribution companies (DSOs) and the NTDC are also likely to be made part of the CPEC in future. These plans can include several projects relating to new or upgrade of secondary transmission grids up to 132kV and 11kV power distribution lines and feeders.

The market, however, may have room for more players outside CPEC. Other planned transmission projects under NTDC, outside the scope of CPEC, are to be completed with the loans from Asian Development Bank, Japan International Cooperation Agency and World Bank. In addition to the HVDC project under CPEC, interviewees mentioned two other HVDC projects under deliberation at NTDC, also not part of CPEC project, one from Faisalabad to Peshawar, one from Lahore to Peshawar. In the future, the transmission and distribution sector will also see a strong growth to complement the generation capacity and increased electricity demand. These projects will be offered through open tenders, giving an opportunity to non-Chinese manufacturers to participate in the bidding. However, project bidders will need to stay vigilant as Pakistan remains a price conscious market to a large extent, typically providing an advantage to Chinese bidders.

Overall, CPEC is the widely discussed economic project with the potential to change the economic profile of the whole region, more so that of Pakistan. There are some political, social, cultural and historical facts which must be addressed to ensure a smooth working of all the projects; which are being worked on. During first All Parties Conference in Islamabad, participants from all political parties in Pakistan, reached a consensus on the China-Pakistan Economic Corridor (CPEC) project and pledged to take full political ownership. If all the projects in CPEC go through successfully, it will certainly improve the economic situation in the country. For now, Pakistan is certainly a dynamic market with a changing landscape. Power Technology Research will continue to keep an eye on its power equipment market as part of our emerging markets coverage.