The global population is growing at a rate of 1.05% per year expecting to reach 9.7 billion in 2050. That is a dramatic increase from 1 billion in 1800 to 7.7 billion today and the agriculture sector will have to feed all those billions of people.

Agriculture is also vital for economic growth and in 2018 accounted for 4% of global GDP. In some developing countries the contribution was more than 25% of GDP.

With the increasing population comes the need to enhance and sustain the capacity to feed the population and mechanization of the agriculture sector is a key-way to achieve this. Farmers need to be equipped with agricultural vehicles and associated equipment and this is the goal that world organizations along with governments of developing countries are pursuing.

In India, 52% of the land is used for agriculture and it constitutes the backbone of economy being the main source of livelihood for approximately 55% of the population. This sector is responsible for providing food for 1.3 billion people of the country while contributing 16% to the national GDP.

It is important to note that growth in the agricultural sector is 2-4 times effective in increasing the income of the poorest and vulnerable segment of society. Hence developing countries like India can focus on the agricultural sector and the mechanization of it in an attempt to stimulate growth and reduce poverty.

Factors that affect the growth of the agricultural sector in the country include: landholdings, agricultural credit, (irrigation), net and gross cropped area, farm mechanization, electricity, storage infrastructure, transportation, agriculture marketing, fertilizers, high yield variety seeds, pesticides and chemicals, population and literacy rate,

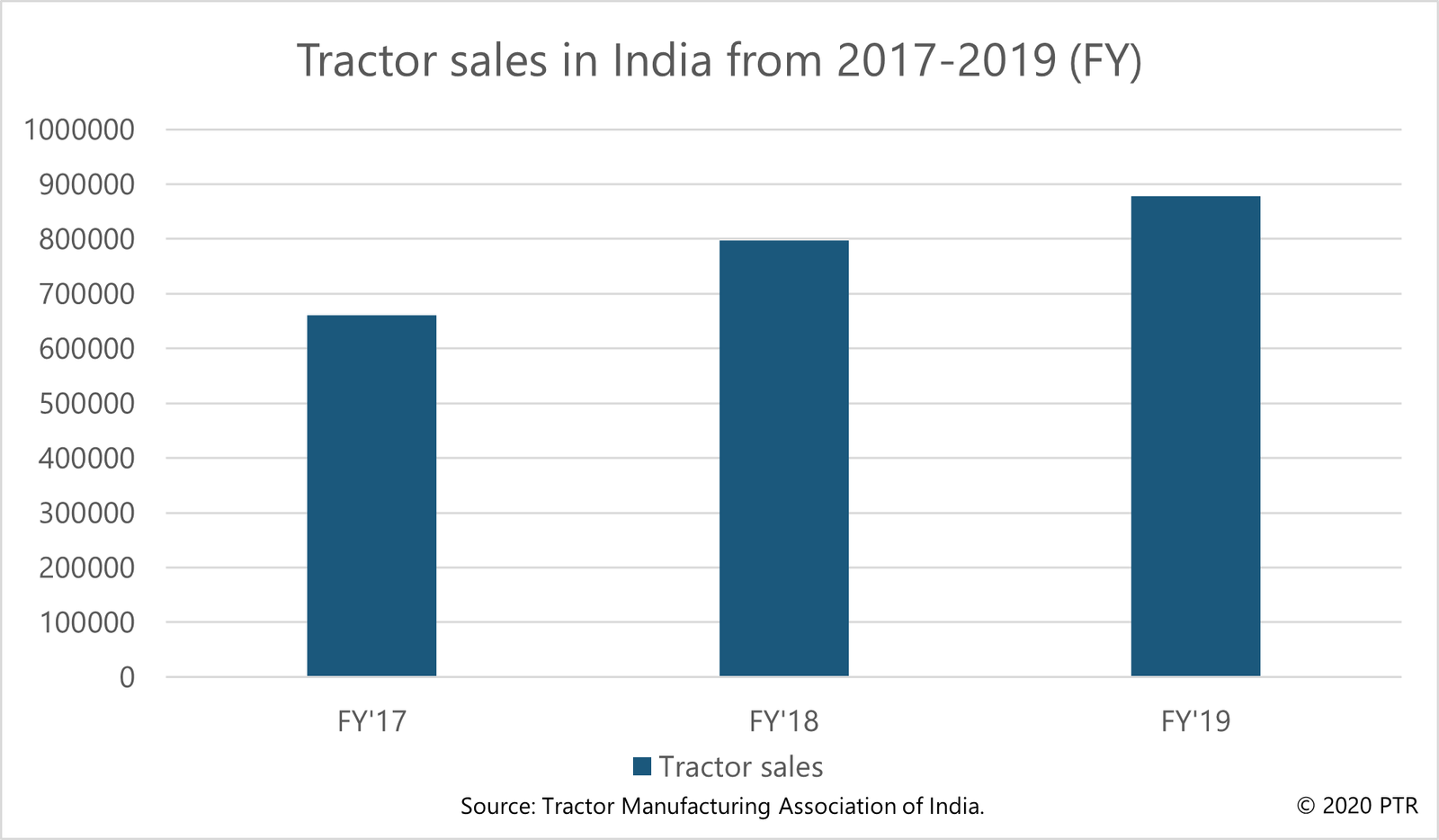

The tractor industry, which is the corner stone of the agricultural commercial vehicle market, has shown double-digit growth from FY 2017-2019 in India although growth slowed down in the FY 2019. Owing to weak consumer sentiment, sector growth declined as sales slipped into negative in February and March 2019 year over year. Tractor sales in India reflect rural consumer sentiment and was greatly impacted by erratic rainfall followed by delayed sowing and low production of rabi crops in the last fiscal quarter. Sales in FY’17 increased by 15.7% and reached 661,195 units where in FY’18 tractor sales increased by 20.5% and reached 796, 873 units.

Figure 1: Tractor sales in India from FY 2017 to FY 2019.

Of the top ten companies selling tractors in India, six are Indian owned manufacturers, with Mahindra, TAFE, Sonalika an Escorts in the top four. John Deere, New Holland, Kubota and SDF are the top foreign owned companies on the list although all these companies have manufacturing facilities in India.

Although some companies announced electric tractors, as far back as 2017, as in the case of Mahindra and Escorts, the production versions of electric tractors seems several years away. In 2019, Escorts unveiled a hybrid concept tractor powered by fuel and battery. John Deere had also announced a fully electric tractor in 2016 but more recently the company has gone in the direction of a tractor having no battery and opted for an extension cable connection to power the engine. Kubota introduced a prototype electric tractor in January 2020 and will begin testing it later this year.

Meanwhile an Indian startup company, Cellestial EMobility, formed in 2019, launched an electric tractor in March, 2020. Its price, at Rs 5 lakh, makes it competitive with traditional tractors. Initially the company plans to produce 100 units a month. Another startup is AutoNxt Automation who builds electric tractors with the idea that most farmers in India own smaller plots of land and can share or rent the tractor as needed. The AutoNxt tractor is autonomous with instructions fed through a smartphone or tablet provided by the company. Operational costs for Cellestial and AutoNext electric tractors are less than their diesel tractors counterparts.

Despite a sharp decline and shrinking of the economy because of Covid-19 and associated lockdowns, tractors was one particular segment of the automotive industry which showed robust growth in September 2020. The resilience shown by the world’s largest tractor market India (both in terms of production and sales) despite the pandemic is because the country observed reverse migration from urban to rural areas, a bountiful monsoon, a favorable kharif season and an increase in the disposable income of rural India.

Looking forward

Indian economy is expected to strongly bounce back in 2021 and grow at 8.8%, according to the World Bank. This along with the tractor segment’s sustainability during the crisis, indicates the remarkable potential for investment and growth.

Related Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential gathering left a profound impact, and I am delighted to share a comprehensive analysis of my experiences. The Greentech...

An Evolving Market: Rise of Electric Vehicles in Europe (2023)

This infographic examines the electric vehicle (EV) market in the European region. It highlights the current and forecasted EV market size of each vehicle type and the current and future trends in the light-duty and heavy-duty EV markets. European Electric Vehicles...

Evolution of V2G: CPOs-Automotive OEMs-Utilities at the center of transition

Evolution of V2G: CPOs-Automotive OEMs-Utilities at the center of transition [ba_advanced_divider active_element="text" title="About the Whitepaper" use_mask="on" border_style_classic="solid" border_color="#1b587c" border_weight="3.8px" border_offset="6px"...

European Electric Vehicle Charging Infrastructure (EVCI) Services Market Landscape

This infographic gives an overview of the electric vehicle charging infrastructure (EVCI) services market in the European region. It highlights the current and forecasted EVCI services market size for Europe, followed by key service providers in the region, and...