• European countries with high vessel traffic are increasingly moving towards electrification to reduce the emissions from the maritime sector.

• The pace of deployment of shore-to-ship power systems is comparatively greater in Northern Europe; however, countries like Italy and Spain have also initiated dedicated plans for the electrification of their ports

• The pipeline of shore-to-ship power projects in most countries is high voltage system to electrify larger ships like container ships and cruise vessels.

A strong inclination towards the decarbonization of maritime operations by 2030 is being observed in the Baltic Sea Region ports. This is a direct consequence of the Paris Agreement, a legally binding international treaty on climate change that aims to limit global warming to well below 2, preferably to 1.5 degrees Celsius relative to pre-industrial levels. As a result, several regional programs have been established that promote the use of alternative fuel technologies (mainly onshore power supply) in the maritime sector, which are also in line with the recent European Green Deal including the EU Strategy for the Baltic Sea Region (EUSBSR), HELCOM Baltic Sea Action Plan, Clean Baltic Sea Shipping program and Interreg Baltic Sea Region (Green Cruise Action Plan).

In 2009, the European Council approved the EUSBSR, which is considered the first macro-region strategy in Europe. This strategy aims to save the sea and improve connectivity followed by a focus on increasing prosperity within the region. BSAP, on the other hand, was adopted by the contracting parties of HELCOM in 2007 but was later updated in 2021. The Baltic Sea Action Plan is a strategic program of measures and activities that aims to improve the health of the Baltic Sea. Whereas the Baltic Sea Shipping program promotes measures that reduce the emissions from the maritime sector, for instance, the promotion of the infrastructure for bunkering of LNG and enhanced use of shoreside electric power. During the last Interreg Baltic Sea Region programming period from 2014 onwards till 2020 around 200 projects were funded that were innovative, sustainable, and improved connectivity in the Baltic Sea region.

The European Green Deal has also sought to align the region’s policies with the target of reducing net greenhouse gas emissions by at least 55% by 2030. These programs and initiatives have led to the creation of a market for shore-to-ship power in certain European countries, especially where there is significant vessel activity.

Leading European Markets in Terms of Vessel Activity

Currently, Norway, Germany, the Netherlands, and France are leading European markets not only in terms of vessel activity but in terms of projects related to shore-to-ship power as well. The majority of the shore-to-ship power pipeline projects in the these countries fall in the high voltage category, except for France. In France, most of the projects in the pipeline are low-voltage shore-to-ship power projects. However, PTR Inc. believes that the shore-to-ship power industry will establish ground in other European countries as well, especially in Spain and Italy. This is mainly due to initiatives like the ‘OPS Master Plan’ and ‘The European flagship action for cold ironing in ports.’

The objective of the OPS Master Plan is to draft a master plan to provide shoreside power to ships docked in Spanish ports. This project is also a part of the National Action Framework that focuses on the development of infrastructure that enables the use of alternative fuels in the transport sector, which is also in line with Article 13 of Directive 2014/94 EU.

On the other hand, the EALING initiative plans to accelerate the deployment of onshore power systems in the ports of EU member states in the first phase. Around 16 ports have been selected as pilot sites to carry out studies including the technical, legal, and regulatory framework.

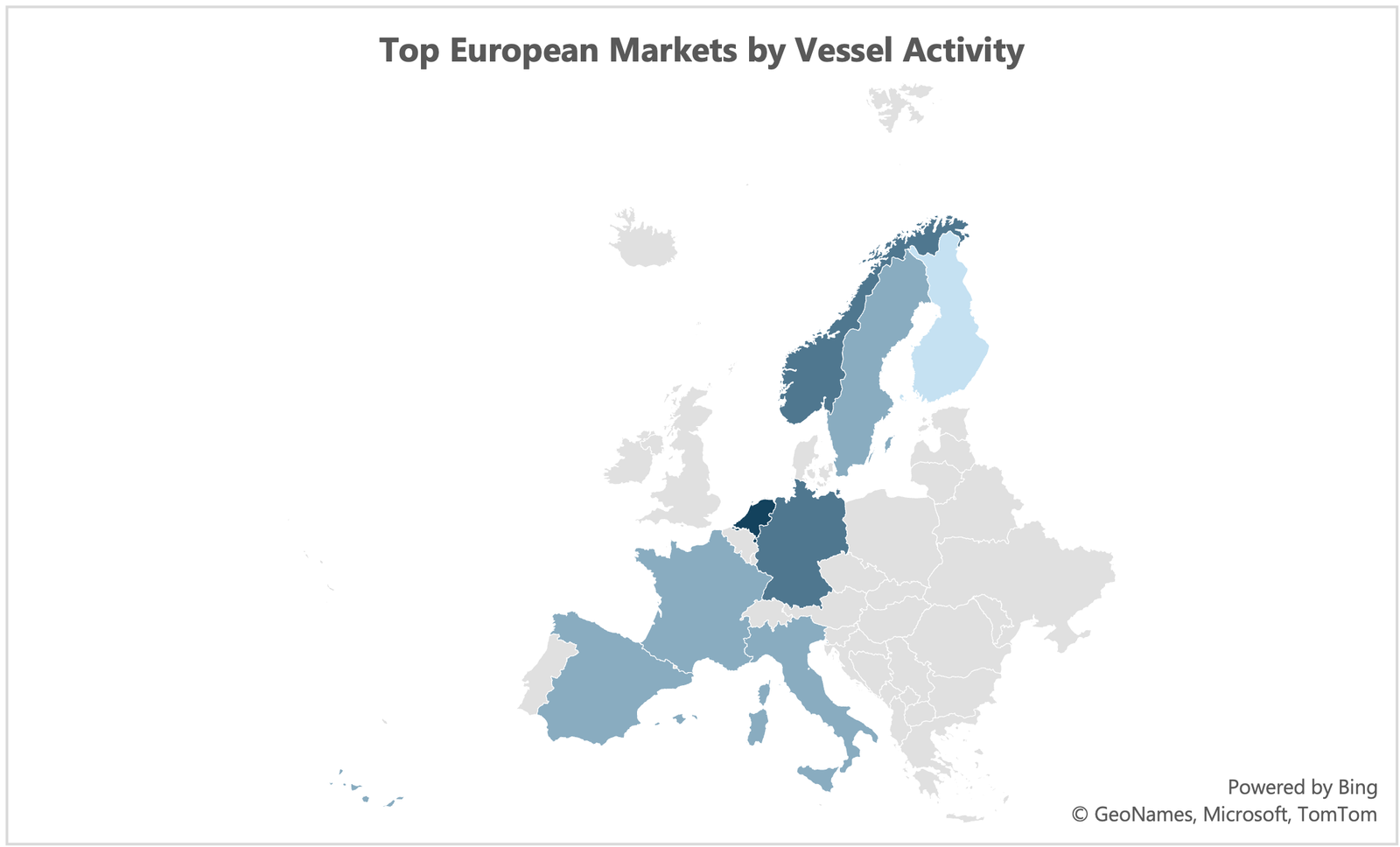

The figure below shows a heat map of the top European market by vessel activity where dark color indicates a higher vessel activity.

Figure 1: Top European Markets by Vessel Activity.

Source: PTR Inc.

Norway

In Norway, two projects were recently undertaken, including a consortium of companies working on a hydrogen-based shore power solution, followed by a shipping company Wilson ASA that is investing to make their vessels shore power ready.

PSW Power & Automation, Westgass Hydrogen, CCB, and H2 Production have formed a Norwegian consortium. The consortium intends to provide a high-capacity hydrogen-based shore power solution to the maritime sector. The groundbreaking system, designed by PSW and evaluated this autumn at CCB’s shipyard in Ågotnes, was demonstrated to the maritime industry on September 19th,2022.

Earlier, the Norwegian shortsea shipping company Wilson ASA completed its first successful shore power trial in Kvinesdal, Norway. Wilson ASA operates a fleet of about 130 bulk cargo vessels, in the range of 1,500 long tons deadweight to 10,000 DWT, and is headquartered in Bergen, Norway. The company has invested funds in preparing most of its vessels for shore power, and around 70% of the fleet is now ready to use this new technology.

The majority of the pipeline shore power projects in the Norwegian shore power market are high voltage projects accounting for 75% of the total projects, whereas only 25% of the projects are low voltage projects.

Enova has provided funding of around USD 3.4 Million for five new onshore electricity projects which are expected to be completed by 2025. This includes USD 1.3 Million in support for the construction of onshore power at Tindekaia in Åndalsnes, along with four other projects by the coast. Beneficiaries of the funding include Molde and Romsdal harbor IKS, the Ålesund Region’s Port Authority, Stavanger region harbor IKS, Holmøy maritime AS, and Plug Bergen AS. It is significant to note that government funding is aimed at helping Norway achieve net neutrality by 2050.

Figure 2: Norway’s Pipeline Technology Split.

Source: PTR Inc.

Germany

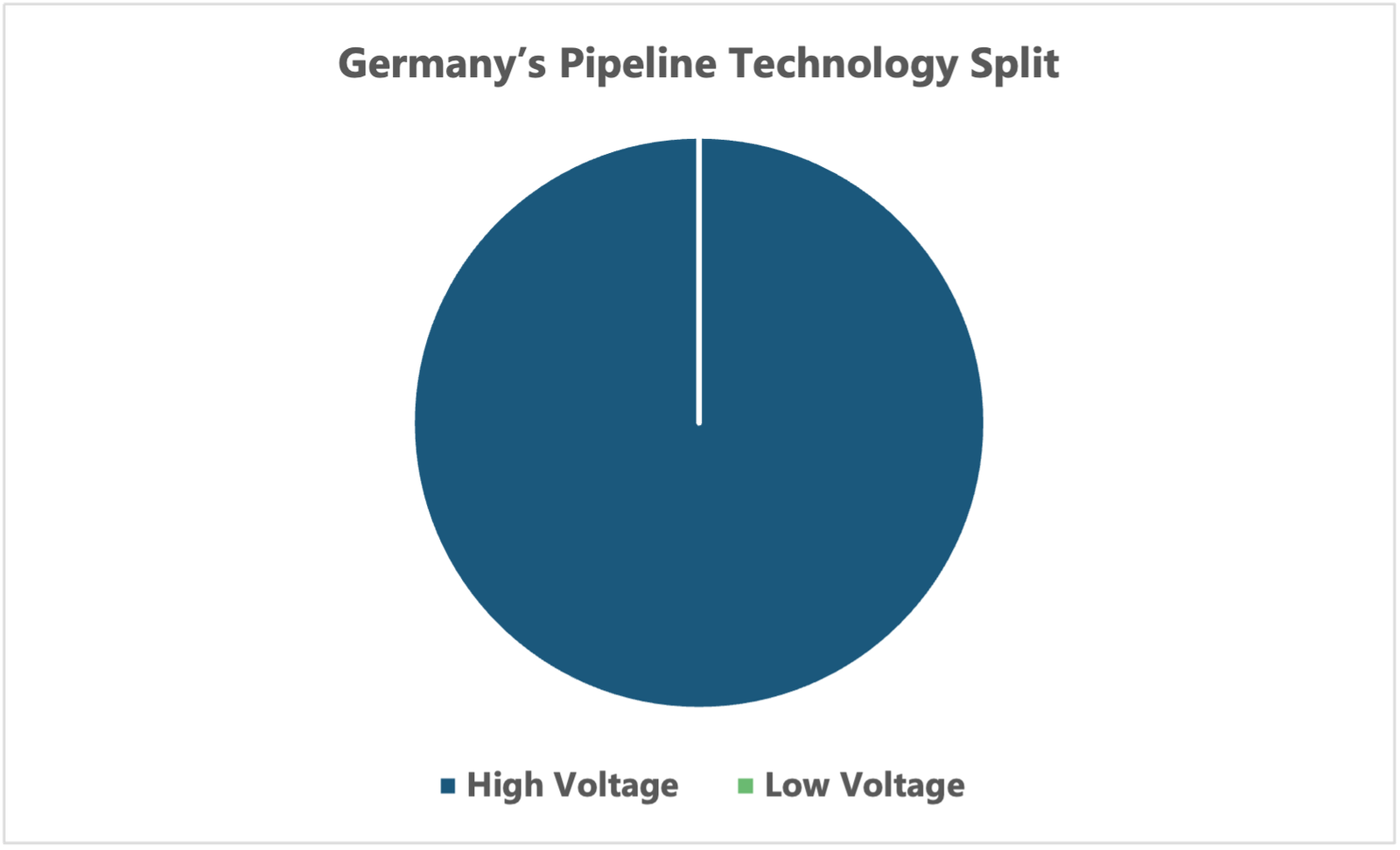

In Germany, a shore power facility was installed in Kiel by the end of 2020. This facility allowed Stena Line to connect 14 vessels at seven terminals with shore power and is expected to reduce emissions from the vessels Stena Scandinavica and Stena Germanica by 2700 tons per year. Accumulatively, Stena Line was expected to reduce emissions with the help of shore power by 13,000 tons per year. As far as the technology split of pipeline shore power projects in Germany is concerned, 100% of the projects fall in the high voltage shore power systems category.

Figure 3: Germany’s Pipeline Technology Split.

Source: PTR Inc.

The European Commission has awarded a grant of USD 20 Million to the Hamburg port authority to facilitate the deployment of onshore power supply for cruise vessels at the HafenCity cruise terminal. This funding complies with the Hamburg port authority’s Clean Air Action Plan which plans to reduce carbon emissions by 80% from the city by 2050. The port authority is prominently inclined to decarbonize maritime operations through alternative fuel technologies. These technologies include shore power as well. The port plans to take the lead in offering shore power supply to all types of vessels including passenger vessels, large container ships, and cruise vessels docking at the port.

Already, the port provides shore electricity to inland ferries at Landungsbrücken and cruise ships at Altona Cruise Terminal. It is the first time that the Hamburg port authority is receiving direct funding from the EU Commission as in the past shore power facilities at Hamburg were funded through the German Ministry of Economics and Energy and state aid. In Germany, state governments of Schleswig-Holstein and Hamburg, Mecklenburg-Western Pomerania, Lower Saxony, and Bremen along with the Ministry of Economics and Energy have signed a consortium to provide shore power facilities for cruise and ferry vessels as they cover the major percentage of port calls at major city ports such as Kiel, Hamburg, and Rostock. The German government has also facilitated the ports to deploy shore power facilities by not only providing state funds but also providing tax exemptions on electricity prices by lowering the EEG surcharge to 20 percent.

The Netherlands

The Port of Amsterdam in the Netherlands is aggressively pursuing plans to completely decarbonize its maritime operations by 2050. Port authorities, along with the Danish grid operator Liander, have initiated the design phase for the installation of shore-based power for sea cruises at the Passenger Terminal Amsterdam (PTA). The tender process for this project was expected to be initiated in 2022 with a target of supplying shore-based power to river and sea cruise ships at the PTA as the cruise season begins in 2025. On the other hand, port authorities are also exploring the possibility of utilizing the power supply for purposes other than shore power, such as charging infrastructure.

The technology split of pipeline projects in the shore power market of the Netherlands indicates that the majority of the upcoming projects are high voltage shore power projects accounting for 67%, whereas only 33% of the projects fall in the low voltage category.

The Port of Rotterdam Authority and the city of Rotterdam are working together and making financial contributions to achieve the goals set by the ‘Rotterdam Climate Agreement’. The agreement aims to reduce the carbon emissions in Rotterdam to one-half in 2030 as compared to carbon emission levels in 2017. In order to lead Europe in shore power-based projects, they would require at least USD 50 Million over the next five years for the installation of shore power projects. The Port of Rotterdam Authorities and the city of Rotterdam have consented to provide the required subsidy. They will be relying on several government authorities be they local, national, or European.

Figure 4: Netherlands’ Pipeline Technology Split.

Source: PTR Inc.

France

The channel port of Dunkirk was the first port in France to provide shore power to shipping lines. The project was expected to radically improve the air quality in the immediate hinterland. This shore power system is one of the most powerful systems ever installed in Europe. It has a capacity of 8 MW which is sufficient to power around 1000 homes.

On the other hand, the Port of Marseille has invested more than USD 50 Million to provide shore power to ships berthing at their port. The Port of Marseille is the only Mediterranean and one of 14 global ports globally that consistently prove high voltage shore power to docking ships. It is noteworthy that as far as the technological split in the pipeline shore power projects in France is concerned, most of the upcoming projects accounting for 63% are low-voltage shore power systems whereas only 37% of the projects fall in the high-voltage category.

In the future, the ABB-led consortium is going to provide shore-to-ship power connections for ferries and cruise ships at the Port of Toulon. The deployment of shore power at the Port of Toulon is expected to reduce not only carbon emissions but noise emissions as well. This turnkey project is expected to provide energy sufficient to meet the requirements of either one cruise ship or three ferries simultaneously. The project will be commissioned in 2023.

Figure 5: France Pipeline Technology Split.

Source: PTR INC

Looking Ahead

Shore-to-ship power is evidently gaining momentum in the European continent as it is pushing to achieve carbon neutrality by 2050. Although Norway, Germany, the Netherlands, and France are leading the region when it comes to shore-to-ship power-related projects and activity there is significant potential in other European countries, as well, to become shore-to-ship power hotspots in the upcoming years.

As per the estimates of PTR Inc., Spain, and Italy are expected to become key players in the shore-to-ship power market of the region due to the high volume of maritime traffic and shore-to-ship power initiatives that they have undertaken, including the OPS Master Plan, EALING, and their national recovery and resilience packages. However, there are still certain bottlenecks in the industry that need to be removed if the adoption of shore-to-ship power technology is to accelerate, especially the lack of incentives at the regional and national levels.

Furthermore, at present, the majority of countries have low-voltage systems in place and the market is expected to shift towards high-voltage systems in the future. It is significant to note that low-voltage systems are less expensive to install and operate as compared to high-voltage systems, which require more investment to install and operate. Additionally, the markets that have more high-voltage systems in the project pipeline will have the capacity to provide shore power to cargo containers and cruise ships (inland vessels and ferries use low-voltage systems).

Shore to Ship Service Overview

The research presented in this article is from PTR's Shore to Ship service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Shore to Ship Power Market Research

Recent Insights

Sustainability Across Sectors: Highlights from GreenTech Festival 2024

Recently, I had the privilege to attend and present at the Greentech Festival, an excellent event in the realm of sustainability. This influential...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

Unveiling the Transformative Journey of Port Electrification

OPS installation is on the rise globally as countries prioritize their environmental objectives and seek to minimize the ecological impact of...